Author: Younger Partners

YP Spotlight: Byron McCoy

Our December #YPSpotlight, Byron McCoy, is one of the nine partners at Younger Partners. He joined the company six years ago and focuses on third-party agency leasing and some sales transactions. Byron says what he enjoys most about his role is that every day, every transaction and every client is different. Getting a property to full occupancy is especially satisfying, too. He and his wife of 31 years, Deah, have three grown children – Kent, Caleb and Katherine – and welcomed their first grandchild this year, Brooks Byron.

Salesmanship has been in Byron’s blood since he was a boy: he was a paperboy for the Dallas Times Herald from the third grade until 11th grade. He was enterprising and came up with the idea to include payment envelopes with the newspapers asking for the subscription payments to be mailed in or pinned to the mailbox, The Herald took the idea citywide with the Dallas Morning News following suit. Named Paperboy of the Year twice, Byron did TV commercials for the Herald and used the money to finance his education at Baylor University.

How Can Office Rates Still be Rising?

By Younger Partners Research Director Steve Triolet

Rates are a lagging indicator, in other words, they often don’t react initially to changing market conditions. Still, over the past few quarters, DFW office asking rates have remained stubbornly high, especially in comparison to other large markets like San Francisco and New York City (which have both seen rates drop about 10% over the past three quarters). The level of distress for owners in those coastal markets is high, so their rates have reacted more quickly.

Diving into the details of what I’m seeing in DFW office rates:

*Lincoln Centre recently raised its asking rate across the business park by $2 to $32 (NNN). The catalyst appears to be the Huitt Zollars lease signing for 32,519 SF at Lincoln Centre III. Lincoln Centre is currently well leased with an occupancy rate near 90%.

On the flipside, some properties in Hall Office Park have seen some rate reductions for direct space. Property G4, for example, at 3011 Internet Blvd recently went from $23 (NNN) to $22 (NNN). The property’s occupancy is low; 82% of the property is available between a combination of direct and sublease space.

Roughly half of the submarkets recently saw a slight decrease in asking rates while the other half had slight increases, making the overall rates relatively flat.

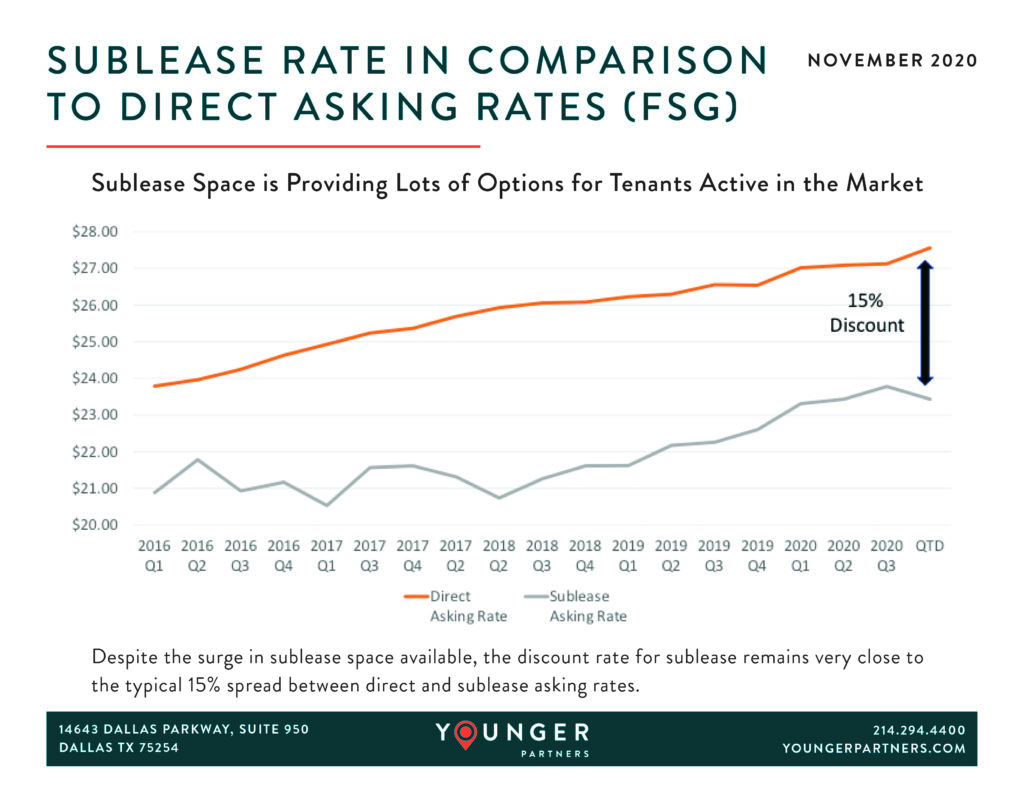

To date, the biggest movement in rates has been for sublease space. While the typical discount between direct and sublease space remains near 15% (which is the historic norm), more than a quarter of all sublease space being marketed does not have a quoted asking rate. Still. among the individual subleases, discounts of around 50% have been quoted. Ashford at Centura Tower I is quoting $15 Plus E, while the direct space at that property was recently quoted at $30 Plus E.

In the most extreme case at Energy Plaza, there is a very large sublease for 570k SF that has over a 60% discount in comparison to direct space ($9.50 full service rate), but that sublease has only a year of term left and has been listed on the market for over three years with no leasing activity to show for it.

Younger Partners Spotlight: Seyoum Amharay

Our November YP Spotlight is Seyoum Amharay. The YP Parking Operations Manager at Republic Center supervises both valet and self-parking activities; he enjoys meeting and engaging with tenants and customers. In his free time, he loves to cook and led the winning team in the YP 2019 Chili Cook Off despite never making chili before.

Each year, he volunteers to cook for the faculty at his daughter’s school. He plans to take his wife, Hirut, and daughter, Elizabeth, to Milan and Rome next year.

DFW Office Sublease Space is Near a 5-Year Supply

By Younger Partners Research Director Steve Triolet

It’s not really new that office sublease space across the US has been rising rapidly over the past 6 months. Dallas, like many markets, are seeing all-time highs. Currently, DFW has just under 9.3 million square feet available with some larger blocks likely to hit the market before year-end (Pioneer Natural Resources, for example, will place 400 to 600K of its headquarters’ space on the market soon). Current estimates point to sublease space surpassing 10 million square feet before the end of the year. That’s a big number, but what does that translate to? I took a historic look at how much sublease space was absorbed on a yearly basis. Typically, there is a little more than 5 million square feet of sublease available and a little more than half of that is absorbed (2.8 million square feet). The other remaining half does not lease and eventually hits the market as direct vacant space (once the master lease gets to a 2-year term or less).

Below you can see these numbers in chart form, along with a pie chart showing the four submarkets that have the highest concentration of sublease space (Far North Dallas, Las Colinas, Dallas CBD and Richardson/Plano).

YPPS Takes Over Renaissance Tower Property Management

Younger Partners Property Services will take over the property management for the 56-story, 1,738,979-square-foot Renaissance Tower at 1201 Elm St. in Downtown Dallas effective Sept. 1.

The Class A trophy office tower, located in the heart of the Dallas Central Business District, is a Dallas landmark known for its distinctive double “X” lighting and majestic rooftop spires.

“We are continually expanding our relationships with owners,” says Greg Grainger, president of Younger Partners Property Services.

This new assignment brings property managed by YPPS up to more than 5 million square feet of local property managed. YPPS ranked No. 15 on the Dallas Business Journal’s 2019 list of North Texas Commercial Property Managers ranked by total local commercial square feet managed.

The on-site property management team will be led by property management veteran Kay Crawford, who comes to Younger Partners to lead the Renaissance Tower from CBRE.

Completed in 1974, the office tower was substantially renovated between 1986 and 1991. Dallas Area Rapid Transit (DART) light rail runs immediately in front of the building and stops at the Akard Street station, just across Field Street from the property. The property also connects to downtown’s extensive underground walkway system.

The Spread Between the Availability Rate and Vacancy Points to Continued Negative Absorption Over the Next Few Quarters

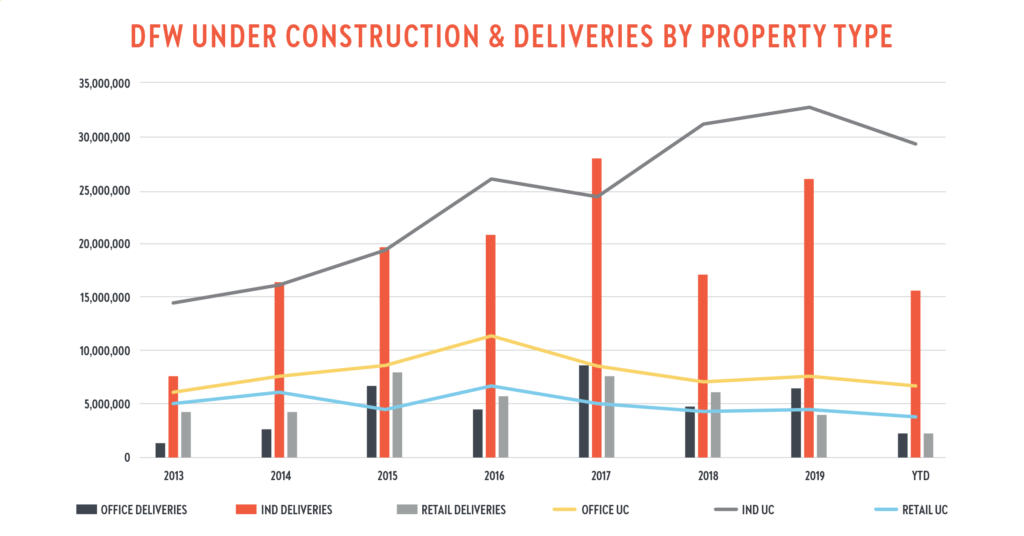

With most properties taking roughly two years between breaking ground and occupancy, the construction pipeline takes time to shift from changing market conditions. Still, I think it is informative to see how the various property types have changed over the past few years, along with some data on the current under construction pipeline.

As you can see in the chart below, the industrial market seems almost unfazed by the current recession, with almost 30 million square feet of space currently under construction (note this does not include flex properties).

Office and retail properties are show parallel trend lines of peaking in 2016 and trending downward since (The current office pipeline is 7.1 million square feet, while the retail pipeline is 3.3 million square feet).

With recent announcements for the office sector though (Cawley is kicking off The Parkwood, a 120,000-square foot office building in Far North Dallas. First United Mortgage Corp. will occupy about half of the property and

Harwood announced Harwood 14 in Uptown. Harwood 14 is a 27 story, 360,000-square foot office project. Haynes and Boone will be the lead tenant and will occupy about 125,000 square feet).

Of the projects currently under way for office and retail, roughly half of the square footage has been pre-leased (54% and 52%, respectively), so the market is scheduled to have over 5 million square foot of new vacant office and retail space delivered over the next two years (3.6 million square feet for office and 1.7 million square feet for retail).

YP Named to DBJ’s 2020 Best Places to Work

We did it! Younger Partners is one of Dallas Business Journal’s 2020 Best Places to Work. The winners were selected from several hundred companies and judged based upon the feedback from employee surveys. Thanks to our team for making this such a great place to work. A service company is only as good as its people and we have the best. #YoungerPartners #OurKindofTeam #DFWworks

August YP Spotlight: Parker Morgan

Our August #YPSpotlight, Parker Morgan, joined Younger Partners as a summer analyst intern from 2015-2017 and became a full-time broker on the office team after graduating from A&M in January 2018.

He enjoys learning more about the industry from the wealth of knowledge possessed by the YP brokerage team. In his downtime, Parker loves to golf and hunt, as well as enjoying Aggie football and the professional Dallas sports teams.

You can often find him spending time with friends and family, including his parents, Randy and Mary and his sisters (twins) Kate and Maggie. #YoungerPartners #MadeforThis #OurKindofPeople

Moody Younger in D CEO: Life Lessons From The Farm

The Younger Partners co-founding partner says his father’s “off your ass and on your feet” advice is resonating more than ever.

BY MOODY YOUNGER PUBLISHED IN COMMERCIAL REAL ESTATE AUGUST 6, 2020

Obviously, it has been a weird year thus far. I don’t think that I am alone in finding it very frustrating. It seems that as we begin to gain momentum, something happens to stop it. Overall, I have been pleased with our company’s performance throughout the uncertainty of the current market conditions. However, I have days when it takes an extra cup of coffee to get me going.

Growing up on a farm in the High Plains of Texas just below the Panhandle, we faced constant uncertainty from the dramatically unpredictable weather, insects, and the inherent randomness of farming. One year we lost a cotton crop due to defective seeds.

I worked on the farm with my dad since I was old enough to remember. There are a couple of things he used to tell my siblings (there are four of us) and me that have resonated with me quite often recently.

The first was, “It’s always something.” He used this phrase anytime any of us complained about unexpected changes or outcomes that we didn’t think were fair. There may be more ‘somethings’ this year, but there is always ‘something’ if you choose to focus on the negative. By saying, “It’s always something,” his message was for us to basically shut up and keep moving forward. Focus on what we could do to improve things and don’t waste time thinking or talking about the ‘something’ that is always there if you choose to make excuses. Excuses were never acceptable to him, and he used all kinds of other witty phrases to establish this position. “It’s always something” was the most passive of the bunch.

The other phrase that has been resonating with me is the one he used in the morning to get us up or if he ever saw us sitting around, not doing anything. It was “Off your ass and on your feet, out of the shade and in the heat!” I am not sure where that phrase originated. My dad’s father was in World War II and grew up during the Great Depression. I expect this was a phrase from that era. For Dad, it didn’t just mean that you were going to work, and it didn’t just mean that you were going to work hard; it meant that you were going to work hard and fast. We didn’t get to walk to get tools or anything on the farm, we ran!

Why are Dad’s phrases resonating so strongly with me now, and how does this relate to the real estate business in Dallas? As real estate brokers, we are salespeople. COVID-19, riots, elections, misrepresentation of facts; “It’s always something.” Staying home, not engaging, lack of in-person connections, missing social interactions that lead to collaboration, that lead to creativity, that lead to deals: “Off your ass, on your feet, out of the shade and in the heat!”

I realize that COVID-19 is very dangerous for people that have significant underlying conditions, and people with those conditions should take all the precautions they deem necessary. However, if you aren’t one of those people, and you plan to be successful in our industry, I strongly recommend that you get “off your ass and on your feet, out of the shade and in the heat!” Because in our industry, “It’s always something.”

As a company, we have had to decide whether to prepare for growth or move home into isolation mode. With the positive influence of our partners and Dad’s phrases bouncing around in our heads, Kathy and I chose growth. We are pursuing new ventures in retail acquisitions and corporate services, expanding our office space by 32 percent, and recruiting new brokers to our platform. Our region of the country is very resilient, and we are incredibly optimistic about its future.

My father passed away in 2002, but if he were here today, I can guarantee that viewing Dallas from the High Plains of Texas, one thing would be apparent to him. The winners next year—when all the pent-up demand emerges for our market—will not be the people hanging out at home complaining about the events of 2020. The winners will be those that are fully engaged in pursuing the tremendous opportunities that will soon emerge for us in North Texas.

Moody Younger is one of the co-founding partners of Younger Partners. To see it in D CEO, click here.

July YP Spotlight: Nancy Vang

Our July #YPSpotlight, Nancy Vang, joined Younger Partners in July 2019 as an accountant for multiple properties.

She says she benefits from a great support system at YP from the office staff to property managers. In her downtime, she enjoys traveling, attending Korean Pop concerts, and playing poker. She is proud of her Hmong heritage; her family was among many immigrants who came to the U.S. from Laos/Thailand after oppression following the Vietnam War. She is grateful for their sacrifices to get her generation to a safer home and provide her with a life that they never had.

She and her husband, Tou Bee, look forward to visiting family, attending postponed concerts, and traveling when it’s safe again. #YoungerPartners #OurKindofPeople #Accounting

Micah Ashford Joins Younger Partners To Lead New Retail Acquisitions Platform

Younger Partners welcomes Micah Ashford to lead a new retail acquisition platform. She is coming off a two-year hiatus from a 20-year career as a partner at Dunhill Partners, a leading commercial real estate firm in the Southwest that focuses on retail shopping centers.

“It is wonderful to join this dynamic organization with such a solid reputation in the commercial real estate industry,” Micah says. “The timing of adding this new investment platform was incredible as I return to the industry. Retail has been cruising along and the impact of the COVID-19 pandemic is unprecedented. I see this as a true opportunity.”

She is thrilled at the prospect of leading the charge in launching this new division and bringing her expertise to an already successful and growing firm.

“We immediately recognized the value that Micah brings us in this new venture,” says Younger Partners Co-Founder Moody Younger. “It was an easy decision for us.” Younger Partners Co-Founder Kathy Permenter added that retail is a specialty niche and having the experience and leadership of Micah makes for a great addition to the team.

Micah’s diversified experience encompasses all facets of commercial real estate including transactional activities, finance and acquisitions. Her role at Younger Partners will include directing acquisitions, financing, and dispositions. She will originate new property opportunities, negotiate partnerships and loan documents, as well as oversee the physical and financial due diligence on those acquisitions.

Micah began her career with Dunhill as an analyst in 1999 and built an impressive roster of key network contacts including highly qualified principals, brokers, lenders, contractors, title associates and legal advisors.

During her career, she has acquired hundreds of centers from the Laguna Design Center in Laugna Niguel, Calif., to the Dallas Design District, and the Nut Tree Legendary Road Stop in Vacaville, Calif. Other projects she’s been affiliated with include the iconic Orinda Theatre Square in Orinda, Calif., and Vintage Park, an Italian shopping promenade in Houston.

Micah can be reached at micah.ashford@youngerpartners.com or by calling 214-238-8016 (office) or 214-215-3871 (mobile).

Younger Partners Adds Retail Investment Division

Younger Partners created a new platform to acquire retail properties: Younger Partners Investments. It will target retail properties from lifestyle to neighborhood centers in the Dallas-Fort Worth Metroplex. Along with this new division comes the hire of Micah Ashford to lead the charge.

“We feel like retail is one of the most disrupted sectors of commercial real estate,” says Younger Partners Co-Founder Moody Younger. “While we can relate to the tough times COVID-19 has created for many, we are confident in the resilience of Texas and we are excited to make this investment in the future of retail and our region. The opportunity to add talent like Micah made the decision to launch this new platform an easy one for us.”

Ashford is coming off a two-year hiatus from a 20-year career as a partner at Dunhill Partners, a leading commercial real estate firm in the Southwest that focuses on retail shopping centers.

Younger Partners Co-Founder Kathy Permenter says the new division has been part of the partners’ long-term strategy. “With the market going through dramatic changes as the result of the COVID-19 pandemic, this is a good time to do it. I started my career in retail, and it continues to interest me. I look forward to investing in this sector,” she says.

Younger says three key factors played a role in why retail was the logical choice for the investment line. First, it doesn’t conflict with Younger Partners’ existing service lines. Additionally, he believes opportunities will emerge in retail and value can be created. Finally, Ashford’s availability to lead the team was the clincher.

You can reach Micah Ashford at micah.ashford@youngerpartners.com or 214-238-8016 (office) and 214-215-3871 (mobile.) For more information on her joining Younger Partners, see her new hire press release here.

Three Hickory Centre set to deliver in December

Three Hickory Centre, a 103,000-square-foot four-story office building under construction as part of the 290-acre Mercer Crossing mixed-use project developed by Centurion American, is scheduled for a Dec. 1 delivery. The building is being marketed by Younger Partners’ Kathy Permenter and Garrett Marler.

The location on five acres at 1801 Whittington Place in Farmers Branch is near DFW Airport with direct access to three major thoroughfares, the President George Bush Turnpike, Interstate 635 and Interstate 35. The building’s floor plates will each feature about 26,000 square feet. The exterior is slated to be very similar to the existing One & Two Hickory buildings.

“The interior will be delivered in shell condition, so it is completely customizable for future tenants and it is for lease or sale,” Permenter says. “We are leasing the building as a multi-tenant building, but Three Hickory is also a great single-tenant option.”

The office building will be part of the 290-acre Mercer Center mixed-use development in the southeast quadrant of Luna Road and Valley View Lane. The project includes urban commerce with shops, restaurants, coffee bars, and office space. The development will also include single-story commercial sites, retail shopping centers, mixed-use buildings, corporate office spaces, and single-family homes. Six distinct residential neighborhoods with parks, trails, and open space have already been completed in the project. Additionally, the developers plan a boardwalk as part of the amenities at Mercer Crossing.

“Three Hickory is conveniently located between three thoroughfares, which gives future tenants the unique ability to quickly get to any location in the Metroplex. The building also offers efficient floor plates and building signage,” Marler says.

Mercer Crossing Development: https://mercercrossing.com

Three Hickory: https://www.youngerpartners.com/properties/three-hickory-centre/

June YP Spotlight: David Hinson

Our June #YPSpotlight, David Hinson, joined Younger Partners in 2017 bringing his client-centric approach focusing on land acquisition and disposition for investment, development or owner/user purposes. David says the best part of being a broker is the positive feedback he receives from a satisfied client. The California native enjoys fishing, hiking and woodworking. He and his wife, Sami, have two daughters, Sarah and Lori. This summer, the family plans a camping and hiking trip in Utah. #YoungerPartners #LandBroker #OurKindofPeople

DFW Office Sublease Space Beginning to Rise Again

By Steve Triolet, Younger Partners Research Director

One indicator of the market’s health is the amount of sublease space available. The DFW office market saw almost 7 million square feet of sublease space in early 2018 (as several tenants opted for new construction). In 2019, sublease declined, but has been on the rise again over the past few quarters as the market has slowed.

Most submarkets have only a little or moderate amount of sublease space. The exceptions being the Dallas CBD, Las Colinas and Richardson/Plano. These three submarkets each have over half a million square feet of sublease space available. For the Dallas CBD, it is over 1 million square feet.

Recent additions to sublease space on the market have mainly been mid-sized to smaller sublease spaces. Some of the larger additions so far this year include, Interstate Hotels, which is trying to sublease 31,596 SF at 125 E John Carpenter, PCI is trying to sublease the top floor (18,371 SF) at 4835 LBJ, and a new 43,162 SF sublease was recently added at Amber Trail Corporate Park.

With the current upheaval in the market, the amount of sublease space is expected to increase over the next few quarters.

YP Shares COVID-19 Experiences with DBJ

By Taylor Tompkins – Data Reporter, Dallas Business Journal

May 31, 2020, 6:05pm EDT

Managing partners Kathy Permenter and Moody Younger have been spending a lot of time on the phone since the beginning of the pandemic.

Once closures began, the pair in charge of Younger Partners began checking on employees and clients. Phone calls ran the gamut — checking on families, comparing notes on what others were hearing in the market and understanding the long-lasting impacts of the shut downs caused by the outbreak.

“Everything that we were working on all the sudden changed,” Younger said.

Uncertainty around construction and moving offices caused a number of the boutique commercial real estate firm’s deals to stall.

“We had several deals that I think had this not occurred, (we) would have made different choices and would have proceeded in different ways,” Permenter said. “I think deals that were in the signature stage — some of those some of those didn’t even go through.”

Younger Partners weren’t the only ones seeing a hesitation to buy or lease space. Dallas-Fort Worth experienced negative net office absorption for the first time in more than two years during the first quarter of 2020.

By the end of April, though, Younger Partners was starting to see movement again in the market.

“Life is coming back into (the market) a little bit,” Younger said in late April. “People are engaging more and over the next month you’ll definitely see people start to stick their toe in the water.”

Industrial transactions for Younger Partners remained steady through the bulk of the COVID-19 interruption. A slowdown in its land business was caused by planning and zoning delays on the local government level, Younger said.

The company also has hopes that the outbreak will create high demand for its leasing services throughout the summer.

“There have been multiple office buildings that haven’t performed as the investors originally anticipated,” Younger said. “Now with what’s happened with COVID-19, they’ve just really been put on hold, and so they still haven’t performed. And so, I think, they’re looking for companies that are creative and energetic to take over.”

The firm expects most of revenue that it had anticipated in the spring and early summer months will be pushed back to the third quarter.

“Especially in Dallas, (real estate firms) really kind of design yourself around recessions so that you can make it through them,” Younger said. “This is a different cause, but it’s really a recession. In our business, revenue isn’t consistent, and it bumps along so you have to keep more capital on hand just for those times when there is a recession and you have to manage a company with limited revenue.”

This story is part of a national series from the Business Journals’ 44 newsrooms across the country. Click here to read all 247 stories. The Younger Partners article can be seen here.

May YP Spotlight: Chito Ruiz

Our May spotlight, Humberto “Chito” Ruiz Jr., has been a maintenance technician for Younger Partners since February 2016 in Tyler. He enjoys keeping the building tenants happy and thrives on their positive feedback. He says receiving a simple thank you means a lot to him. He is very family-oriented and enjoys riding ATVs with his wife, Araseli, and sons, Daniel and Yadier. They enjoy country-living and cooking out, especially smoking brisket, chicken and pork ribs. On his to-do list: a trip to Puerto Vallarta. #YoungerPartners #YPPS #OurKindofPeople

Innovative Private Training Fitness Concept Coming to Dallas

A new fitness concept designed to help personal trainers take charge of their schedules, help their clients 24/7, and keep 100% of what they make is coming to the Dallas Design District. Self Made Training Facility (SMTF) Dallas is targeting an early July opening in a 13,375-square-foot fitness facility at 1925 E Levee St. in Dallas.

This is not an ordinary fitness facility. Unlike big box gyms, we do not have public memberships. We employ trainers as independent contractors, who run and operate their business out of our facility. The trainers pay a flat monthly fee, and receive 24/7 access to the facility, their own personalized nutrition and online training app, educational video database, marketing assistance, and much more, says SMTF Dallas franchise owner Austin Kent.

“Think of it like co-working for a personal trainer,” he explains. “Dallas consistently ranks atop lists of the fittest cities in the United States and we are within a 10-mile radius of a number of big box fitness facilities. That means that there are a lot of personal trainers who could join SMTF Dallas and start keeping more of their money by not sharing it with the commercial gyms that employ them.”

“We have a motto that SMTF is ‘where champions are self made’ and I believe that,” he says. The SMTF concept was created by company founder, Miguel Aguilar, as a single location in Murrieta, Calif., in 2013 with a goal of empowering the trainer-turned entrepreneur. There are now 28 locations and it is still growing. The idea is to allow trainers to earn a substantial living for themselves while being able to give top-quality service to athletes from all walks of life at an affordable price.

With 24/7 access to the facility, trainers pay a flat fee per month and can use it as much as they would like. SMTF Dallas is filled with top-of-the-line commercial grade equipment that covers all areas of training so that each trainer can utilize their respective specialties. Kent says trainers can offer group training or even small classes at the facility.

“Many personal trainers are struggling to make money because the big box gyms where they work keep 60 to 70 percent of the personal training fees,” he says. “Here, they can train how they want, set their own training rates, and make their own schedules that fit their lifestyles and those of their clients.”

Our facility is designed as a one stop shop for every discipline and training background. The equipment at the SMTF Dallas facility includes opportunities to train for a variety of sports ranging from MMA, weight loss, muscle gain, weight management, powerlifting, athletic training, speed, agility, quickness, boxing, jiu-jitsu, self-defense, cross training, Olympic lifting, wrestling, and much more. SMTF Dallas also has private showers and dressing room facilities, Kent says.

“This facility couldn’t have a better location,” says Kent, who is an SMU graduate, real estate developer and a real estate broker. “It is within a five-minute drive from Downtown, Uptown, the North Dallas Tollway, and I-35. It really is accessible for just about everyone.”

Younger Partners broker Tanja McAleavey represented Kent in finding the location and signing the lease. Bates and Myers Co’s Richard Myers represented the landlord, Levee Street Alliance LLC.

“This site is a great fit for Self Made,” McAleavey says. “This is one of the largest facilities in the chain at almost 14,000 square feet, which gives trainers more room to work. There are so many options here for trainers and coaches to work with clients on weight loss or body building or even just training athletes.”

Additionally, McAleavey says the location is right in the path of the future Katy Trail extension. It is still in the planning stages, but looks like it should cut right through the property upon completion to connect Uptown to the Design District and Trinity Grove.

For more info: https://smtfdallas.com

D CEO: How Yoga Helps This YP Exec Get Through The Chaotic New Normal

By Scot C. Farber

Sometimes the most life-changing events happen by accident. Today, I’m a yogi who practices being in the moment and enjoying life every day. However, the path that led me to reach that balance was not one I had planned to take.

About 15 years ago, I lost a bet with a female coworker and had to go to a 90-minute hot yoga class. I was already struggling with prior long term injuries, including a torn ACL and a dislocated pelvis, which had impacted my gait and left me with unmanageable pain. Getting out of bed each day was challenging.

That yoga class was pure misery, even just five minutes in. I’ve never been a quitter. I was going to tough it out, and I did.

Once I finished the class, I thought I would keep doing it. It was hard for me, but I’m always up for a physical challenge. I wanted to keep on and prove to myself that not only could I do this, but I could master it.

I’m not just a Type-A personality; I’m a Type-A+. So I searched for the longest, hardest yoga classes I could find. I’d chug an energy drink and tackle it. I looked like a train hit me when it was over. While I burned off a tremendous amount of stress, I still was not at peace.

Then, about four or five years ago, the mental part of yoga clicked for me. I even became an RYT 500 Hour yoga instructor and began to embrace life from a different point of view. I started changing my life and my habits.

I live, think, and even breathe differently today. My core has changed, both mentally and physically. As a result, my life has improved dramatically. This way of thinking, breathing, and living is part of what is helping me get through this chaotic new norm we are living in right now.

Finding balance in life allows me the ability to monitor what I absorb; you can only take in so much at one time.

Any of us can get ourselves all wound up about our circumstances, but I find it critical for me to look at what I can do next. Sometimes, we just have to be in the moment, breathe, and know that everything is going to be ok. When it gets crazy, each one of us has something within ourselves that we were born with to help us through this–our breath.

Slowing down and focusing from one breath to the next one is a natural calming tool.

Balance requires both physical and mental attention. If you’re trying to balance on one foot, it’s almost impossible to be thinking about other things at the same time. You have to have an almost complete focus to maintain your balance. Life is like that.

I see things clearer today than I ever have. That’s not to say that I don’t get stressed, wound up or tight, because I do. However, I can find a way through, with breathing, yoga, and other things to calm myself and see the bigger picture. For instance, I look at what I can do this week to prepare for next week, month, and year that could position myself to be in the right spot to find a prosperous outcome from the current situation.

Many of us have been through these cycles before with stock market crashes and deals blowing up. We can hope things were like they were, or we can accept that things have changed dramatically. If you are waiting for something to go back to “normal,” you’ll be stuck in the past. We have to take a moment to figure out how we can use our current skills, or if we need to develop new ones, to create a new successful strategy. The current environment gives us all the opportunity to take this blank slate and create a new way to be proactive and successful.

While I was fortunate to close two deals in the past few weeks, I’ve also had several deals fall out of a contract. Some owners are pulling properties off the market for now, and I assist them with reevaluating their options. I look at business day-to-day right now because it’s changing so fast. This will turn out ok, but when I feel like it won’t, I slow down my breathing, and I focus my thoughts on what I can do next.

I’ve taken up hiking and enjoy being able to take my yoga practice deeper mentally while being in the outdoors. I can connect to nature when I slow my breath and get outside. Like so many things in my life, I’m going big! I’m training now to climb Mount Kilimanjaro in Africa. Because I will use my breath to get there, I will send pictures from the summit!

While making my wish come true to Climb Kilimanjaro, I decided to combine this effort with helping others. I’ve teamed up with the Make-A-Wish Foundation of North Texas to help them grant wishes for critically ill children. My goal is to raise $1 for every foot I climb, which brings my goal to $19,341. To date, I have raised nearly $6,000 or 30 percent of my goal. #TheHopeClimb (You can donate here.)

While we are all feeling the punch in the gut from the economy right now, charities are being hit especially hard. Make-A-Wish grants thousands of unique wishes each year to critically and terminally ill children. It’s truly amazing what they do for these kids and families, giving children renewed energy and strength, bringing families closer together and uniting communities. For every wish granted, another eligible child is waiting for his or her wish to come true.

Please consider helping me help them? No amount is too small. Collectively, we can all make the world a better place, one breath at a time.

Scot C. Farber is the managing principal for capital markets at Younger Partners. You can see the article here.