Author: Younger Partners

Scot Farber Takes on Mount Kilimanjaro

Younger Partners Managing Principal Capital Markets Scot Farber is knocking an item off of his bucket list this June when he climbs Mount Kilimanjaro. He’s partnering with the Make-A-Wish Foundation of North Texas to help raise money for critically ill children to be granted wishes. He wants to raise $1 for every one of the 19,341 feet he will climb to reach the summit. We’re asking for your support. You can contribute by donating here.

Greenway Tower Featured in Bisnow: CRE Industry Keeps Deals Afloat Through VR Technology, Skype and FaceTime

March 30, 2020 Kerri Panchuk, Bisnow Dallas-Fort Worth

All the intangibles revealed during commercial property tours, like a building’s patina or its interior design, or how it just feels to walk into the lobby, help landlords win over potential tenants.

But what happens when an international pandemic like the coronavirus makes it impossible for brokers to invite prospective tenants and clients on-site for personalized tours? For some, it means business activity subsides until the crisis ends.

Others are sealing the deal from the comfort of their own homes. While virtual reality and remote building tours aren’t new to the brokerage industry, the pandemic may hasten their move into must-haves.

Sergey Zolkin/Unsplash Texas-based landlord Boxer Property decided to go full-throttle into the virtual realty space when the COVID-19 pandemic forced potential tenants away from the company’s office buildings.

Boxer had already deployed virtual reality tech tools that allow tenants to capture realistic, multidimensional views of its properties online.

“Years ago, we started taking pictures of suites, and then we started doing videos,” Boxer Properties Marketing Director Heather Shuttleworth said. “Then, we recently got a Matterport camera, and we are doing the full 360-virtual tour experience at several of our properties.”

Even though 3D tours are effective, Boxer still wanted a more personalized approach during the COVID-19 crisis, so the firm upped the ante and now offers live Skype property tours hosted by Boxer employees. “They can talk to [the leasing agent] face to face and see the space through the camera,” Shuttleworth said. “If they want to walk through it on their computer they can, but we are kind of missing the personal touch there and people often have questions and want to look at something more closely in the space.”

The Boxer team is already receiving positive feedback; and at least one Skype tour recipient signed up for a lease right after taking a remote interactive tour. Unsplash/Kentaro Toma Co-living and microstudio multifamily provider Common says 30% of its rental applications come from the firm’s online virtual tour experience, which the firm has operated in some form since its inception five years ago.

But Vice President of Operations Eric Rodriguez said Common, much like Boxer Property, kicked its existing remote solutions up a notch when the coronavirus crisis sent New York and other areas into lockdown mode. With the firm already offering FaceTime and Google Hangout tours with live specialists prior to the crisis, the transition to conducting everything remotely was an easy one.

“It has always been part of our concept,” Rodriguez said of the firm’s tech-first approach. Rodriguez said Common has always believed its mission is to get more people inside the property at all times of the day. In good times, that involves both in-person tours and VR-guided tours. In bad times like these, it means doing everything remotely without missing a beat.

The firm believes all multifamily leasing in the future will depend heavily on remote access and virtual reality components to stay competitive.

“Generally the property management industry is shifting toward that convenience-first perspective,” he said. Real estate brokerage Younger Partners out of Dallas has been offering virtual tours of its Greenway Tower listing in Irving, Texas, for quite some time. The brokerage doesn’t view remote-viewing or virtual tours as new concepts, nor do they see their emergence as related to COVID-19.

“I think it’s becoming more and more a must-have,” founding principal Sean Dalton said. “Everything is changing in our society as far as [everyone] wanting things now and quicker. Everyone wants things to get done faster … and I think these virtual tours allow people to be more efficient with their time.” Greenway Tower’s owner poured millions of dollars into renovating the property, and the virtual tours were put into place with the help of an app to simply get more eyes on the building and all its improvements, Dalton told Bisnow. This is exactly where virtual technology succeeds best. “We felt that this was an opportunity to really get the building into [prospective tenants’] hands rather than pulling them out to Las Colinas.”

Here’s a link to the virtual tours available at Greenway Tower.

You can find the Bisnow article here.

CoStar: Younger Partners Brokers 185k SF Building Sale to Texas Investor

By Candace Carlisle

CoStar News

March 27, 2020 | 03:44 P.M.

A Texas-based real estate investment and services firm has made its latest buy in North Texas and plans to renovate the office building.

Dallas-based Sunwest Real Estate Group bought the building from iStar, a New York City-based real estate investment trust, according to CoStar data. The three-story, 185,148-square-foot office building is at 2901 Kinwest Parkway in Irving, Texas.

Terms of the deal were not disclosed, but the Dallas Central Appraisal District last valued the property at $13.6 million.

“We’ve been working on [the deal] since November in starts and stops,” Marc Grossfeld, managing principal at Sunwest Real Estate Group, said in an interview. “For all intents and purposes, we are buying a vacant building. We think repositioning a vacant building in this submarket will have long-term potential.”

The Irving office building has been the home of operations for AllianceRx Walgreens Prime, a home delivery pharmacy collaboration between Walgreens and Prime Therapeutics. But the company is in the midst of moving out of the office building into about 90,000 square feet of space in Dallas as part of a larger real estate strategy for the home delivery pharmacy.

In looking at the building, Sunwest Real Estate Group knew the pharmacy would no longer be leasing space, but given the firm’s knack for renovating and leasing up value-add office buildings, Grossfeld said he wasn’t concerned and still isn’t concerned going forward. That being said, a lot has changed since the firm began looking at the building with the coronavirus pandemic bringing a new level of uncertainty into the investment market.

“I am nervous with the current environment and leasing has slowed down, but this is the building for us and we are going to renovate the building and market it as a low-cost back office call center,” he added. “It’s a very attractive value proposition for call center users in today’s environment.”

Some office tenants, such as dentists, unable to work for what could be months, he said, have begun asking for special lease considerations in existing office buildings Sunwest Real Estate Group manages. So far, he said, the team has been able to handle those requests.

“There is no standard operating procedure,” Grossfeld said. “These are unprecedented times and we are looking at this on a case-by-case basis. Right now, we are evaluating April, but haven’t evaluated anything beyond that.

“A few of our dentist tenants can’t practice right now and whether that’s six months or 45 days, it’s hard for us to make a decision like that today,” he added.

In future deal making, Grossfeld said he believes the market will create some buying opportunities, but those buyers will have to carefully underwrite rent growth and manage for potentially extending lease up time. For sellers, they may need to set more realistic expectations, he said, and not expect pricing from months ago to return anytime soon.

“Something we still have going for us is the really low interest rates,” he added. “We are still going to be buying.”

For the Record

Sunwest Real Estate Group represented itself in the deal. Scot Farber and Tom Strohbehn of Younger Partners represented the seller.

Online Sales/Returns Creating Growing Reverse Logistics Problems

By Steve Triolet, Younger Partners Director of Research

The Dallas-Fort Worth industrial market continues to perform well, thanks to the Metroplex’s robust job and population growth and the continued strength of the regional and U.S. economy. The market continues to deliver an incredible amount of industrial supply.

The metroplex has averaged more than 20 million SF of net new supply annually over the past few years. In 2019 alone, the DFW market has added 27.1 million SF of new industrial product (flex properties not included), with another 30.5 million SF currently underway. This is driven by a number of factors. First is just sheer population growth (DFW has seen more population growth than any other metro area over the past several years), but in addition to local population growth, DFW serves as a regional distribution hub for a good portion of south central United States, particularly for online retailers (Amazon, Wayfair, etc.).

As online sales has continued to boom, there’s been an inevitable side effect: more merchandise is getting returned, boosting costs and complexity for retailers and increasing the need for additional warehouse space. See the slides below that give further info. on this trend.

YP Spotlight: Whitney Motley

Leasing Activity by Industry: How is 2020 Going to Compare to Recent Years?

By Younger Partners Research Director Steve Triolet

Large built-to-suits and corporate relocations can change what industries garner the most activity in any given year, but over the past few years a handful of trends have emerged for the DFW office market. One is DFW’s lack of reliance on the energy sector as a key industry driver (particularly in Fort Worth); another is the increasing importance of the Technology industry for moving into new construction and finally the flash of Co-working growth and its subsequent pause after WeWork’s failed IPO last year. The healthcare industry is also worth mentioning, especially given the level of activity and its implications to the construction pipeline underway (BTS for Baylor Scott & White).

YP Spotlight: Davey McAleavey

YP 2019 Top Producers

Congratulations to Younger Partners’ 2019 Top Producers. (Pictured left to right, along with YP leadership): Robert Grunnah, Byron McCoy, Jeremy Lillard, Shawn Street, Tom Grunnah, Trae Anderson, Sean Dalton, Garrett Marler, Michael Ytem, John St. Clair, and Moody Younger. Seated: Tanja McAleavey and Kathy Permenter. #YoungerPartners #OurKindOfPeople #TopProducers

YP Works Together on Lease; Grows Brokerage Team

Younger Partners brokers teamed up on an 8,423-square-foot lease for Lifecare 2.0 Management Services, LLC at Colonnade III in Addison. The tenant was represented by Bo Estes and the landlord was represented by Moody Younger, Kathy Permenter and Sean Dalton.

Bo joined the Younger Partners team in late 2019 from Colliers International, where he served as an executive vice president. He has 40 years of commercial real estate experience specializing in tenant representation in the Dallas/Fort Worth market and with national clients across the country.

“Collaboration with the land and agency leasing teams played a big role in my decision to join Younger Partners,” Bo says. “Working together to benefit our clients is ultimately the goal and this is a great place to be.”

Over the years Bo has represented such firms as Littler Mendelson, Lincoln Financial Group, Lincoln National Life Insurance, Presbyterian Healthcare Services, Henderson Engineers, Vulcan Materials and Blue Cross Blue Shield in markets across the country, with transactions totaling in in excess of 5 million square feet since the early 1980s.

“Bo consistently helps his clients determine how best to enhance their strategic operational goals through leasing, acquisition and disposition of their real estate properties,” says Younger Partners Co-Founder Moody Younger. “We have worked together over the years and he brings a wealth of experience to the company.”

“I was fortunate to work with Moody, Kathy Permenter, Sean Dalton and Trae Anderson at Grubb & Ellis and to have the opportunity to reconnect with them by joining the Younger Partners team was a

great opportunity,” Bo says. “The company culture and the entrepreneurial environment here played a big role in joining the team, along with the ability to pull from the expertise of other great brokers. I look forward to working in a fun environment with people I enjoy being around while making some deals and helping my clients.”

Bo began his career with Hank Dickerson & Company in 1978 as an associate and later as a vice president becoming a multi-million-dollar producer in 1980, 1981, and 1982. In 1983, he joined Hines Industrial establishing a staff and leading the leasing efforts for a portfolio of 18 properties totaling 4.5 million square feet in the Dallas/Fort Worth office market and totaling more than $500,000,000 in lease transactions. Bo joined Bell & Hocker, Inc. in 1986, where he successfully negotiated leases for major tenants in some of Dallas’ most prominent office addresses. He was at Grubb & Ellis (and later, under a merger, as Newmark, Grubb, Knight, Frank) for more than 20 years before going to Colliers.

Bo graduated from the University of Arkansas. He and his wife, Shelley, have been married for 44 years. They have three sons, four grandsons and two more grandchildren (twins) on the way. He’s an avid outdoorsman enjoying hunting, and spending summers in Colorado fishing and hiking, but his most important time is spent with his family.

Bo was the fifth major addition to the Younger Partners brokerage team in 2019. He joins Greg Hoffman and Jerry Averyt as well as the investment services team of Scot Farber and Tom Strohbehn.

Kathy Permenter: Stemmons Service Award Winner

Congratulations to YP’s Co-Managing Partner Kathy Permenter on her NTCAR Stemmons Service Award win. She leads with a servant-leader style, working side-by-side with her team. She is the epitome of class and we couldn’t be prouder. Congratulations to her fellow nominees, Mike Geisler of Venture Commercial, Lynn Dowdle of Dowdle Real Estate and Sharon Friedberg of Fischer & Co.

Kathy Permenter, co-managing partner of Younger Partners

Mike Geisler, founding principal and managing partner of Venture Commercial

Sharon Friedberg, senior vice president of Fischer & Company

Lynn Dowdle, president of Dowdle Real Estate

D CEO Names Younger Partners’ Tenet HQ Relo/Lease to 2020 Commercial RE Awards

Younger Partners is excited to be a D CEO 2020 Commercial Real Estate Awards finalist for the Tenet Healthcare HQ relocation/lease. Winners will be revealed by D CEO in March. YP’s Kathy Permenter and Moody Younger represented Fortune 500 Tenet in a more than 392k SF lease at International Plaza 1. Cushman and Wakefield represented the landlord.

At 392,201 rentable square feet, Tenet Healthcare’s lease in International Plaza I was one of Dallas’ largest office leases of 2019. It was also one of the largest leases closed in existing product (non build-to-suit) in DFW in the last eight years, and the largest lease closed in more than 15 years in the southern part of the Dallas North Tollway. The leading healthcare services company signed a long-term lease for the entire 13-story, Class-A office tower to establish its new headquarters.

Tenet is a Fortune 200 company and the third largest investor-owned hospital company in the country. With this move, Tenet can consolidate its Dallas-area operations from multiple offices to a single headquarters location, which will support its efforts to bring more of its teams together to deepen integration and collaboration. The property’s convenient location near the Dallas North Tollway and Interstate 635 will also provide easy access for Tenet’s diverse employee base.

Ronald A. Rittenmeyer, Executive Chairman and CEO of Tenet Healthcare, said, “Moving to International Plaza will support our efforts to bring more of our teams together and deepen integration and collaboration. International Plaza is a great new home for our corporate headquarters and provides us with the opportunity to further enhance our working environment for the benefit of our colleagues.”

The Tenet lease comes just one year after Taconic Capital Advisors acquired International Plaza I and II—one of the most notable office developments on the Dallas North Tollway—and before the new landlord completed a multi-million-dollar capital improvement plan of both buildings. The extensive renovations played a major role in attracting Tenet, as the company prioritized providing an attractive, amenity-rich office environment for its employees.

Additionally, Tenet wanted to fast-track the move-in process and create one enterprise that merges the best aspects of the organization’s cultures. By adopting a singular philosophy and minimizing silos, synergies between users will increase. The lease was completed in early summer and employees began moving into the facility in December while the finish-out continues.

What’s in store for the DFW Office Market in 2020

By Younger Partners Research Director Steve Triolet

As the New Year kicks off, the greatest challenge (or pain point) for the Dallas/Fort Worth office market in 2020 is the abundance of large blocks of second generation space that will need to be backfilled. The charts below breakdown where the large blocks of space are, what building class and vintage year the spaces fall into. By and large, the greatest concentration of big blocks of space are in the 80s vintage Class-A space in the northern submarkets of Las Colinas, Richardson/Plano and Far North Dallas. Attached are the charts, along with building by building list (second attachment) of the large blocks of space.

Robert Grunnah’s Year-End Annual North Texas Land Absorption Report

Younger Partners’ Robert Grunnah gives the lay of the land in the land investment market for DFW in D CEO on Dec. 26, 2019.

The North Central Texas land market has seen no significant influence modifying its prior three years of sales and absorption activity, with the exception of increasing values and scarcity of inventory in most developable submarkets.

In reviewing last year’s North Texas Land Absorption report, only a few minor observations have changed.

For many years, our Investments/Land Group, a division of Younger Partners, has produced a report designed to assist investors in deciding the viability of acquiring for investment undeveloped land for medium and long-term positive returns.

Since our 2018 report was distributed, DFW has experienced continued active growth in virtually every commercial and residential product type.

Transaction volume held steady for both user and investment product. Absorption of developed, undeveloped (land without access to infrastructure permitting immediate use), and underutilized land progressed at a comparable rate to 2018. The trend continues as increased, aggressive, new vertical development has left even fewer desirable infill sites remaining.

Recent infill development site purchases have been at record sales prices per square foot. More peripheral sites are seeing increasing activity with employers competing for employees desiring a shorter commuting distance.

This competition for employees, inflated raw land cost, a rapidly increasing cost of living, and transportation congestion are all beginning to affect our extended growth cycle. However, we still remain attractive to geographical relocations compared to our competition.

Retaining the anticipated continued job growth, inbound population increases, relatively low-interest rates, and a sound local economy, no reason appears visible for an immediate corrective cycle. Should any of those benchmarks collapse or even display a solid weakness, some correction is imminent.

Strength and Resilience

While few deny that our extended period of strong economic growth is vulnerable, actual project starts and announcements of pending projects doubled over 2017 in all product segments except Retail.

The low unemployment rate, although being partially addressed by extensive inbound migration, and rapidly increasing construction costs seem not to have a major influence on the positive personalities of developers.

Wisely, projects are being valued on a long-term basis, assuming a negative period within their ten-year hold expectations.

A common belief within the investment community holds that DFW is well-positioned to absorb even a relatively strong readjustment and will emerge as a top-five national investment market–2019 saw the square footage of actual office building construction started and announced to start in the approximate estimate of 39 million square feet; for new industrial, 60 million square feet.

The remaining major categories, MOB, Retail, and Mixed commercial will add an additional 25 million square feet.

Again for 2019, approximately 40,000 MF units have been built or will be started along with approximately 35,000 single-family units. Major announced mixed-use residential developments, encompassing thousands of undeveloped acres, were proposed virtually in all directions circling DFW. Confidence stems from DFW’s strength and resilience.

Despite sale prices at a multiple of replacement cost and static retail demand, income-producing investments have maintained their active volume due largely to the need to invest 1031 trade equity and lack of competition with alternative investments which has kept capitalization rates at record historical lows.

Excessive competition to acquire cash flow assets providing even the smallest yields produces increased vulnerability to market corrections.

A cyclical downturn in the national economy would have a dour negative impact and threaten or eliminate positive cash flows. The introduction of the new tax-advantaged “Opportunity Zone” investment vehicle, while moderately active, appears to be having limited success due to the lack of firm guidelines and the startup costs commensurate with the risk.

Land Opportunities

Inherently, land investment differs greatly from other types of real estate products generally because of its inability to produce interim cash flow and its considerably more sensitive vulnerability to recurring cycles. The criteria used to determine potential land opportunities, while becoming more sophisticated over the last two cycles, remains principally in implementing basic strategies.

Perhaps the most important of these is the ability to project and fund ownership long term.

Positive liquidity, the ability to sell for an acceptable profit at the optimum market time, can be highly speculative. When an investor is placed in an imposed forced sale position or loses confidence in the future of the investment, returns are jeopardized and most frequently result in a significant loss.

With expanding IT capabilities and the proliferation of social media vehicles, should an investor wish to search hard enough, she can find support for any investment philosophy, positive or negative to justify an action.

However, certain facts remain more pertinent than most as they may apply to investments in unimproved or underutilized land assets in DFW.

A conservative estimate of ten-year population growth for the DFW population is well in excess of one million new or organically grown residents.

Climate, central location, progressive state, and local government, and no personal or corporate income tax would support this projection.

Possessing no true natural barriers for continued land absorption, there appears no pure, single real estate-oriented obstacle to argue the impact of this projection. Population growth can be fueled both organically and by external inbound relocations.

With trailing twelve-month growth demand for 160,000 jobs statewide, the majority have been or will be filled by relocations.

It is estimated that only seventy percent of the jobs created have been filled. In the last seven years, over 50,000 thousand acres of land have traded with a greater number not being included as pure long term investment inland.

Boom or Bust

Like most types of investments, real estate is cyclical.

Investment success or failure can often solely depend on where the cycle is at the time the purchase is made in conjunction with the investor’s ability to determine the true state of the cycle.

Buying at various points in a cycle–cost averaging–can provide some security. There has yet to be a final cycle, thus, the ability to hold long term may affect the yield but does offer some degree of safety.

With access to historical data, projecting long term value, while still speculative, is much more achievable.

Many down cycles have been created by artificial, non-real estate related influences, the effects of which were difficult to anticipate. For example, in the late 1980s, tax law changes and deregulation destroyed the market. In the late 2000s, the subprime collapse did the same.

It is reasonable to assume there will be more fragile “bubbles” determining what historically created a boom or bust.

Analyzing the probability of a reoccurrence can mitigate future disasters.

Setting Benchmarks

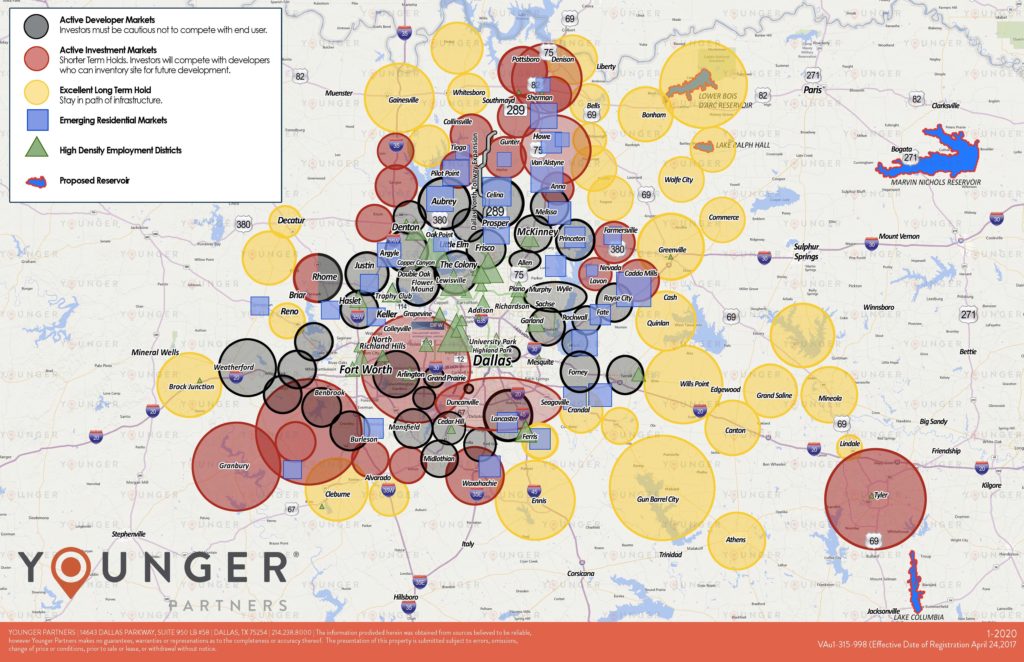

Included in our report is our Land Absorption Map, which sets out various types of 2019 commercial real estate activity in specific geographic areas.

Actual sales, current listings, and announcements of pending projects are the basic criteria used and have been benchmarked annually to complete the current year’s map.

Not difficult to understand, the progression from active to long term generally follows the current availability of infrastructure and newer expanding utility systems. Land currently available for vertical construction will bring significantly higher value over those that must wait for services.

Over the 20-plus years of presenting the map, it is interesting to note that, while the circles have limited movement, the colors have many changes and generally move out from the core in concentric circles.

Younger Partners is a member of the highly respected North Texas Land Council (NTLC), a group comprised of 50 of the most active and talented land brokers in our area.

Believing that activity generates more activity, the North Texas Land Council freely shares information with its competing members, and the market in general, on a level of professionalism unusual within similar organizations. As such, the organization is a benefit to all clients and those anticipating a land investment. Much of the projected activity displayed on the Younger Land Absorption Map (YLAM) reflects the activities of the NTLC.

As in 2018, the market today continues to see record prices for infill, readily developable sites possessing available infrastructure, permitted anticipated uses, and increased demand for product.

For many increased cost factors, single-family new home prices have increased by 50 percent in six years making affordability more difficult. Less obvious are completed per square foot costs in all commercial sectors.

The strong national economy, as well as local, and the continued relocations, have provided record employment and income. That momentum will carry through at least through 2020, but past that, projections are difficult.

Best though to recognize it sooner than later.

Perhaps one of the strongest influences softening the impact of a correction is the enormous amount of uncommitted cash held by investors awaiting their perception of pending opportunities. That cash would be quickly reinvested, buoying prices in the event of a devaluation, by investors not wishing to miss value.

Future Projections

Our continuing extended analysis, as displayed on the “Younger Land Absorption Map” (revised December 2019) is principally based on extensive historical data collected utilizing over 150 years of market experience possessed by Younger associates, members of the NTLC, and reliable future projections from sources that have traditionally displayed accurate information. Our market demographic information was provided by Steve Triolet, Director of Younger Research.

Depending on which source one chooses to use, the DFW market still expects to absorb an additional expansion of 25-to 30,000 acres over the next 15 years.

Success in real estate investment lies in determining where that growth will occur.

History has taught us that product will be made available and priced based on pure economics. The cost to provide an available product to meet demand will depend on the availability of affordable infrastructure (sewer, water, roads, proximity to employment centers, service commercial, schools, political climate, etc.) and hard construction costs.

Land prices will fluctuate according to such availability, absorption, the national economy, and the popularity of any specific product.

Investing in the right product will produce exceptional rewards. Some estimate that it requires approximately 12,000 to 15,000 acres of raw land to accommodate one million people in a reasonably confined, socially acceptable, service provided environment.

We have been fortunate to have had an extended period of prodigious activity, which can at least be partially credited to our aggressive political structure, both local and state, our sophisticated and informed developers and engineers, and our incredibly competent and equally aggressive EDC’s.

Of equal depth, however, is the dynamic, well educated, hard-working, and professional “under 40” group of brokers, administrators, managers, and general employee base who have emerged during this cycle. They may well be the first group exiting a positive cycle who have learned and benefited from the experience of their predecessors. They may not need a disaster to stay relevant and solvent.

In conclusion, the principals of sophisticated investment must utilize primary criteria, some of which are outlined above.

Access to infrastructure, most importantly water, the admirable effort by our past Dallas Mayor to utilize available land in our southern corridor, absorption of the remaining few infill sites, high suburban infill land costs, and the migration of employment centers will all play significant roles in prudent land investment decisions. Utilized in the investment process, the only remaining elements are sound financial strength and patience.

Helping Wishes Come True: Make-A-Wish North Texas

Younger Partners has a tremendous relationship with the wonderful charitable organization, Make-A-Wish North Texas. Our team not only manages and leases its regional headquarters, but to show our ongoing support, Make-A-Wish was selected as one of Younger Partners’ 2019 charities. In December, Younger Partners was fortunate to be a part of the Make-A-Wish send-off for wish recipient Jackson at Prosper High School. Jackson was treated to an escort from the school with the PHS drumline, cheerleaders and dance team cheering him on to meet

Do the Stats Tell the Real Story of DFW Office Gross Absorption?

By Younger Partners Research Director Steve Triolet

No one statistic tells the whole story of a market and this is certainly the case for Far North Dallas in regard to office net absorption in 2019. While Far North Dallas is one of the key submarkets for the DFW you wouldn’t be able to tell that from the net absorption statistics for 2019 (YTD). While net absorption is a currently a negative 216,331 square feet for Far North Dallas, the gross absorption (all of the move-ins, whether leased or owner-occupied excluding move-outs is the highest in the market at over 2.5 million square feet).

This is another example of new properties drawing tenants away from old inventory to newer construction. In the case of Far North Dallas, key move-outs from HPE and DXC Technology both leaving 5400 Legacy to go into Platinum Park and Cityline, respectively, resulted in over 1 million square feet of net absorption. For those not aware, 5400 Legacy is the former EDS/Perot and Hewlett Packard headquarters and at 1,587,458 square feet is currently the largest contiguous block of vacant Class A space in the US.

The other two submarkets that stand out in 2019 from a gross absorption standpoint also include large levels of new construction. Mid-cities has the new American Airlines campus that just completed construction and Las Colinas has several Cypress Waters projects and Pioneer Natural Resources which is scheduled for completion before the end of the year.

YP Research: Uber Air as an Infrastructure Option

Dallas-Fort Worth is one of the fastest growing metropolitan areas in the U.S. and that means infrastructure challenges. Today’s research features Uber Air. It is the fourth part of Younger Partners’ exploration of the various infrastructure options and how they will impact the region. Today features

CRE Veteran Greg Hoffman Joins Younger Partners

Younger Partners welcomes CRE veteran Greg Hoffman to the brokerage team. He comes to Younger Partners from Colliers International, where he served as senior vice president. The 40-year veteran of commercial real estate in Dallas will continue working with both office tenants and owners.

“Greg Hoffman is a well-respected in the industry and is one of the hardest working brokers I know. We expect him to continue doing great things at Younger Partners,” says Younger Partners’ Moody Younger.

Hoffman specializes in tenant and landlord representation for office and office/tech properties across the country, but especially in the Greater Dallas area, with an emphasis on office buildings in the North Dallas and LBJ submarkets. His experience includes handling income property acquisitions and dispositions, development, and general brokerage.

“My clients can continue to expect personalized, no-nonsense representation from me,” Hoffman says. “I’m excited to make this transition to Younger Partners. The company culture was very appealing to me as well as the strong leadership and management of Moody Younger and Kathy Permenter.”

Since 2010, Hoffman has participated in more than 650 transactions totalling almost 5 million square feet. For the past 10 years, he has leased about a dozen buildings for a national landlord’s portfolio and has acted as broker and asset manager while selling 16 buildings for another ownership group.

At one point in his career, he handled real estate transactions for Texas Instruments coast-to-coast. He has also played a role in disposing of multiple properties across the state for Baker Hughes.

Other clients have included CRT Properties, CMD Realty Investors, Merit Texas Properties, DRA Advisors, Colonial Properties Trust, and Crest Holdings.

Hoffman and his wife, Patricia, have been married for 38 years and have three children. He added his first grandchild to the family this year. He’s an avid sports fan and you can find him cheering on the Southern Methodist University Mustangs, the Dallas Cowboys and the Texas Rangers.

YP Spotlight: Vickie Wiltcher

D CEO Selects YP Co-Founder Kathy Permenter to the Exclusive Dallas 500 List

D CEO announced its Dallas 500 recipients at a reception last night and we’re proud to congratulate Younger Partners Co-Founder Kathy Permenter for being selected to this illustrious list of business leaders chosen by D CEO.

D CEO, the business title of D Magazine Partners, revealed the 500 leaders featured in the 2020 edition of the Dallas 500 on Nov. 4 at an exclusive reception at the Meyerson Symphony Center. Now in its fifth year, the publication is the culmination of months of research by the editors of D CEO, who base selections on extensive contacts in local business circles and hundreds of interviews.

The Dallas 500 publication provides an engaging, personal look at people at the top of their game in 53 prominent industries. For 2020, 336 of last year’s Dallas 500 were brought back, including Mark Cuban, Ross Perot Jr., Lyda Hill, and Jerry Jones. That means 164 new individuals were added, including Younger Partners Co-Founder Kathy Permenter.

“Making the Dallas 500 is no easy feat in a market as large and vibrant as North Texas,” said D CEO Editor Christine Perez. “Those featured in our 2020 edition are at the best of the best; they play an integral role in driving the local economy.”

Kathy Permenter Nominated for 2019 Stemmons Award

Congrats to Younger Partners Co-Founder Kathy Permenter for her 2019 NTCAR Stemmons Service Award nomination