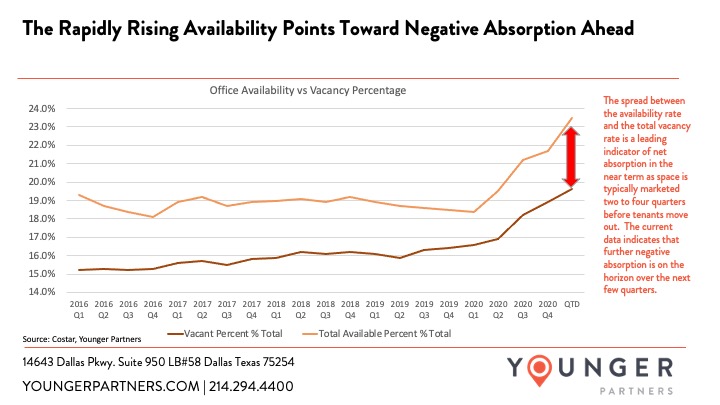

The Spread Between the Availability Rate and Vacancy Points

By Steve Triolet, Younger Partners Director of Research

While most numbers like vacancy, net absorption and asking rates that are reported in our quarterly reports give a current pulse on the market fundamentals, there are a few that can be leading indicators of where the market is heading in the quarters ahead. One of those is the availability rate and its relationship with the total vacancy rate. If spread between the availability rate and the vacancy rate is narrowing that means that there is less of pipeline of space coming to the market or as we’ve seen in 2020 and 2021 (to-date) the availability rate for DFW office market has been steadily climbing, outpacing the rising vacancy rate. This indicates negative net absorption ahead, along with softer fundamentals like a higher total vacancy rate.

The rapid rise in the DFW office availability over the past year has been due to a combination of direct and sublease space. While sublease has been gaining more attention in the news, the rise in direct space available (mainly due to new construction) has far outpaced the rise in sublease space. Available sublease space and direct space have increased by roughly 3.5 million and 6 million square feet, respectively over the past year.