2017 Dallas-Fort Worth Land Absorption Report

By Robert Grunnah

For many years, our Investments/Land Division, now a division of Younger Partners, has produced a report designed to assist investors in deciding the viability of acquiring undeveloped land for medium and long term positive returns. Since our 2016 report was distributed, DFW has experienced continued enormous growth in virtually every commercial and residential product type. Much remains the same in our report this year, except we are seeing legitimate evolving trends that should be considered. Absorption of undeveloped and underutilized land continues at an unprecedented rate. Aggressive, new vertical development has left even fewer desirable infill sites remaining, producing ever increasing activity further out from current job markets and increasing commuter distance demands. However, employers, recognizing that the seriously evident shrinking pool of employee candidates, sensitive to job location, are moving employment centers closer to demand. This competition for employees, inflated raw land cost, a rapidly increasing cost of living, and transportation congestion are all beginning to affect our extended growth cycle. We remain attractive to relocation compared to our competition, however, the gap is decidedly smaller. Our observation is economically based. As long as we have the anticipated continued job growth, inbound population increases, low interest rates, and a sound local economy, there is no reason for an immediate reverse cycle. However, should any one of those standards collapse, the effect will be telling on all. To repeat, there has never been a “last cycle”.

Historically low capitalization rates, purchase prices far in excess of replacement costs, and decreasing retail demand, have made income producing investments extremely vulnerable to negative economic conditions and all but impossible to rationalize purchasing. Excessive competition to acquire cash flow assets producing even the smallest yields is a precursor to failure. A cyclical correction in the national economy would have an exceptional negative impact. Inherently, land investment differs greatly from other types of real estate products generally by its inability to produce interim cash flow and its sensitive vulnerability to recurring cycles. The criteria used to determine potential land opportunities, while becoming considerably more sophisticated over the last two cycles, remains principally in implementing four basic strategies.

Perhaps the most important of these is the ability to project and fund ownership long term. Positive liquidity, the ability to sell for an acceptable profit at the optimum market time, can be highly speculative. When an investor is placed in an imposed forced sale position or loses confidence in the future of the investment, returns are jeopardized and most frequently result in a significant loss.

We have all learned that real estate is “local” in character. No two markets possess the same dynamics. Location will ultimately best determine value. Values of similar properties will vary greatly in specific submarkets and in different geographical locations. Public perception, while an intangible, plays a large role. As an example, southern Dallas County, until recently, has had little attention from investors and developers. Ignored were its extensive existing infrastructure, excellent highway and rail access, attractive land values, and existing employee base. While historically competitive locations north, without similar benefits, trading at prices two and three times higher, the southern sector remained overlooked. Over the last few years, however, both users and developers have rapidly recognized this area as the jewel it is. Millions of square feet of new construction, intermodals, and support commercial have been built and more is planned. Our “slow to lead, quick to follow” mentality has given new life to the “Southern Sector” which promises to have a long term and deserved resurgence.

Anticipated use governed by demand, zoning, proximity to infrastructure, interim use, historical absorption, positively perceived location, and the municipal political climate, are but a few of the investment points to be considered. Current investment and development activity by informed entities and verifiable market comparables are equally important.

To repeat, like most types of investments, real estate is cyclical. Investment success or failure can often solely depend on where the cycle is at the time the purchase is made and the investor’s ability to determine the true state of the cycle. There has yet to be a final cycle, thus, the ability to hold long term may affect the yield but does offer some degree of security. While the ability to use historical data to project long term value as set out above is logical, many down cycles have been created by artificial, non-real estate related influences that were difficult to anticipate. For example, in the late 1980’s, tax law changes and deregulation destroyed the market. In the late 2000’s, the subprime collapse did the same. It is reasonable to assume there will be more fragile “bubbles”.

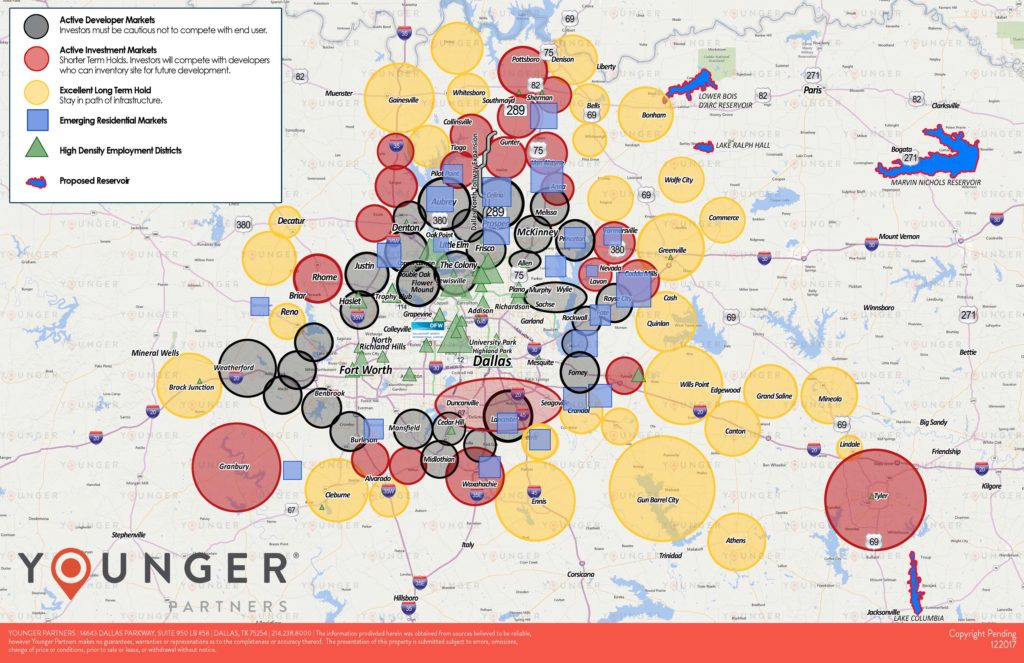

Younger Partners is a member of the highly respected North Texas Land Council (NTLC), a group comprised of 50 of the most active and talented land brokers in our area. Believing that activity generates more activity, the North Texas Land Council freely shares information with its competing members, and the market in general, on a level of professionalism unusual within similar organizations and, as such, is a benefit to all clients. Much of the projected activity displayed on the Younger Land Absorption Map (YLAM) reflects the activities of the NTLC.

The DFW market today continues to see record prices for infill, readily developable sites possessing available infrastructure, permitted anticipated uses, and demand for product. Developers are now aggressively demolishing fully functional buildings in order to build product more in demand which has historically been a warning to a pending market correction. Fueled by extensive population and employment growth, new construction remains at a record pace which is anticipated to continue at least through 2018, a projection supported by deals currently designed, engineered, and possessing financing commitments. It will be interesting to observe the effect new construction growth achieves as the six major current DFW projects are completed. Of course, the anticipated arrival of HQ2 will extend for years our current positive cycle. Increased land, labor, and materials cost will, however, inevitably have a negative impact. Construction in process and fully financed new projects pending ground breaking, although distinctly slowing, will continue to fuel the real estate market for the short term. That “pipeline” has gotten understandably smaller which presents an interesting speculative projection for 2020 and beyond. Increased activity for pure, longer term investment sites has continued the extension to the outer lying, concentric circle tracts, considered “pure investment tracts”, which until recently remained fairly benign in sales activity and price fluctuation. It appears that such specific investments are becoming more attractive since competing investments such as oil and gas (price fluctuation), a pending bear stock and bond market (the same non-occurring “pending” from last year), and the tech world which offer a less equitable vehicle. Additionally, local investors (the heretofore most active group of land speculators) are seeing increased competition from more patient national and foreign investors. Yet, historically, and perhaps ironically, a large number of the most successful, wealthiest investors have made their patient fortunes in land by simply applying these basic techniques.

Our continuing and extended analysis, as displayed on the “Younger Land Absorption Map” (revised November 2017, available upon request) is principally based on extensive historical data collected utilizing over 100 years of market experience possessed by Younger associates, members of the NTLC, and reliable future projections from sources that have traditionally displayed accurate demographic information. Depending on which source one chooses to use, the DFW market still expects to absorb an additional 1.6 to 2.5 million residents over the next fifteen years. Success in real estate investment will be to determine where that growth will locate. History has taught us that product will be made available and priced based on pure economics. The cost to provide available product to meet demand will depend on the availability of affordable infrastructure (sewer, water, roads, proximity to employment centers, service commercial, schools, political climate, etc.). Land prices will fluctuate according to such availability. Investing in the right product will produce exceptional rewards. Some estimate that it requires approximately 12,000 to 15,000 acres of raw land to accommodate one million people in a reasonably confined, socially acceptable, service provided environment.

We have been fortunate to have had an extended period of prodigious activity which can at least be partially credited to our aggressive polital structure, both local and state, our sophisticated and informed developers and engineers, and our incredibly competent and equally aggressive EDC’s. Of equal depth, however, is the dynamic, well educated, hard working, and professional “under 40” group of brokers, administrators, managers, and general employment base whom have emerged during this cycle. They may well be the first group exiting a positive cycle who have learned and benefited from the experience of their predisessors. They may not need a disaster to stay relevant and solvent.

In conclusion, the principals of sophisticated investment must utilize primary criteria, some of which is outlined above. Access to infrastructure, most importantly water, the admirable, continued effort by our current Dallas Mayor to utilize available land in our southern corridor, absorption of the remaining few infill sites, high suburban infill land costs, and the migration of employment centers will all play significant roles in prudent investment decisions. Utilized in the investment process, the only remaining elements are sound financial strength and patience.

About Younger Partners

Younger Partners is a full service DFW brokerage firm specializing in all areas of commercial real estate sales, leasing, and management including land and income producing investment. Please consider contacting us for any commercial real estate needs. The opinions expressed herein are solely those of Younger’s Investment/Land Division. For questions or comments, please contact us:

Robert Grunnah Robert.Grunnah@youngerpartners.com

Sam Kartalis Sam.Kartalis@youngerpartners.com

Ali Farmehr Ali.Farmehr@youngerpartners.com

Ben McCutchin Ben.McCutchin@youngerpartners.com

Chris Callicutt Chris.Callicutt@youngerpartners.com

Cole Bradford Cole.Bradford@youngerpartners.com

David Hinson David.Hinson@youngerpartners.com

Don Plunk Don.Plunk@youngerpartners.com

Jeremy Lillard Jeremy.Lillard@youngerpartners.com

John St. Clair John.StClair@youngerpartners.com

Kevin Harrell Kevin.Harrell@youngerpatners.com

Lew Wood Lew.Wood@youngerpartners.com

Michael Ytem Michael.Ytem@youngerpartners.com

Nan Li Nan.Li@youngerpartners.com

Renzo Cella Renzo.Cella@youngerpartners.com

Shawn Street Shawn.Street@youngerpartners.com

Tom Grunnah Tom.Grunnah@youngerpartners.com