How Can Office Rates Still be Rising?

By Younger Partners Research Director Steve Triolet

Rates are a lagging indicator, in other words, they often don’t react initially to changing market conditions. Still, over the past few quarters, DFW office asking rates have remained stubbornly high, especially in comparison to other large markets like San Francisco and New York City (which have both seen rates drop about 10% over the past three quarters). The level of distress for owners in those coastal markets is high, so their rates have reacted more quickly.

Diving into the details of what I’m seeing in DFW office rates:

*Lincoln Centre recently raised its asking rate across the business park by $2 to $32 (NNN). The catalyst appears to be the Huitt Zollars lease signing for 32,519 SF at Lincoln Centre III. Lincoln Centre is currently well leased with an occupancy rate near 90%.

On the flipside, some properties in Hall Office Park have seen some rate reductions for direct space. Property G4, for example, at 3011 Internet Blvd recently went from $23 (NNN) to $22 (NNN). The property’s occupancy is low; 82% of the property is available between a combination of direct and sublease space.

Roughly half of the submarkets recently saw a slight decrease in asking rates while the other half had slight increases, making the overall rates relatively flat.

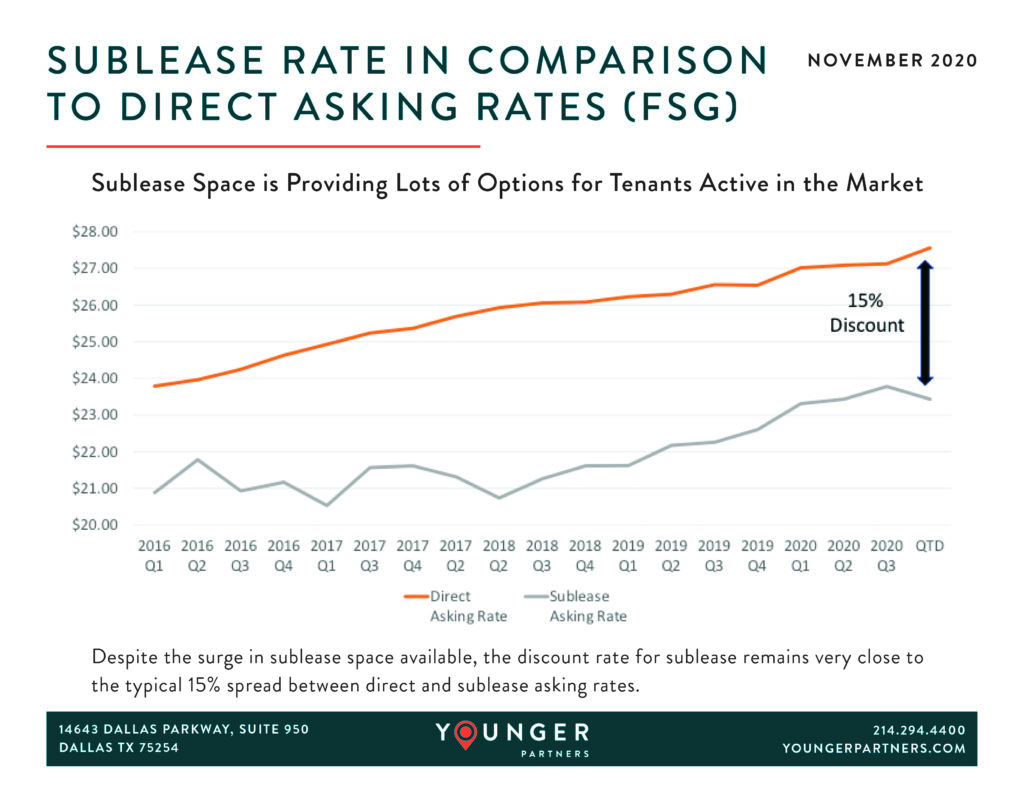

To date, the biggest movement in rates has been for sublease space. While the typical discount between direct and sublease space remains near 15% (which is the historic norm), more than a quarter of all sublease space being marketed does not have a quoted asking rate. Still. among the individual subleases, discounts of around 50% have been quoted. Ashford at Centura Tower I is quoting $15 Plus E, while the direct space at that property was recently quoted at $30 Plus E.

In the most extreme case at Energy Plaza, there is a very large sublease for 570k SF that has over a 60% discount in comparison to direct space ($9.50 full service rate), but that sublease has only a year of term left and has been listed on the market for over three years with no leasing activity to show for it.