Robert Grunnah’s Year-End Annual North Texas Land Absorption Report

Younger Partners’ Robert Grunnah gives the lay of the land in the land investment market for DFW in D CEO on Dec. 26, 2019.

The North Central Texas land market has seen no significant influence modifying its prior three years of sales and absorption activity, with the exception of increasing values and scarcity of inventory in most developable submarkets.

In reviewing last year’s North Texas Land Absorption report, only a few minor observations have changed.

For many years, our Investments/Land Group, a division of Younger Partners, has produced a report designed to assist investors in deciding the viability of acquiring for investment undeveloped land for medium and long-term positive returns.

Since our 2018 report was distributed, DFW has experienced continued active growth in virtually every commercial and residential product type.

Transaction volume held steady for both user and investment product. Absorption of developed, undeveloped (land without access to infrastructure permitting immediate use), and underutilized land progressed at a comparable rate to 2018. The trend continues as increased, aggressive, new vertical development has left even fewer desirable infill sites remaining.

Recent infill development site purchases have been at record sales prices per square foot. More peripheral sites are seeing increasing activity with employers competing for employees desiring a shorter commuting distance.

This competition for employees, inflated raw land cost, a rapidly increasing cost of living, and transportation congestion are all beginning to affect our extended growth cycle. However, we still remain attractive to geographical relocations compared to our competition.

Retaining the anticipated continued job growth, inbound population increases, relatively low-interest rates, and a sound local economy, no reason appears visible for an immediate corrective cycle. Should any of those benchmarks collapse or even display a solid weakness, some correction is imminent.

Strength and Resilience

While few deny that our extended period of strong economic growth is vulnerable, actual project starts and announcements of pending projects doubled over 2017 in all product segments except Retail.

The low unemployment rate, although being partially addressed by extensive inbound migration, and rapidly increasing construction costs seem not to have a major influence on the positive personalities of developers.

Wisely, projects are being valued on a long-term basis, assuming a negative period within their ten-year hold expectations.

A common belief within the investment community holds that DFW is well-positioned to absorb even a relatively strong readjustment and will emerge as a top-five national investment market–2019 saw the square footage of actual office building construction started and announced to start in the approximate estimate of 39 million square feet; for new industrial, 60 million square feet.

The remaining major categories, MOB, Retail, and Mixed commercial will add an additional 25 million square feet.

Again for 2019, approximately 40,000 MF units have been built or will be started along with approximately 35,000 single-family units. Major announced mixed-use residential developments, encompassing thousands of undeveloped acres, were proposed virtually in all directions circling DFW. Confidence stems from DFW’s strength and resilience.

Despite sale prices at a multiple of replacement cost and static retail demand, income-producing investments have maintained their active volume due largely to the need to invest 1031 trade equity and lack of competition with alternative investments which has kept capitalization rates at record historical lows.

Excessive competition to acquire cash flow assets providing even the smallest yields produces increased vulnerability to market corrections.

A cyclical downturn in the national economy would have a dour negative impact and threaten or eliminate positive cash flows. The introduction of the new tax-advantaged “Opportunity Zone” investment vehicle, while moderately active, appears to be having limited success due to the lack of firm guidelines and the startup costs commensurate with the risk.

Land Opportunities

Inherently, land investment differs greatly from other types of real estate products generally because of its inability to produce interim cash flow and its considerably more sensitive vulnerability to recurring cycles. The criteria used to determine potential land opportunities, while becoming more sophisticated over the last two cycles, remains principally in implementing basic strategies.

Perhaps the most important of these is the ability to project and fund ownership long term.

Positive liquidity, the ability to sell for an acceptable profit at the optimum market time, can be highly speculative. When an investor is placed in an imposed forced sale position or loses confidence in the future of the investment, returns are jeopardized and most frequently result in a significant loss.

With expanding IT capabilities and the proliferation of social media vehicles, should an investor wish to search hard enough, she can find support for any investment philosophy, positive or negative to justify an action.

However, certain facts remain more pertinent than most as they may apply to investments in unimproved or underutilized land assets in DFW.

A conservative estimate of ten-year population growth for the DFW population is well in excess of one million new or organically grown residents.

Climate, central location, progressive state, and local government, and no personal or corporate income tax would support this projection.

Possessing no true natural barriers for continued land absorption, there appears no pure, single real estate-oriented obstacle to argue the impact of this projection. Population growth can be fueled both organically and by external inbound relocations.

With trailing twelve-month growth demand for 160,000 jobs statewide, the majority have been or will be filled by relocations.

It is estimated that only seventy percent of the jobs created have been filled. In the last seven years, over 50,000 thousand acres of land have traded with a greater number not being included as pure long term investment inland.

Boom or Bust

Like most types of investments, real estate is cyclical.

Investment success or failure can often solely depend on where the cycle is at the time the purchase is made in conjunction with the investor’s ability to determine the true state of the cycle.

Buying at various points in a cycle–cost averaging–can provide some security. There has yet to be a final cycle, thus, the ability to hold long term may affect the yield but does offer some degree of safety.

With access to historical data, projecting long term value, while still speculative, is much more achievable.

Many down cycles have been created by artificial, non-real estate related influences, the effects of which were difficult to anticipate. For example, in the late 1980s, tax law changes and deregulation destroyed the market. In the late 2000s, the subprime collapse did the same.

It is reasonable to assume there will be more fragile “bubbles” determining what historically created a boom or bust.

Analyzing the probability of a reoccurrence can mitigate future disasters.

Setting Benchmarks

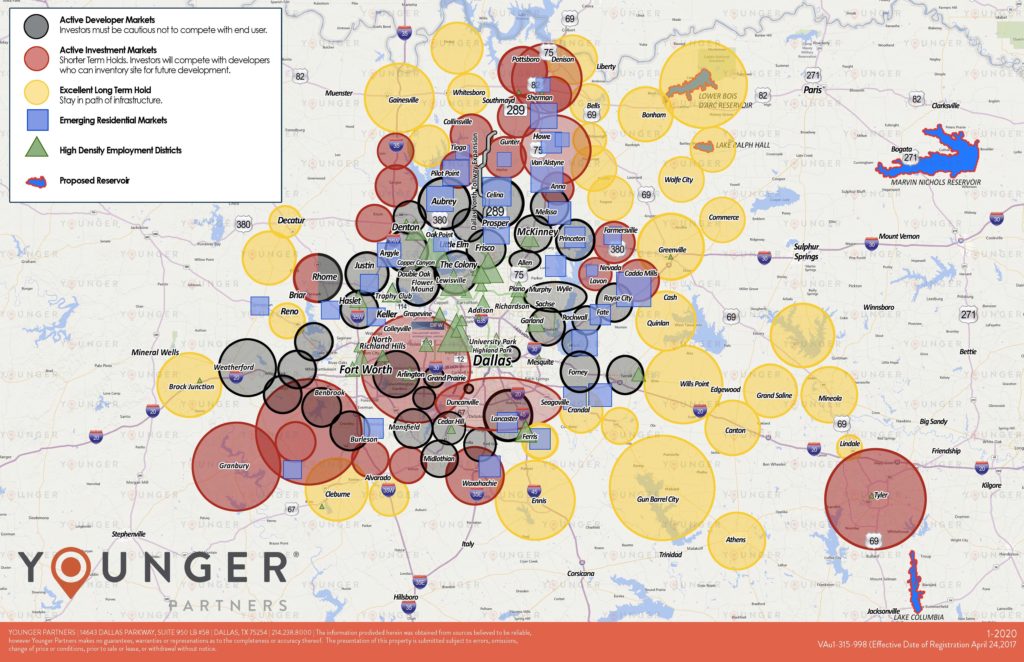

Included in our report is our Land Absorption Map, which sets out various types of 2019 commercial real estate activity in specific geographic areas.

Actual sales, current listings, and announcements of pending projects are the basic criteria used and have been benchmarked annually to complete the current year’s map.

Not difficult to understand, the progression from active to long term generally follows the current availability of infrastructure and newer expanding utility systems. Land currently available for vertical construction will bring significantly higher value over those that must wait for services.

Over the 20-plus years of presenting the map, it is interesting to note that, while the circles have limited movement, the colors have many changes and generally move out from the core in concentric circles.

Younger Partners is a member of the highly respected North Texas Land Council (NTLC), a group comprised of 50 of the most active and talented land brokers in our area.

Believing that activity generates more activity, the North Texas Land Council freely shares information with its competing members, and the market in general, on a level of professionalism unusual within similar organizations. As such, the organization is a benefit to all clients and those anticipating a land investment. Much of the projected activity displayed on the Younger Land Absorption Map (YLAM) reflects the activities of the NTLC.

As in 2018, the market today continues to see record prices for infill, readily developable sites possessing available infrastructure, permitted anticipated uses, and increased demand for product.

For many increased cost factors, single-family new home prices have increased by 50 percent in six years making affordability more difficult. Less obvious are completed per square foot costs in all commercial sectors.

The strong national economy, as well as local, and the continued relocations, have provided record employment and income. That momentum will carry through at least through 2020, but past that, projections are difficult.

Best though to recognize it sooner than later.

Perhaps one of the strongest influences softening the impact of a correction is the enormous amount of uncommitted cash held by investors awaiting their perception of pending opportunities. That cash would be quickly reinvested, buoying prices in the event of a devaluation, by investors not wishing to miss value.

Future Projections

Our continuing extended analysis, as displayed on the “Younger Land Absorption Map” (revised December 2019) is principally based on extensive historical data collected utilizing over 150 years of market experience possessed by Younger associates, members of the NTLC, and reliable future projections from sources that have traditionally displayed accurate information. Our market demographic information was provided by Steve Triolet, Director of Younger Research.

Depending on which source one chooses to use, the DFW market still expects to absorb an additional expansion of 25-to 30,000 acres over the next 15 years.

Success in real estate investment lies in determining where that growth will occur.

History has taught us that product will be made available and priced based on pure economics. The cost to provide an available product to meet demand will depend on the availability of affordable infrastructure (sewer, water, roads, proximity to employment centers, service commercial, schools, political climate, etc.) and hard construction costs.

Land prices will fluctuate according to such availability, absorption, the national economy, and the popularity of any specific product.

Investing in the right product will produce exceptional rewards. Some estimate that it requires approximately 12,000 to 15,000 acres of raw land to accommodate one million people in a reasonably confined, socially acceptable, service provided environment.

We have been fortunate to have had an extended period of prodigious activity, which can at least be partially credited to our aggressive political structure, both local and state, our sophisticated and informed developers and engineers, and our incredibly competent and equally aggressive EDC’s.

Of equal depth, however, is the dynamic, well educated, hard-working, and professional “under 40” group of brokers, administrators, managers, and general employee base who have emerged during this cycle. They may well be the first group exiting a positive cycle who have learned and benefited from the experience of their predecessors. They may not need a disaster to stay relevant and solvent.

In conclusion, the principals of sophisticated investment must utilize primary criteria, some of which are outlined above.

Access to infrastructure, most importantly water, the admirable effort by our past Dallas Mayor to utilize available land in our southern corridor, absorption of the remaining few infill sites, high suburban infill land costs, and the migration of employment centers will all play significant roles in prudent land investment decisions. Utilized in the investment process, the only remaining elements are sound financial strength and patience.