Author: Amy Chavez

Younger Partners Brokers 42-Acre Land Sale for Grocery-Anchored Retail in the Collin County City of Lucas

LUCAS, Texas (April 2, 2025 )— Coming soon to the Collin County city of Lucas: a highly anticipated commercial planned development featuring a 130,000-square-foot grocery-anchored shopping center, a 25,000-square-foot restaurant village with 15 adjacent pad sites and a community park.

Younger Partners Senior Vice President Michael Ytem and Executive Vice President Tom Grunnah brokered the sale of the 42-acre parcel of undeveloped land at the northwest corner of Parker Road and Southview Drive (FM 1378) in Lucas, 30 miles northeast of Downtown Dallas in Collin County.

Ytem and Grunnah represented both the buyer, Lucas Crossing LTD – led by Malouf Interests – and the seller, JCBR Holdings, in the transaction. The sale price was not disclosed. Construction is set to begin in Q4 with an estimated completion in 2026.

“This prime retail and commercial project has been years in the making,” said Ytem. “The extensive planning and city approvals reflect the commitment to bringing a best-in-class development that meets the needs of the growing community. This project enhances Lucas’ retail and dining landscape while also creating a vibrant gathering place for residents and visitors that supports local businesses and fosters long-term economic growth.”

Lucas Mayor Dusty Kuykendall agrees. “This will be our first true grocery store serving the community,” he said. “The development team worked with city leaders, as well as the residents, to plan this project based on our comprehensive plan from the start.

“From the roof design to the paint colors, we wanted to be involved in every part of the plan and they were willing to work with us on that,” Kuykendall added. “This project will drastically increase our sales tax base, which is great to bolster funds for our infrastructure and roads. This will be a unique addition to the largely residential town because it is all commercial with some green spaces included. Our feedback on materials, the aesthetic and the layout were all incorporated. For some time, our residents have wanted a full-service restaurant, and this planned development will incorporate a few of these.”

Malouf Interests is leading its retail transformation in the highly desirable suburban area in northeastern Dallas. The development is strategically positioned to serve not only Lucas but also neighboring communities including Parker, North Wylie, Northeast Murphy and St. Paul. With its strong residential growth and appeal, Lucas continues to attract families and professionals, drawn to its high-quality lifestyle and expanding amenities.

Lucas, with almost 10,000 residents, has no multifamily or high-density neighborhoods. Home lots tend to be around two acres with an average value of $1.2 million, Kuykendall said.

“The planned development will create a dynamic new retail destination for the area and tremendous amenities for the region,” Grunnah said. “This transaction will have a lasting impact on the community and create value for the city, its residents and the new property owners.”

Younger Partners Earn Green Street’s Top 20 National and Top 5 Local for Sales Transaction Volume

Younger Partners earned a Top 20 recognition for the Top Office Brokers 2024 list, ranked by Green Street. The firm also earned a Top 5 ranking for Top Office Brokers within the DFW area. Both accolades were for deals with a $5 million to $25 million value. These rankings are published in Green Street’s February 2025 Real Estate Alert report.

Younger Partners’ Capital Markets Principals Scot Farber and Tom Strohbehn inked three transactions in 2024 earning them the Green Street accolades. Among their transactions is the 90,980 SF 3200 Broadway Blvd., in south Garland. Located off Interstate 635, it is a convenient location for office workers to reach to their office with ease. The second deal, also located off 635, at 8111 LBJ Freeway is an impressive 266,412 SF in north Dallas, which allows office workers proximity to the heart of downtown Dallas.

On the other side of the Metroplex is the third deal in Arlington. The 115,700 SF building, at 1521 N Cooper St. off I-30, offers convenient proximity to major attractions such as entertainment districts, AT&T Stadium and multiple amenities.

“These recognitions highlight Younger Partners’ adaptability to the ebbs and flows of the industry,” Farber says. “Our team is encouraged to lean into our competitive streak as we strive to build on the success of 2024 by working even harder in 2025.”

As companies continue to evaluate their RTO mandates, the landscape of CRE is changing, according to Green Street. Since 2020, remote work has become more common, leaving office spaces desolate with a lack of urgency for companies to invest in empty buildings. Securing these deals highlights the grit of Younger Partners because of the challenges of selling office spaces within the current landscape of the working culture. However, companies are scaling back on remote work and shifting back to an in-person setting. According to a KPMG survey, 83% of CEOs expect a full return to the office within the next three years. These deals preview the back-to-office reality, where life is breathed back into previously shunned office spaces, Farber said.

On his whiteboard for the year, Farber made it a goal to earn recognition for YP’s accomplishments from 2024. By the end of Q1 ‘25, he’s already checked one goal off his list—and if these rankings are any sign, there are plenty more wins ahead for Younger Partners as the year rolls on.

Younger Partners Negotiates Sale of 54 Acres in Alvarado for Future Use

ALVARADO, Texas (Feb. 24, 2025)— Younger Partners Senior Vice President Andrew Boster brokered the sale of 54 acres in Alvarado, 21 miles from the Fort Worth CBD and 29 miles from the Dallas CBD, for future development.

Boster represented both the buyer and seller.

The site is just two miles from U.S. 67 and less than six miles from both I-35W and U.S. 287 in unincorporated Johnson County. “This provides the flexibility of unzoned development in a strategic location for easy access while allowing for a wide range of potential uses,” Boster said. “The submarket has become a sought-after location for industrial investment and development making this a great opportunity for both the buyer and the seller.”

This site lies within the rapidly growing Midlothian-Venus submarket, making it a prime candidate for various types of development. The deal closed on Jan. 16, 2025.

“The seller’s family, like many of the families in the Midlothian-Venus submarket owned the property for generations,” Boster added. “Much of the area’s undeveloped land is still being held by long-time landowners who have historically been reluctant to sell. However, after three years of substantial growth, many are reconsidering, creating new opportunities in a previously scarce land market.”

With land still priced per acre rather than per square foot, the Midlothian-Venus submarket remains one of the last affordable options within 25 miles of both downtown Fort Worth and Dallas, making it highly attractive to developers.

“The location of the 54 acres is at the intersection where investor pricing meets developer pricing,” said Boster.

This transaction highlights the increasing demand for land south of Fort Worth, driven by the region’s affordability and expanding infrastructure. The Chisholm Trail Parkway has played a significant role in spurring development in the southern part of the Metroplex, along with I35W, attracting investors and developers looking for opportunities beyond the traditionally high-growth corridors north of Dallas. As expansion continues, Venus remains well-positioned for future development.

Boster, along with Younger Partners Executive Vice President Tom Grunnah, are also marketing 67 acres in Prosper (Denton County) with frontage along FM 1385 and 1.5 miles north of U.S. Hwy. 380. This site is just west of the Windsong Ranch Master Planned community and immediately east and south of several additional new residential developments.

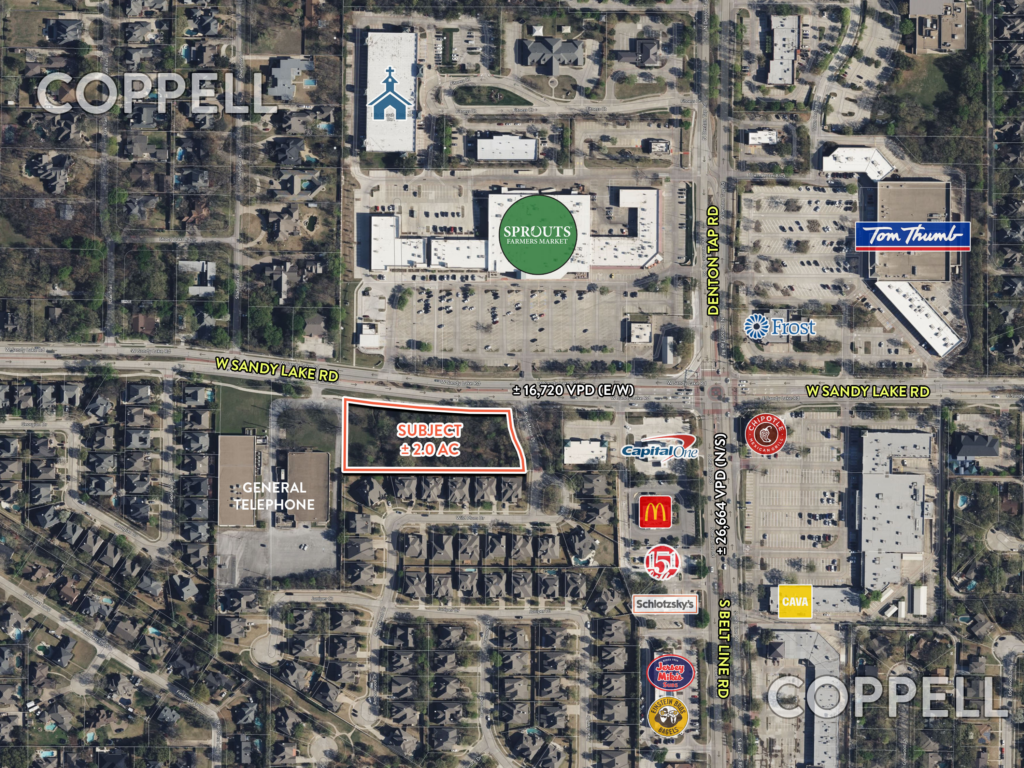

Younger Partners Brokers Sale of Prime Two-Acre Infill Site in the Heart of Coppell

COPPELL, Texas (Feb. 10, 2025) –Younger Partners Associates Davis Willoughby and Luke Nolan successfully negotiated the sale of 2 prime development acres at 1 W. Sandy Lake Road in the Dallas suburb of Coppell.

Located just across from Sprouts and Andys Frozen Custard at West Sandy Lake Road and North Denton Tap Road, the land was sold by Ardinger Properties LLC. The buyer is Dallas-based commercial real estate development firm, Peak Development Partners, which focuses on single-tenant retail spaces. Younger Partners represented both buyer and seller. The sales price was not disclosed.

The property is a future retail development site and fronts a major east-west thoroughfare along Sandy Lake Boulevard, which sees roughly 17,000 VPD on average. The site shares its southern property line with six single-family residences that front Wild Plum Drive.

“This property is just about 500 feet west of Belt Line at the most prominent retail intersection in Coppell with major anchors such as Trader Joe’s, Tom Thumb and Sprouts,” Nolan said.

“This acquisition will transform this underutilized parcel at Coppell’s premier intersection into a cornerstone of opportunity for the community,” Willoughby said. “As the city continues to grow, we want to ensure the real estate keeps up with the demands and needs of Coppell’s booming population.”

“This tract has all the qualities of a prime retail development site—ideal visibility, high traffic and unbeatable location—making it a rare gem in Coppell’s competitive marketplace,” Nolan said.

Fort Worth Cultural District Alliance Announces 2025 Board Leadership

Leading the CDA as Chair is Moody Younger of Artisan Circle/Younger Partners. Marshall Horn of Texas Air Systems and Kim Tillman of Regions Bank will serve as Vice Chairs. Reagan Ferguson of Pressman Printing takes on the role of Secretary, while Jerry Thompson of Inwood Bank will serve as Treasurer. Scott Wilcox, immediate past Chair, will continue to offer guidance.

“The Cultural District Alliance is the only organization solely committed to preserving and promoting Fort Worth’s Cultural District,” said Moody Younger, CDA Chair. “Through collaboration with our board, corporate partners and community leaders, we will continue to strengthen this vital economic and cultural hub.”

The CDA is committed to connecting corporate and community leaders, residents and visitors to local businesses and cultural initiatives, fostering creativity through premier events and exhibitions, and collaborating with businesses, museums and city officials to ensure a thriving district.

As a cornerstone of Fort Worth’s identity, the Cultural District boasts world-class museums, thriving businesses, and a vibrant arts scene. It is also home to the Will Rogers Memorial Complex, UNT Health Science Center, the Fort Worth Botanic Garden and the Botanical Research Institute of Texas, further solidifying its reputation as a premier destination for education, research and cultural experiences. The CDA plays a vital role in sustaining its success and fostering its continued growth. For more information about the Fort Worth Cultural District Alliance, visit www.fwculture.com.

YPI Sells 3 Restaurant Parcels at Midlothian Towne Crossing

MIDLOTHIAN, Texas (Feb. 4, 2025) – Dallas-based Younger Partners Investments (YPI) recently sold three restaurant land parcels at the Midlothian Towne Crossing shopping center. YPI acquired the 99%-leased retail center in December 2023.

The parcels sold include Chili’s Bar & Grill at 2250 FM 663, McDonald’s at Hwy 287 and FM 664, and Chick-fil-A at 2010 FM 663. CBRE’s Jared Aubrey and Michael Austry represented YPI in the sale to undisclosed buyers. The sale prices were not disclosed.

Midlothian Towne Crossing features 147,161 square feet of retail space on 34 acres at the southeast corner of the FM 633 and Highway 287 intersection in Midlothian, about 25 miles south of Dallas.

Built in 2019, Chili’s is located on a 1.69-acre pad site and has a 10-year lease. The restaurant features a dedicated curbside pick-up, ample parking and excellent ingress and egress along FM 663. The site pad that McDonald’s occupies also has a long-term lease. Built in 2022 on 1.07 acres, the corporate location includes a double drive-thru, abundant parking and excellent ingress/egress. Chick-fil-A was built in 2018 on a 1.73-acre pad site with a 20-year lease. The quick-service restaurant has two drive-thru lanes with indoor seating and ample parking. Chick-fil-A is the third largest fast-food restaurant chain in the U.S.

“Less than a year after we closed on Midlothian Towne Crossing, we are pleased that CBRE has successfully marketed these pad sites, which will be a great addition to any company’s portfolio,” said Younger Partners Investments’ Cort Martin. “This retail center is in a high-traffic location with about 2.9 million visitors a year and a growing Midlothian population, which has grown more than 6.8% since 2010 to now almost 47,000 strong.”

The Class A power center, anchored by Kroger, is comprised of several national brand tenants including Ross, Burkes Outlet, Petco, Ulta Beauty and Famous Footwear serving as junior anchors. Additionally, there is a complementary 65,656 SF of shop space offering a mix of retail, service and restaurant tenants.

“Midlothian Towne Crossing is anchored by the 13th most visited Kroger in Texas, which shows the viability of the power center and these pad sites,” said Aubrey, senior vice president with CBRE’s Private Capital Investment group.

“This location is in the path of growth,” Austry, also a senior vice president with CBRE, added. “With an average household income of more than $120,000, Midlothian is a great place for retail.”

Midlothian Towne Crossing is surrounded by 9,938 planned or under-construction single-family homes and 513 planned or under-construction multifamily units within a five-mile radius of the property, according to Esri 2022.

YPI acquired its first retail asset in 2021. In January, YPI acquired a two-property, 288,063-square-foot retail portfolio from the developer, Weber & Company, bringing YPI’s portfolio to more than 1 million square feet of retail. The acquisition also marks YPI’s expansion into East Texas while strengthening its existing North Texas holdings.

Younger Partners Brokers Sale of Prime Land in Sherman

SHERMAN, Texas (Jan. 14, 2025) – A New York-based investment group acquired 4.7 acres at the northeast quadrant of US 75 and Peyton Street in Sherman, Texas, for multiple commercial uses including possible hospitality opportunities.

Younger Partners Executive Vice President Tom Grunnah and Associate Luke Nolan represented the seller. Younger Partners Associate Nan Li represented the buyer. The all-cash sale closed within 45 days. Sales price was not disclosed.

“The property’s C-1 zoning designation sets this land up to serve the immediate needs of the neighborhood,” Grunnah said. “Its location is immediately adjacent to Furniture Row and a future major bank headquarters development. In addition, the land has an ag exemption, making it an excellent investment hold within the city of Sherman. The buyer has ambitious plans to expand its presence in Texas.”

Located at 320 Payton St. in the heart of Sherman, this property is in the path of growth for a city rapidly becoming an investment hotspot with remarkable development potential. With major players like Texas Instruments, GlobalWafers and other high-end manufacturing companies moving in, Sherman is primed for an economic boom. The land is reachable via U.S. highways 75 and 377 (north/south), U.S. Highway 82 (east/west) and multiple state highways and farm-to-market roads and is located 65 miles north of Dallas.

“The property’s accessibility makes it an ideal location as the city continues to expand,” Grunnah said. “As the DFW area and surrounding cities continue to welcome an influx of people, Sherman seeks to expand its workforce and add new businesses to accommodate this growth.”

“Our approach is truly a collaborative team effort within the Younger Partners Land Group,” Li emphasized. “By working together, we ensure our clients – both seller and buyer – benefit from the full scope of our combined knowledge, resources and industry connections.”

Younger Partners Investments Acquires 288,000-Square Foot Retail Portfolio

MCKINNEY and LONGVIEW, Texas (Jan. 6, 2025) – Dallas-based Younger Partners Investments (YPI) acquired a two-property, 288,063-square-foot retail portfolio from the developer, Weber & Company.

The addition of these properties brings YPI’s portfolio to over 1,000,000 square feet of retail. The acquisition also marks YPI’s expansion into East Texas while strengthening its existing North Texas holdings.

“These high-quality, Class A regional centers built in 2007 & 2008 respectively, have never traded. The centers have very limited vacancy. We are thrilled to enhance value when opportunities arise, such as the recently announced Party City bankruptcy. This creates an opportunity for a freestanding 12,000 square foot user in 380 Towne Crossing,” said Managing Director, Micah Ashford.

The 137,287-square-foot 380 Towne Crossing is at 2014 W. University Drive, at the northwest corner of US 75 and SH 380 in McKinney. The center is shadow anchored by Super Target and Lowe’s Home Improvement. The center’s occupancy is 98.2%, with a diverse tenant mix including FedEx Office, Buffalo Wild Wings, Leslie’s Pool, Cook Children’s Pediatrics, Storming Crab, Jimmy John’s and Sleep Experts.

“McKinney, known for its small-town charm and big-time growth, is the fourth-fastest growing city in the nation,” said Kathy Permenter, Co-Managing Partner. “380 Towne Crossing has prime visibility from two major highways and is close to Raytheon’s McKinney campus. These and other factors make it an ideal location for robust tenant sales.”

The 95.6%-occupied Longview Towne Crossing consists of 150,775 square feet. Located at 3092 N. Eastman Road at the northeast corner of US 259 and Hawkins Parkway, the property’s anchors are PetSmart, Five Below and Old Navy. Target and Kohl’s serve as the center’s shadow anchors. Other tenants include James Avery, Cowboy Chicken, Sport Clips, Ulta Beauty, Crumbl Cookies, Sleep Number and Lane Bryant.

“Longview enjoys an exceptional infrastructure that has attracted companies, including Westlake Chemical, Eastman Chemical and Komatsu. We anticipate more companies will target this region for expansion in the coming years,” said Moody Younger, Co-Managing Partner.

Younger Partners Brokers Sale of Midway Square in Addison to AMLI for Mixed-Use Development

ADDISON, Texas (Dec. 12, 2024) — Younger Partners Executive Vice President Ben McCutchin and Consultant Sam Kartalis brokered the sale of the eight-acre former Midway Square Shopping Center, at 14833 Midway Road in Addison to AMLI Residential. Located within the 79-acre Midway South neighborhood, the aging center was earmarked for redevelopment and now will become a key addition to AMLI’s highly anticipated AMLI Treehouse mixed-use development. McCutchin and Kartalis represented both the seller, VVI, Inc. and the buyer, AMLI Residential.

McCutchin has close ties to the property as this was an integral component of the 150-acre homestead that his mother purchased some 60 years ago when it was farmland. Over the years, the McCutchin family selectively developed the 150-acre farm into various successful projects, which included the Midway Square Shopping Center.

First developed in the early 1980s, the Midway Square Shopping Center served as a local destination with several well-known restaurants including the Midway Point and Jaxx Steakhouse, among others. Since 2020, the Midway Square Shopping Center grew increasingly difficult to maintain.

“This was one of the last large-acre, single-owner development sites on Midway between LBJ and Belt Line,” McCutchin said. “The shopping center was aging and would have required millions of dollars to bring it up to date. The ownership decided it was best to put it on the market and felt that it could fit in well with AMLI’s existing development next door.”

Kartalis noted that this property attracted multiple premier multifamily developers interested in its acquisition. “We went with AMLI because of its excellent reputation within the Town of Addison and its proposal to create a truly mixed-use development, a requirement of the Midway South neighborhood overlay.”

“Soon, AMLI will commence demolition of the 40-plus-year-old structures and incorporate the site into its AMLI Treehouse development south of the site, which broke ground about a year ago and will now extend up to Beltway Road,” Kartalis said.

“AMLI’s experience with its existing AMLI Addison apartment community and AMLI Treehouse mixed-use development is visible evidence of its ability to create something iconic on this property to the satisfaction of the neighborhood and the Town,” he added.

AMLI Treehouse is slated for its first resident move-ins in the first half of 2026 and completion by the middle of 2027. Once complete, the overall community will include 570 luxury apartments, 30 luxury rental townhomes, 56 for-sale townhomes, 3.7 acres of green space and 12,500 square feet of stand-alone retail. The retail is actively being marketed by Thomas Glendenning with SHOP Companies.

“Special thanks to Ben and Sam for entrusting AMLI to honor the McCutchin legacy through a continuation of our existing AMLI Treehouse development. Redevelopment of Midway Square unlocks numerous community benefits and completes the Town’s vision for the burgeoning Midway South neighborhood. The mixed-use community will offer plentiful green space, desirable destination retail and outstanding housing choices,” said Robert Lapp, AMLI Development Co. Vice President.

“This will be a high-end project that really benefits the Town of Addison,” McCutchin said. “My family would be pleased with the legacy of what is happening on the land.”

About AMLI Residential

A 2023 USGBC LEED Homes Awards Outstanding Developer and Power Builder and a 2023 EPA ENERGY STAR PARTNER of the Year, AMLI Residential focuses on the development, acquisition and management of environmentally responsible apartment communities throughout the U.S. Founded in 1980, AMLI is owned by PRIME Property Fund, a core commingled institutional fund. AMLI owns and manages 78 apartment communities, including approximately 25,600 apartment homes, and has over 3,100 additional apartment homes under development at seven new communities. AMLI is a leader in multifamily sustainability. Forty-nine AMLI communities are LEED®-certified and 47 communities are ENERGY STAR®-certified. For more information, visit AMLI.com.

Younger Partners Brokers Site for Carwash in Adaptive Reuse Project

LAKE HIGHLANDS, Texas (Dec. 10, 2024)— Younger Partners Senior Vice President Michael Ytem and Associate Luke Nolan successfully brokered an off-market sale of a vacant 11,200 square feet CVS at 10666 E Northwest Highway in the Old Lake Highlands area in Northeast Dallas for an out-of-the-ordinary adaptive reuse project.

Younger Partners brokered the deal between the seller, Sierra Properties, and the buyer, Victron Energy Inc. Vice President Mohamed Sharaf.

“When CVS did not renew its lease, I recognized there was an incredible opportunity to leverage the existing building that was soon to go dark,” Ytem said. “I brought in a buyer that saw the potential in an adaptive reuse play, transforming the empty CVS into a state-of-the-art carwash facility.”

“Pharmacy brands like CVS continue to reevaluate their real estate strategies, driven by oversaturation and a shift to smaller, more efficient formats. This trend has made larger stores increasingly obsolete, opening the door for groups to repurpose highly sought-after real estate,” Nolan said.

This site, on 1.15 acres on the hard corner of E. Northwest Highway and Plano Road, is a major intersection, heavily trafficked for morning and evening commuters, Ytem added. “Establishing a carwash site fills a major void between 635 and 75.”

“I was looking to repurpose the building after CVS closed. Michael Ytem and his team were able to locate numerous potential buyers and tenants in a timely fashion. They followed up every step of the way and their detail-oriented approach made this process seamless,” said Sierra Properties Owner John Kenny.

Sharaf added that the site’s location is in a key urban market on a busy corner which is one of the main attributes that makes the property so attractive.

“Breathing life back into an abandoned site provides a unique opportunity to be creative as we need to find a way to cut entrances, windows, fit equipment, tear out the mezzanine, change the grading and flooring to accommodate vehicular instead of pedestrian traffic,” he said.

Wash Masters is owned by Victron Energy and was started by Ali Sharaf in 2004 when the first location opened in Irving. Securing this deal in the company’s 20th year means a lot to Mohamed Sharaf.

“We recently became the largest car wash chain in the DFW area and are excited to open our second location in Dallas proper,” he said.

Lake Highlands boasts a population of 99,360 and is primarily a residential community. The addition of a new car wash facility demonstrates the area’s commitment to accommodating new residents as the area continues to boom.

“As a Lake Highlands resident, I was personally vested in bringing positive change to a premier corner with much-needed services,” Ytem said. “This is the second deal we’ve brokered for John at that intersection.”

Younger Partners Negotiates Sale of 116 Acres in Anna for Mixed-Use Development

ANNA, Texas (Nov. 19, 2024)— Rockhill Capital & Investments struck a deal with the Cox Family to acquire 116 acres in the North Texas city of Anna, 45 miles north of Dallas. The Frisco buyer will sell fully entitled tracts of land to homebuilders, multifamily and commercial developers, as well as end-users at County Road 371 and State Highway 5, approximately two miles east of the booming U.S. 75 corridor.

Younger Partners Executive Managing Director John St. Clair, Vice President Tyler Hemenway and Associate Davis Willoughby represented the seller in the transaction. The sales price was not disclosed.

The single-family portion will be built in phases with development of 325 single-family lots, said Rockhill Chief Development Officer Brent Libby.

“Construction will likely begin early in Q2 2025,” Libby said. “We’ve already sold 82 of the 116 acres to homebuilder Taylor Morrison and they should break ground first.”

Libby added that 9.5 acres on SH 5 is under contract to a commercial developer. Meanwhile, Rockhill is negotiating with a user/developer on the remaining 24 acres, which is zoned for multifamily.

The seller, the Cox Family, owned the land for decades before this sale, Hemenway said, noting that the seller received multiple offers on the property over the years but wasn’t prepared to sell.

“Ultimately, the family wanted to capitalize on the land market before unforeseen market factors took place,” St. Clair added. “This deal took place at the right time with the right buyer.”

The acquisition involved a lengthy zoning process to acquire the land, Willoughby said.

“The Cox Tract is essentially infill on the east side of Anna, and we were able to secure a great entitlement package, which included single-family, multifamily and commercial zoning,” Libby explained. He added that Rockhill created a Public Improvement District (PID) on the single-family portion of the land, which helped the deal move forward.

“The City of Anna was great to work with and supported the project all the way through the process, which was a fairly complicated zoning case,” Libby said.

The transaction made sense to Rockhill, as it expands their current land holdings located in the nearby high-growth cities of Howe, Van Alstyne and Sherman.

“We’ll continue to source and acquire land in the area where we can add value through entitlements, and either develop the property or hold it for some time and exit to another developer or end user,” Libby said.

In addition to this deal in Anna, Hemenway and Younger Partners Senior Vice President Michael Ytem brokered the sale of more than 17 acres of family land in far north Collin County to Ascent Land Ventures for future development. Ytem and Hemenway also have 10.3 acres on the market for sale at a future hard corner of 923 E. FM 455 in Anna.

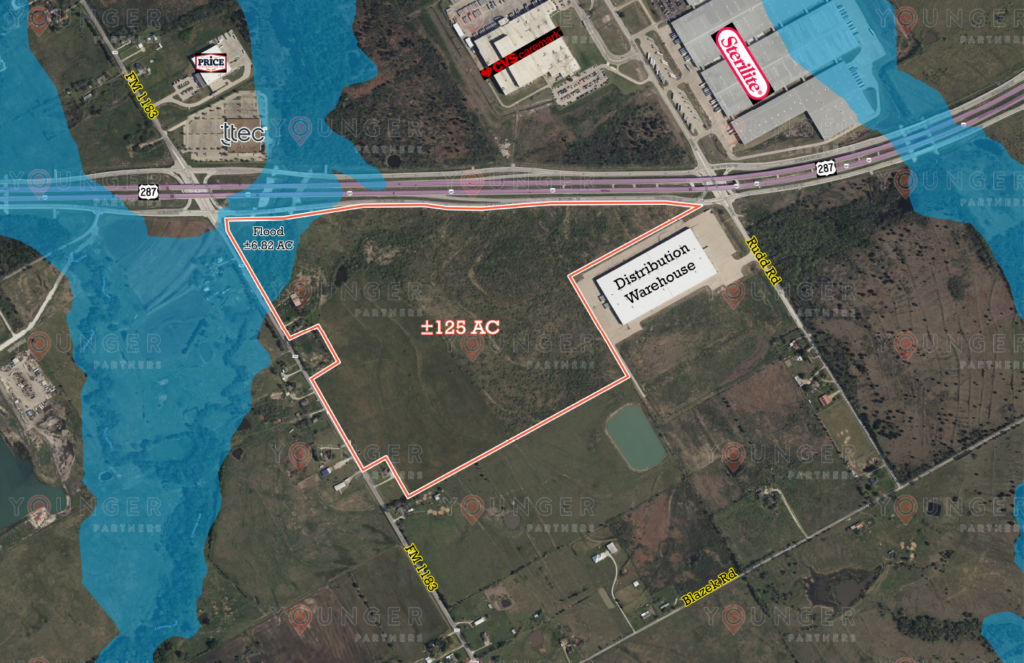

Dallas Company Buys 125 Acres in Ennis; Plans to Consolidate Operations and Distribution Activities

ENNIS, Texas (Oct. 31, 2024)—Younger Partners represented a Dallas company in its acquisition of 125 acres in Ennis, approximately 35 miles south of downtown Dallas. The new landowner plans to use the acreage at U.S. 287 and Oak Grove Road to expand its Metroplex operations.

Younger Partners’ Executive Managing Director—Land Division John St. Clair represented the buyer. The seller and sales price were undisclosed.

The buyer selected the land for its operations because of its proximity to major highway systems and land availability. In addition, Ennis and Ellis County offered the buyer economic incentives to add appeal to the relocation of its operations to the site.

“The buyer had been looking for the ideal site for distribution,” St. Clair said. The company had targeted developed areas in the region of South Dallas but could not find the right property at a reasonable price point.

St. Clair explained that Ennis and Ellis County have been under most developers’ radars. But that might not be the case for much longer. The U.S. Census reported that Ellis County’s population grew by 4.9% in 2023, making it one of the 10 fastest-growing counties in the South. Ennis is also experiencing a population boom, increasing by 17.7% between 2020 and 2023.

St. Clair said Ellis County could become a target for future commercial development along Dallas-Fort Worth’s southern region. The area contains a major highway (U.S. 287), interstates (IH-45 and easy access to IH-35), with plenty of undeveloped land. With people moving to the region it also means a larger skilled labor force, he said.

“Ellis County and Ennis are ideal for industrial development, particularly distribution,” St. Clair observed. “Ennis hasn’t been on the radar for projects like this, but when I brought the buyer down there, they immediately recognized the potential of the location.”

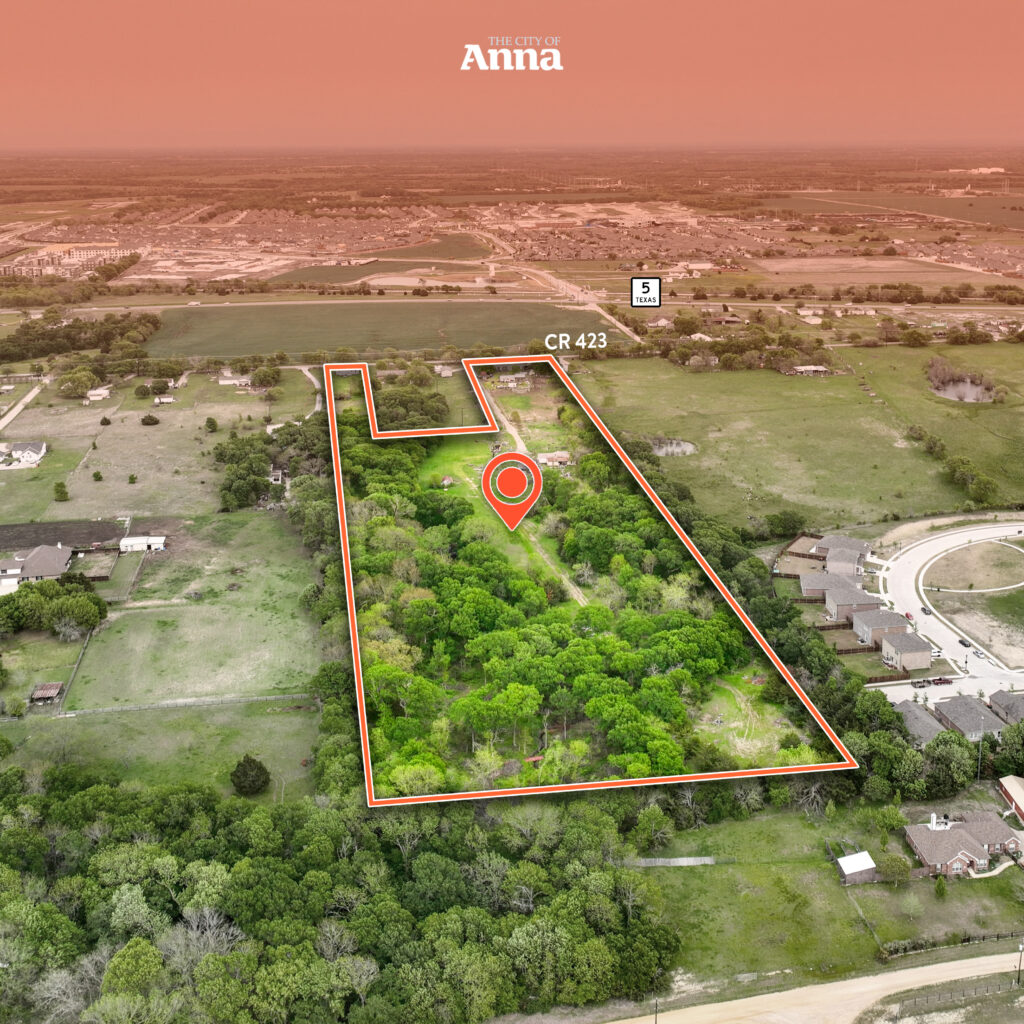

Younger Partners Brokers 17-Acre Land Sale in Far North Collin County Town of Anna

ANNA, Texas (Oct. 29, 2024)— Younger Partners Senior Vice President Michael Ytem and Vice President Tyler Hemenway brokered the sale of more than 17 acres of family land in Anna, TX to Ascent Land Ventures LLC, represented by Brandon Kendall and Tom Dosch from Dosch Marshall Real Estate (DMRE) for future development.

Ytem and Hemenway represented the seller, the heirs of the Copeland/Cottrell/Adams family in the transaction. DMRE Associate Brendon Kendall and Principal Tom Dosch negotiated on behalf of the buyer.

Located about 45 miles north of Dallas, the 17.26-acre parcel (at 9391 County Road 423) is intersected by County Road 422, west of Anna’s Town Square. The land is just minutes away from the under-construction Collin County Outer Loop, which will link the area with the Dallas North Tollway and State Highways 5, 121 and 78.

“Anna is a hot market. Since 2015, the city’s growth has skyrocketed by 1,915% with nearly 6,000 new rooftops added. Its location halfway between Dallas and Sherman is on a growth path coming from Plano and McKinney along U.S. 75,” Hemenway said. “Ranked as North Texas’ ninth fastest-growing city, the town’s appeal is its residential, commercial and industrial real estate development potential.”

Anna’s commercial presence continues to expand, highlighted by the upcoming construction of Home Depot and numerous chain restaurants along the Highway 75 corridor, he added.

“The town’s well-planned infrastructure supports this rapid growth with several key projects in the pipeline, catalyzed by significant additions such as Walmart and expanded city infrastructure extending west of U.S. 75,” he added. “These developments underscore Anna’s evolution from a gas station stop on the way to Lake Texoma to a vibrant community poised for substantial economic and residential expansion.”

“Closing on this property in one of the fastest-growing suburbs of Dallas-Fort Worth is a big win,” Kendall added, noting that the site will be held for future development.

“Despite tight market conditions, deals are still getting done and to the closing table,” Ytem said. “This deal, which is part of a larger assemblage of land that DMRE is developing there, resulted from a relationship with a classmate in The Real Estate Council’s Associate Leadership Council. It demonstrates the power of cultivating connections and operating with integrity and trust.”

Ytem and Hemenway also have 10.3 acres on the market for sale at a future hard corner of 923 E. FM 455 in Anna. Located in the ETJ (extraterritorial jurisdiction) of Anna, the land is designated as a Transitional Development area in Anna’s newly authored Downtown Master Plan. This parcel is also adjacent to the proposed 970-acre Sherley Farms single-family residential community set to include 3,000 homes with 125 acres of open space featuring a central green, pocket parks, along with hike and bike trails. Prosper-based developer Tellus Group – the developer of North Texas large-scale communities from Windsong Ranch in Aubrey to Mosaic in Celina – is the mastermind of Sherley Farms.

Younger Partners Closes Four-Acre Deal in Active East Fort Worth Submarket

Site Near Loop 820 & SH 121 Closed Within Three Months of Listing

RICHLAND HILLS, Texas (Sept. 24, 2024) – Younger Partners Senior Vice President Michael Ytem successfully negotiated the sale of a four-acre parcel zoned business park in the active East Fort Worth submarket.

Ytem represented the seller, Bridge Cap Partners, in the 2525 Handley Ederville Rd. transaction. Forrest Cook, a Senior Vice President at Stream Realty Partners, represented the buyer, G-Catch LLC.

The site near Interstate 820 and State Highway 121 once held the 150,000-square-foot Advanced Foam Recycling which was destroyed in a fire in 2021. Following that event, the structure was razed, and the pad scraped, with the seller acquiring it in 2022 as an opportunistic play.

“The location drove interest in the site. It’s at the very edge of where the East Fort Worth submarket ends and the Mid-Cities begins,” Ytem added. “With major thoroughfare access, it’s ideal for servicing both Fort Worth and Dallas.”

The property sold within three months of its listing date.

“The buyer was highly motivated to close on this deal,” Ytem said.

Cook said that the new owner is an established player in the DFW market, with plans to build flex and retail buildings on the acreage.

“East Fort Worth continues to be a highly sought-after industrial market due to high barriers to entry coupled with excellent labor and connectivity with the Dallas-Fort Worth Metroplex,” he added.

Ytem explained that the seller is a long-term client of Younger Partners Managing Principals Trae Anderson and Sean Dalton.

“It was a true privilege working for Sean and Trae’s client as the designated land expert.” Ytem said, adding that the transaction sailed through with few obstacles. “Forrest Cook was easy to work with on this transaction.”

Ytem, along with Younger Partners Executive Managing Director John St. Clair, recently listed Bell County 707 Ranch in the fast-growing Central Texas city of Temple to the market for immediate sale. The 707-acre ranch at West Adams Avenue and Texas 317, two of Temple’s main arteries, just minutes from Interstate 35 has a starting list price of $40 million. On-site amenities include an operational horse ranch, a working stone quarry and several natural springs. Also included is a 4,000-square-foot, 19th-century house built from stones sourced from the land and remodeled in 2015.

McCutchin Family is a Tangible Reminder of North Texas Land Development

Ben McCutchin reminisces about Pilot Knob and his family’s land legacy

Sitting at Interstate 35W and Robson Ranch Road lies Pilot Knob, a North Texas landmark southwest of Denton. The 900-foot-high natural rock protrusion provides a breathtaking 360-degree view of North Texas. Once the highest point in Denton County, the closer someone gets to the top, the slower they must walk because of the uneven terrain. Before the McCutchin family took over, infamous outlaw Sam Bass used this site as a hideout because of its cave-like structure. Today, Hillwood Communities plans to incorporate the knob and transform its surrounding areas for a combination of residential and mixed-use development projects.

How did Pilot Knob go from a hideout to an iconic landmark in North Texas? The McCutchin family might have something to do with that. Long before Younger Partners Executive Vice President Ben McCutchin was immersed in the world of real estate, his dad, Alex, started off drilling wells in the oil business, which piqued the family’s interest in land development. After Alex passed away, Ben’s mom, Alma, continued to invest in North Texas real estate. She possessed the foresight and vision to know that North Texas held the growth opportunities to become a major metroplex one day. Eventually, Ben caught on to the family’s passion for real estate and got involved in shaping North Texas to be what it is today.

Pilot Knob was owned by the McCutchin family until they sold it to Ross Perot in 1987. Ben recalls that this land was a hot commodity with numerous entities interested in the land in addition to Perot. In the middle of finalizing the deal, Texas was going through the Savings and Loan (S&L) crisis that caused the financial collapse in the late 1980s affecting the banking industry throughout the United States. Caused by several factors ranging from speculative lending, fixed-rate loans and interest rate hikes. The chaotic experience of selling this land amid turmoil taught Ben about the highs and lows of owning land. There is a certain tenacity and resilience that he developed while owning this land during that difficult time.

Recently, North Texas developer Hillwood (founded by Perot in 1988) finalized plans to develop the property. Because of Pilot Knob’s rich history, they plan to preserve the knob within the planned residential communities. Pilot Knob and the post oak trees will be incorporated into a trail system with recreation areas and parks. The 360-degree view that Ben mentioned is here to stay. In addition to Hillwood, a portion of the land was sold several years ago to single-family land developer, Zena Development, which is in its last phase of successful build-out. What was once an endless sprawl of cattle grazing land is now going to be a major hub for Denton County homeowners.

When thinking about the legacy of his family in the North Texas area, the main sentiment that Ben expresses is immense gratitude. His family’s legacy is a tangible reminder of the evolution of North Texas land development. He is thankful to have grown up in Dallas and acknowledges how good the city has been to him and his family. As far as working in real estate, Ben says he never wants to retire because this industry has given him a purpose and something that he loves all in one.

The cliché saying that “love what you do, and you will never work a day in your life,” rings true for Ben McCutchin. As for the future of North Texas land development: it won’t slow down, he says. “I can see development going all the way up to the state line bordering Oklahoma,” he predicts. In the future, keep your eyes on the lookout for the next development in North Texas. The McCutchins just might have something to do with it.

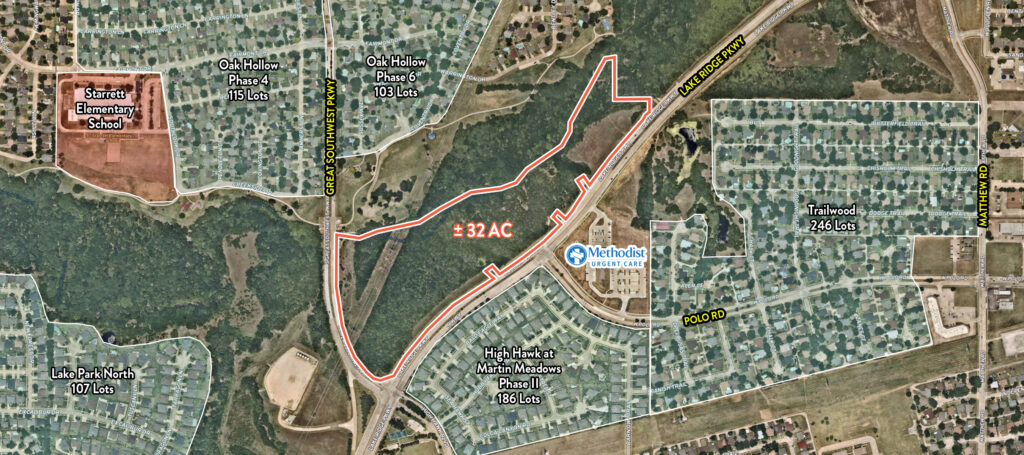

Younger Partners Brokers 32-Acre Sale to Multifamily Giant JPI

GRAND PRAIRIE, Texas (Aug. 14, 2024) – Younger Partners Executive Managing Director John St. Clair and Associate Davis Willoughby brokered the sale of 31.8 acres at the northwest corner of Lake Ridge Parkway and Great Southwest Parkway in Grand Prairie, Texas, to JPI, a leader in the development of best-in-class multifamily communities.

St. Clair and Willoughby represented the undisclosed seller, the property’s longtime owner. The transaction was a direct deal with JPI.

“This tract has been overlooked for years because of its topography and the city’s floodplain challenges, but JPI saw the potential to make those issues an asset,” St. Clair said. “This is an amazing acquisition for JPI and a wonderful addition to the city of Grand Prairie’s multifamily offerings.”

Like most North Texas cities, there is demand for housing units, particularly multifamily, throughout Grand Prairie. “Infill multifamily sites are highly coveted, and it is difficult to find them in the right location with the appropriate zoning,” Willoughby said. “When these parcels are found, they have great value. This site was a rare gem for JPI as it was already zoned for multifamily usage.”

Occupancy for all multifamily units across DFW hovers around 92%, according to Q2 data. The city also has some of the region’s largest employers with Lockheed Martin, Grand Prairie ISD and Poly-America Inc. leading the way, according to the City of Grand Prairie.

“City leadership recognizes the need for these kinds of projects,” Willoughby said. “The city’s planned development provision for this property was written in the 1980s, which required some discussion to ensure the multifamily stipulated within the zoning complies with the city’s multifamily standards of today. It was a unique situation to have the purchaser, seller and city working together to bring the project to fruition.”

Additionally, because about half of the land is located in the flood plain, it inspired some out-of-the-box thinking for JPI in considering this site, St. Clair added. “On the positive side, the flood plain creates a site featuring natural, wooded views which JPI can take advantage of to create an amenity for the residents,” he said.

“It is a testament to JPI to select this parcel for a project,” St. Clair said. “JPI has a quality team. The combination of a long track record of success and its ability to perform sets the firm apart. From a broker’s perspective, JPI appreciates and values the work we bring to a transaction. This is not always the case with sellers and buyers.”

Younger Partners Helps Secure Old Lake Highlands Site for The Goddard School

LAKE HIGHLANDS, Texas (Aug. 13, 2024) – Younger Partners Senior Vice President Michael Ytem and Associate Luke Nolan successfully negotiated the sale of 19,000 square feet on 1.15 acres at 10620-10624 E Northwest Highway in the Old Lake Highlands area in Northeast Dallas.

Younger Partners represented the seller, Johny Kenny, in the transaction. The buyer, Noori Abdulghani, president of Linhope Companies, was represented by Cushman & Wakefield Senior Director Steve Wentz.

The site has been various businesses, ranging from a Hollywood Video to a Dollar General and a furniture store. The buyer plans to transform a majority of the building into a new location for The Goddard School, bringing the inquiry-based learning experience to area families.

“Conveniently located on Northwest Highway, I had no doubt this site would lend itself to something great,” said Ytem. “Old Lake Highlands is the place to be; this sale will fulfill the demand of a growing population.”

Abdulghani said the retail storefront is an ideal location for adaptive reuse into a childcare facility. “As a local resident with young children, I know firsthand the need for additional childcare in this part of Dallas. We look forward to partnering with Goddard to develop a leading childcare facility and invest in quality education and care for our youngest generation,” Abdulghani said.

Currently, only 14 childcare facilities are within 15 miles of Lake Highlands. The facility is surrounded by multiple residential communities, giving those parents a convenient location and high-quality childcare option, Ytem said.

The Goddard School’s inquiry-based education program embraces how children learn best—through their innate curiosity—because research confirms that when wonder leads, learning follows. The program features a cutting-edge curriculum developed by a diversely skilled group of educators, researchers, physicians and early childhood experts, as well as built-in assessment of academic and social-emotional progress and family communication via a proprietary app.

The Goddard School serves almost 100,000 students from six weeks to six years old in 37 states and Washington, D.C.

About The Goddard School

For 36 years, The Goddard School has nurtured the extraordinary in every child, providing a warm, caring and safe environment that supports their individual social, emotional and academic development, appreciates their unique talents and personalities, and fosters skills they need for long-term success in school and in life. The Goddard School’s exclusive inquiry-based education program, Wonder of Learning, embraces how children learn best—through their innate curiosity—because research confirms that when wonder leads, learning follows. Wonder of Learning is backed by expert knowledge, data-driven insight and unwavering compassion for growing minds, encouraging children to explore their curiosities and interests as they discover the joy—and wonder—of learning. The Goddard School serves almost 100,000 students from six weeks to six years old in 37 states and Washington, D.C. To learn more about The Goddard School, please visit GoddardSchool.com.

Three Takeaways from ICSC 2024

By: Masen Stamp, Office and Retail Leasing Senior Associate

If you’ve ever been to ICSC Las Vegas, you know it is an eventful, three-day gathering of the biggest retail CRE dealmakers and industry experts. These retail influencers and leaders are driving the innovation and evolution commercial real estate has to offer, specifically in the retail sector.

Younger Partners sent a team including Co-Managing Partners Moody Younger and Kathy Permenter, Investments-Land Division VP Renzo Cella, me and Retail Leasing Associate Carson Mitchell. And, if you even think about bringing heels, don’t! We walked over 15,000 steps daily with back-to-back meetings on both Monday and Tuesday. I made some amazing contacts and although I returned tired from the day-in and day-out of the convention, I am also refreshed for the work!

If you haven’t been and are thinking about going next year, here are three of my takeaways:

- Set the meeting: Whether you’re nervous to call and ask or think someone won’t give you the time of day—try anyway. People appreciate the hustle and likely will fit you in. You can get something out of every single meeting. You never know what one meeting can lead to or what you can learn from somebody else in the industry just by taking the time to have a conversation.When scheduling meetings, make sure to put the calendar invite in the time zone of the location of your meeting to avoid confusion. The convention center is huge—give yourself plenty of time between meetings or group them in the same halls.

- Amp up the energy: With long days, it can be easy to succumb to fatigue, but bring your energy. Be the broker people look forward to running into at these events. Drink three cups of coffee if you must. A lot of energy can go a long way. It’s contagious!

- Bring water and a snack: A pro tip for big events is to eat/drink water when you can. You don’t know when the next meal is going to happen. It’s also a good idea to bring a big water bottle as you hop from meeting to meeting. Bring electrolytes…you’re in Vegas!

ICSC showed me the importance of building relationships, especially in the commercial real estate industry. Networking and putting yourself in the room with decision-makers and other dealmakers is crucial. It’s much easier to negotiate deals with brokers and tenants you have a relationship with because you’ve built trust and camaraderie. Moving forward in my role at Younger Partners, I plan on being more intentional with my relationship building.

As a group, we ventured through some of Vegas’ most iconic hotels, such as the Bellagio, Cosmopolitan, Encore/Wynn, Caesars Palace and Paris. We proceeded to eat and drink our way through Vegas as well. Since the NBA playoffs were happening, we didn’t miss our chance to place a bet at the Wynn Sportsbook. We put $100 on the Dallas Mavericks winning the game— the Mavericks won, so we won!

We can’t wait to explore all the opportunities given, and we are already planning for ICSC 2025! Not everything that happens in Vegas has to stay in Vegas.

Younger Partners Brings Rare 707-Acre Parcel to Market

Central Texas region

TEMPLE, Texas (July 9, 2024) – Younger Partners Executive Managing Director John St. Clair and Senior Vice President Michael Ytem have brought the 700+ acre Bell County 707 Ranch, in the fast-growing city of Temple, to the market for immediate sale.

Located about 128 miles south of Dallas and 74 miles north of Austin, the Central Texas tract is currently zoned for agricultural use and offers rare and compelling commercial and residential opportunities in a fast-growing Texas city.

The 707-acre parcel is at West Adams Avenue and Texas 317, two of Temple’s main arteries, just minutes from Interstate 35. On-site amenities include an operational horse ranch, a working stone quarry and several natural springs. Also included is a 4,000-square-foot, 19th-century house built from stones sourced from the land and remodeled in 2015.

“The sellers held the land for decades,” St. Clair said. “Potential buyers expressed interest in the site in the past, but it wasn’t for sale until now.”

The location is in the growth path for Temple, he added. The city has an active health and life sciences sector, anchored by Baylor Scott & White Health. Temple also attracts companies active in the technology and financial services arenas. According to the U.S. Census Bureau, the population increased by 13.4% between 2020 and 2023 to more than 93,000 and is anticipated to reach 100,000 residents by spring 2025.

“Temple’s growth has moved west and gone as far as it can,” Ytem said. “Ranch 707 is between that growth and Lake Belton, which is the property’s western edge.”

The acreage offers a convenient location, situated close to new retail outlets and educational institutions while offering the peace and serenity of the agricultural land. Ranch 707 is also the only parcel of its size available in the immediate area.

St. Clair said the land would be ideal for residential and commercial mixed-use purposes, both of which are in demand. “It’s also a great investment that could offer a good long-term hold strategy,” St. Clair said.

Ytem added that its strategic location also provides an opportunity for a business park with retail and residential components. “It’s about 1.5 hours away from Austin and two or so hours from Dallas,” he said. “With the massive growth along the I-35 corridor and more connectivity between these cities, this ‘tweener’ position could be an ideal home base for companies that do business in both cities.”

St. Clair and Ytem said that Ranch 707 would be an ideal opportunity for an imaginative developer or investor who understands and appreciates the growth occurring west of I-35 in Temple.

“Although Younger Partners is a Dallas-based company, we have successfully transacted Austin-area deals,” St. Clair added. “We anticipate this offering will attract much attention.”

Kelly Stewart Named General Manager of Artisan Circle

FORT WORTH, Texas (June 27, 2024) – Younger Partners announced today the appointment of Kelly Stewart as the new General Manager of Artisan Circle in Fort Worth, Texas. With more than 20 years of experience in commercial real estate, Stewart brings extensive expertise and a proven track record in property management and strategic development.

Artisan Circle is a 282,805-square-foot urban village located at the corner of University Drive and 7th Street. Spanning five walkable blocks, this vibrant destination features salons, spas, gourmet and fast-casual restaurants, virtual reality gaming and a movie theater. It also offers pedestrian-friendly, Class A office space in the heart of the Fort Worth Cultural District.

Stewart previously served as the Director of Property Management for Younger Partners, leading a team managing 5 million square feet of office and retail space. She streamlined operational processes and implemented innovative budgeting software. Her extensive background includes roles as Senior Property Manager and General Manager, highlighting her exceptional financial, operational and client management skills.

Stewart holds a Bachelor of Arts in Chemistry and a master’s degree in Land Economics and Real Estate from Texas A&M University. She is a Certified Property Manager and a licensed Real Estate Salesperson.

“We are excited to see Kelly transition into the role of General Manager at Artisan Circle,” said Kathy Permenter, co-owner of Younger Partners. “Her vast experience and commitment to excellence make her the ideal leader to guide our team as we transform Artisan Circle into a vibrant lifestyle hub for dining, shopping and entertainment. Kelly’s talent for finding innovative solutions to complex challenges aligns perfectly with our mission to establish Artisan Circle as a premier destination for Fort Worth residents and visitors alike.”

Stewart’s leadership will enhance Artisan Circle’s operations, build strategic partnerships and elevate the overall visitor experience. Her dedication to maintaining quality assets while balancing business, technology and people ensures that Artisan Circle will thrive and grow under her guidance. For more information, please visit www.artisancirclefw.com.