DFW Office Deliveries may be high in late 2021, but taper notably in 2022-23

By Steve Triolet, Younger Partners Research Director

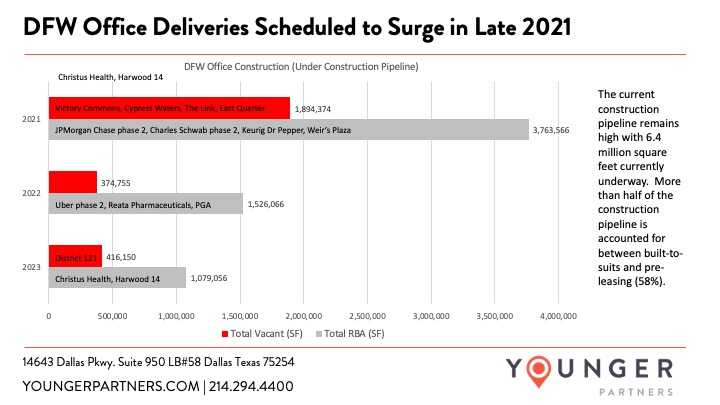

Recently, we looked at current leasing volume trends in comparison to the historic norm. I thought it might be helpful to take a look at the construction delivery pipeline and what it likely indicates for the future market fundamentals for the DFW office market. The construction pipeline remains elevated at 6.4 million square feet. The majority of this construction was started in 2019 and is scheduled for delivery in the second half of 2021. While more than half of the construction pipeline is accounted for between pre-leasing and built-to-suits (58%), there is still almost 2 million square feet of vacant space scheduled for completion before the end of this year. This surge of new vacant construction in 2021 has the potential to move the total vacancy rate up roughly 40 basis points (preliminary numbers show the second quarter total vacancy rate will be 20%).

For 2022, the amount of new vacant space is less than 400,000 square feet, but it is worth noting that the dynamics of Uber at the Epic. The Epic Phase 1 was built in 2019, but most of the project is currently largely available for sublease (115,995 square feet of Uber space), direct space (68,785 square feet) or via co-working space (42,862 square feet). The Epic Phase 2 is 469,000 square feet and scheduled for delivery in mid-2022. The Uber Air division was supposed to be based in Phase 2 and be the primary pilot program for the company. In December 2020, Uber Air was officially discontinued and the app technology behind the division was sold to Joby Aviation. Given the current uncertainty of Uber and its near term growth, there is a high probability that all or a large portion of phase 2 will be placed on the sublease market (similar to what we have seen with Liberty Mutual). Still, even if the Uber space is placed on the market the amount of new unaccounted for space should be about 800,000 square feet or less.

The tapering of construction is expected to accelerate in 2023, with the majority of the pipeline accounted for by Christus Health (456,000 square feet) and Haynes and Boone (125,789 square feet at Harwood 14).

Note: Data is all currently under construction office properties over 15,000 (excluding medical). The larger projects are listed by name within the chart, with largely vacant projects in the red and the larger built-to-suits and spec projects with significant pre-leasing in the gray columns.