Author: Younger Partners

Garrett Marler Awarded Bob Edge Scholarship

Younger Partners Broker Garrett Marler was selected as a recipient for the 2019 Bob Edge Scholarship.

The Bob Edge Scholarship Fund promotes the profession of real estate while honoring Robert T. “Bob” Edge, who was one of the most active brokerage professionals in the country. The Bob Edge Scholarship Fund was established in 2004 to recognize Bob Edge for his significant contributions to the Dallas/Fort Worth real estate community and assist emerging North Texas commercial real estate professionals with their educational development.

“What sets some candidates apart from others? We awarded two scholarships this year, one was to Kathy Mulgew and the other to Garrett. Two very different needs. We were very impressed with Garrett and the drive and passion he has to grow his career,” says Liz Trocchio Smith, founder and CEO of The Trocchio Advantage and chairwoman of the Bob Edge Scholarship Fund.

“We try to look at each situation as Bob Edge would and think ‘What would Bob do’. In Garrett’s case, we saw a young professional who was committed to growing in both his personal and professional career. Bob was very passionate about mentoring and helping the younger generation and Garrett fit everything the scholarship represents,” Trocchio adds.

Scholarship funds provide recipients the necessary tuition to gain industry designations as CCIM, SIOR, MAI, as well as other qualified educational opportunities, Trocchio says.

Marler plans to use the scholarship funding to earn his Certified Commercial Investment Member (CCIM) designation. He started his commercial real estate career at Younger Partners in 2014 as an analyst before moving into brokerage. He graduated from the University of

Kansas in 2014. He served on the 2019 TREC Fight Night Committee and helped launch the Young Professionals Board for Folds of Honor, North Texas Chapter. He now serves on that board of directors. He was a Younger Partners Top Producer for 2018.

“Garrett is an outstanding broker,” says Younger Partners Co-Founder Moody Younger. “He’s eager to learn and we’re seeing him develop and improve every day. Being one of our 2018 Top Producers is quite an accomplishment so early in his career and we see Garrett as a future leader in our firm and within the industry.”

Trocchio says Kathy Mulgrew of Spencer Consulting was also a 2019 scholarship recipient. The scholarships are administered by Communities Foundation of Texas. For more information about the scholarship: http://bobedgescholarship.com

YP Spotlight: Tanja McAleavey

YP’s Moody Younger: TREC FightNight Raised $1.4M

It has been almost a month since FightNight XXXI and ICYMI, more than $1.4 million was raised for the TREC Foundation and its good works. Kudos to Younger Partners Co-Founder Moody Younger for his efforts as the FightNight Chairman for the event’s 25th anniversary. Here is a look at some of the FightNight photos featuring Younger Partners.

Photos courtesy of TREC.

Making Deals Work

One of the lesser used metrics of a market’s overall office fundamentals is the level of discount that sublease space needs to be reduced in order to compete with direct space, says Younger Partners Director of Research Steve Triolet.

This discount rate can vary dramatically by submarket, with the overall vacancy and the number of large blocks of space (both direct and sublease) having the greatest impact, which is most evident in both the Dallas CBD and Fort Worth CBD. In the Dallas CBD, for example, the total vacancy rate is 22.2% and there are several large blocks of space available, one of the largest being a 570,000-square-foot sublease at Energy Plaza for $9.50 (FSG) per SF. This is a 62% discount below the average CBD direct asking rate for direct space.

YP Spotlight: Michael Ytem

Fight Night ’19 Knockout

TREC Fight Night 2019 was a knock-out evening. Younger Partners Co-Founder Moody Younger (and Fight Night chairman) sparred with the Dallas Stars’ Victor E. Green and hung out in the ring with Dallas Stars legend Marty Turco, as well as many DFW CRE greats. Here are just some of the event highlights.

YP Research: DFW Office Sublease Space Trends Down from All-Time High

By Steve Triolet, YP Research Director

In late 2018, the amount of DFW office sublease space reached an all-time at just under 7 million square feet. In early 2019, however, several large sublease transactions have brought that number down significantly where it currently stands at 5.8 million square feet.

This is a good, healthy sign for the market, especially with over 2.2 million square feet of unaccounted for spec office construction scheduled for delivery over the next year and additional new spec sites announced but not yet started.

CRE Veterans Scot Farber & Tom Strohbehn Join YP

Dallas-based commercial real estate firm Younger Partners welcomed CRE veterans Scot Farber and Tom Strohbehn to lead a new capital markets team. They will serve as managing principals effectively immediately.

The duo comes to Younger Partners from Cushman & Wakefield of Texas Inc. where Farber served as Executive Managing Director and Strohbehn was Senior Financial Manager within Cushman & Wakefield’s Capital Markets Group.

“Scot and Tom bring with them years of experience, extensive market knowledge, and long-term industry relationships,” says Younger Partners Co-Founder Moody Younger.

“They are highly respected within the commercial real estate world and we are thrilled to have them join our team. Moody and I worked with them at Grubb & Ellis and know the dedication and integrity they bring to their clients,” says Younger Partners Co-Founder Kathy Permenter.

“We have a long history with Moody and Kathy and some of the other team members at Younger Partners. Younger Partners’ platform and reputation complements our area of focus and creates outstanding opportunities to leverage their strengths and our own in the market,” Farber says.

Strohbehn and Farber focus on the disposition of office and flex assets within DFW and other Texas markets, as well as Oklahoma, Arkansas, Louisiana and New Mexico.

“Our goal is – and always has been – to provide institutional quality service to our clients regardless of transaction size. As a result, we have completed nearly 250 assignments across the Southwest,” Strohbehn says.

At Cushman & Wakefield, Farber was in charge of the disposition of investment sales properties for financial institutions, banks, special servicers, pension funds, REITs, corporate users and private investors. Throughout his career, Farber has completed investment sales assignments with a market value of approximately $5 billion.

Tom has analyzed, underwritten, and valued more than $3 billion worth of commercial property. He has completed more than 22.2 million square feet of commercial transactions, with a market value in excess of $1.5 billion.

YP Spolight: Sean Dalton

YP Goes Blue for World Autism Awareness Day

Today we #LightItUpBlue for #WorldAutismAwarenessDay.

The YP crew sported blue to show our support for increasing understanding and acceptance of people with autism.

We also wear blue to support creating a more inclusive world for people like, Dylan, the son of YP’s Tonie Auer.

Younger Partners Wins Two More Property Management Assignments Totaling 203K SF

Younger Partners Property Services was awarded two new assignments at the 61,000-square-foot Forest Central 1 in Dallas and the 142,000-square-foot 800 W. Airport Freeway in Irving. Effective date of takeover was March 1.

“We are continually expanding our relationships with owners,” says Greg Grainger, president of Younger Partners Property Services. “These two new assignments are part of an expansion of our relationship with a local entrepreneur. They bring us up to managing six buildings for this owner. We also manage Empire Central, a 155,000 square-foot two building office complex, the 91,000-square-foot Chase Bank Building in Garland as well as the 221,000-square-foot Promenade Tower in Richardson. Our leasing team also recently picked up the leasing assignment at Promenade.”

“We are continually expanding our relationships with owners,” says Greg Grainger, president of Younger Partners Property Services. “These two new assignments are part of an expansion of our relationship with a local entrepreneur. They bring us up to managing six buildings for this owner. We also manage Empire Central, a 155,000 square-foot two building office complex, the 91,000-square-foot Chase Bank Building in Garland as well as the 221,000-square-foot Promenade Tower in Richardson. Our leasing team also recently picked up the leasing assignment at Promenade.”

These new assignments bring property managed by YPPS up to almost 4 million square feet of local property managed. YPPS moved up to No. 17 (from No. 21 in 2017) on Dallas Business Journal’s 2018 list of North Texas Commercial Property Managers ranked by total local commercial square feet managed.

“Four years ago, we weren’t even on the list. Today, we are No. 17 on the DBJ list,” Grainger says. “We continue to grow around core clients who are entrepreneurial owners; we grow our portfolio as they grow theirs. They appreciate the quality service that we provide.”

YP’s Moody Younger Talks CRE on NTCAR Panel

YP’s Co-Founder Moody Younger is bullish on the Dallas CRE market because of the pro-business environment, ease of starting and growing a business here and the inbound demographic growth. He was among a top-notch panel of CRE experts at NTCAR’s quarterly membership meeting today at the Frontiers of Flight Museum.

Moody says while the office market is slowing just a bit, the industrial market is off the charts. However, he says office landlords are getting longer-term leases – from 10 to 15 years — as a trade-off to offset higher TI expenses. Newer office buildings are all about added services, noting that some new buildings feel more like a hotel than an office lobby.

Here’s Moody, far right, with Granite’s David Cunningham, CBRE Urban’s Jack Gosnell, Cushman & Wakefield’s Brad Blankenship and Structure Tone Southwest’s Vincent Gallagher.

Younger Partners: No. 12 on DBJ’s List of the Biggest North Texas CRE Firms

We are thrilled to announce that Younger Partners has moved up the rankings to No. 12 (from No. 16 in 2018) on DBJ’s list of the biggest North Texas Commercial Real Estate Brokerage Firms.

See the full list here.

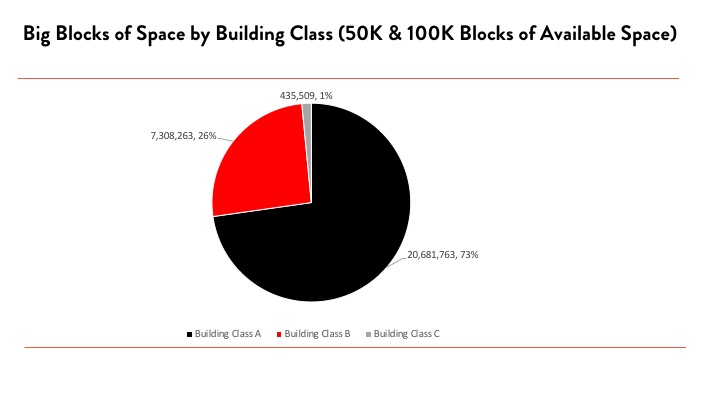

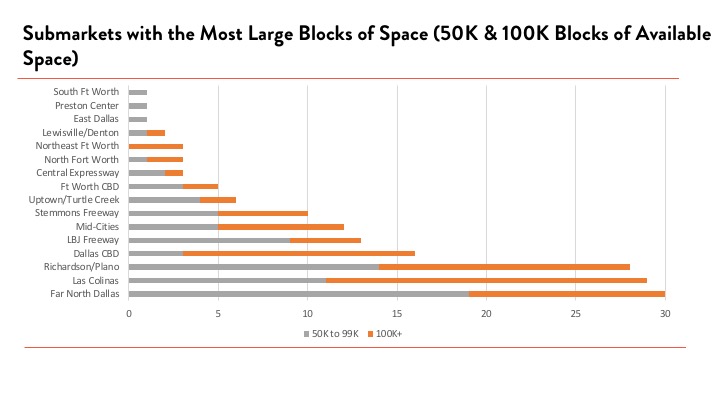

DFW Construction Boom: What Does it Mean for Big Blocks of Space?

Dallas/Fort Worth is in a construction boom: between 2015 and 2018 almost 23 million square feet of new office inventory was completed with an additional 7.1 million square feet currently underway, says Younger Partners Director of Research Steve Triolet.

All of these numbers are among the highest in the United States for the respective time periods. With a few notable exceptions (Toyota), the vast majority of the tenants taking occupancy of the new space are leaving behind older Class-A space that will need to be backfilled. Class-A space makes up the vast majority of the space available at 20.7 million square feet or 73% of the large blocks of space.

D CEO Names Six YP Brokers as 2019 Power Brokers

Congrats to YP’s D CEO RealEstate Power Brokers for 2019: Trae Anderson, John St. Clair, Sean Dalton, Ben McCutchin, Byron McCoy, and Michael Ytem.

Kathy Permenter Leads NTCAR Round Table

Younger Partners’ Co-Founder Kathy Permenter led a round-table discussion at #NTCAR’s first DFW Office Academy event Thursday evening at Park District Dallas. Kathy was among an illustrious group of #commercialrealestate experts leading the talks. #brokers#office#dallasoffice

Moody Younger Featured in TREC Member Spotlight

TREC featured Younger Partners Co-Founder Moody Younger in its Member Spotlight. Moody will serve as the Fight Night 19 Chairman.

FightNight is the real estate industry’s premier philanthropic event, with opportunities to reconnect with friends and colleagues in a fun Vegas-style environment right here in Dallas. We are blazing a new trail this year with our theme of “black ties and boots.” I expect it to be to be tons of fun. The event is also for a great cause and the amount of work put in by volunteers and the TREC staff to continuously improve the event and raise money for the TREC Foundation is truly remarkable.

Read the full spotlight here.

FightNight 19 will be April 25 at the Hilton Anatole and help celebrate TREC Foundation’s 25th anniversary with a night of professional boxing, exceptional cuisine, casino-style gaming and the opportunity to network with the top decision makers in the commercial real estate industry and political community. Since its inception in 1989, FightNight has become one of North Texas’ largest philanthropic events, raising more than $27 million to support the Foundation and its good works. This year’s proceeds benefit TREC Foundation and the Dallas Catalyst Project. Tickets and tables are available now at RECouncil.com.

CoStar Features Arlington Commons Transaction

FEBRUARY 06, 2019|CRAIG DONAHUE

New York Investment Firm Buys Arlington Commons

A New York-based investment firm purchased a 353-unit apartment complex in Arlington, Texas, dubbed Arlington Commons, for an undisclosed price.

The Praedium Group acquired the complex from The Nehemiah Co., which developed Arlington Commons. Nehemiah broke ground on property in 2016 and completed construction this past year.

Located at 425 E. Lamar Blvd., the mid-rise complex consists of a four-story building with an attached parking garage. Arlington Commons offers a mix of one- and two-bedroom floorplans, ranging in size from 580 to 1,418 square feet.

“The acquisition of this property fits well within our strategy of purchasing quality assets in growth markets,” Peter Calatozzo, managing director at The Praedium Group, said in a statement. “The Dallas-Fort Worth metroplex continues to experience substantial population growth and strong employment gains, which have been and continue to be facilitated by a significant number of corporate relocations and expansions within the MSA.”

Bob Helterbran and Lew Wood of Younger Partners Dallas LLC brokered the deal on behalf of the seller.

YP’s Jack Gail in CoStar’s Opportunity Zones Article

FEBRUARY 05, 2019|MARK HESCHMEYER

Big Money Enters Race for Opportunity Zone Investments

Private Equity, Institutional Funds Are Likely to Drive Property Pricing, Market Selection

Markets with the most opportunity zones, such as Chicago, are areas that are likely to be on the receiving end of a substantial amount of new investment. Image: Lisa Blue

Large institutional and private equity funds are beginning to stream into the unseasoned strategy of investing in federally designated low-income zones where every new dollar spent on development or redevelopment could be eligible for tax breaks.

With the entrance of these funds, the nature of capital raising and the target markets where the funds will invest could change dramatically.

The Opportunity Zone program was created under a provision of the Tax Cuts and Jobs Act of 2017 to encourage private capital investments in underfunded communities. Under the law, anyone owing capital gains taxes can start a qualified opportunity fund by self-certifying with the Internal Revenue Service. Until this year, the bulk of the money being raised for opportunity zone investments was coming from smaller funds targeting one deal in one market.

CoStar Group is keeping a running list of qualified real estate opportunity funds. Of the more than 230 funds on the list, more than half average a target capital raising of less than $30 million. Most of these were launched early last year when the provision in the tax law first took effect.

This year, though, has seen new funds launched by major players such as CIM Group, Bridge Investment Group Partners, The Bernstein Cos. and Starwood Capital Group. The four firms are seeking to raise a combined $7 billion, the equivalent of 233 funds trying to raise $30 million each.

“We are seeing opportunity zones restructure the traditional capital stack being deployed in emerging neighborhoods, which has largely been serviced by local and regional investors,” said Jaime Sturgis, chief executive of Native Realty in Fort Lauderdale, Florida. “Institutional capital, which historically only chased ‘Main & Main’ credit deals has been enticed by the tax savings to venture into less developed emerging neighborhoods. This introduction of institutional capital into these under-capitalized neighborhoods is going to dramatically accelerate the gentrification of these neighborhoods as the opportunity zones require substantial capital investments to the real property to qualify for the tax exceptions.”

Starwood Capital Group, a global private investment firm focused on real estate and energy investments, this month launched Starwood Opportunity Zone Partners I to raise $500 million. Starwood Capital currently has 58 properties located in opportunity zones.

It hired Anthony Balestrieri as a senior vice president to lead the business. Balestrieri joins Starwood from MetLife Real Estate Investors, where he most recently served as director and head of acquisitions in Washington, D.C.

Starwood Capital will focus its opportunity zone strategy on markets in regions where the firm has developed a strong real estate presence, including the West Coast, Southeast and large metropolitan markets such as New York City and Washington, D.C.

Time Pressure

Jack Gail, an associate with Younger Partners, a full-service boutique commercial real estate firm in Dallas, sees potential issues for some of the larger companies and private equity funds that are raising enormous amounts of capital.

“The potential problem with raising, say, a $500 million qualified opportunity fund is that based on the current guidelines, that money needs to be deployed,” Gail said. “For lack of a better term, there is a ‘shot clock’ on the fund, and its capital needs to be invested in a timely manner or the entire fund could face penalties and potentially lose the tax incentives all together.”

That means opportunity funds do not have the luxury of time to store up dry powder to spend at some future point. It has to be deployed and deployed fairly quickly.

“At the end of the day, yes, raising a few hundred million dollars is an enormous accomplishment but they will have to find quality deals that makes sense for their investors long term,” Gail said. “And that part is not as easy as you might think. The designated opportunity zones were selected for a reason — they are the more impoverished areas in our country.”

Bridge Investment Group in Salt Lake City this month launched a $1 billion qualified opportunity zone fund after announcing the beginning of the effort this past October. Bridge is targeting development and redevelopment projects to invest in alongside high-quality development partners.

“Our acquisition team has already identified over $500 million of attractive opportunities that are expected to provide meaningful impact on the districts in which capital is invested,” said Jonathan Slager, co-chief executive of Bridge Investment Group, in a statement announcing the initiative.

Over the past decade, Bridge has invested more than $12 billion of equity across its apartment, office and seniors living platforms. Given that not all opportunity zones are created equal, Bridge is leveraging its national footprint and local market knowledge to focus on zones at an inflection point or located inside of or within close proximity to high growth markets.

Michael Walker and Lane Beene are partners in a more typically sized opportunity fund, the $50 million Pilot And Legacy Opportunity Fund. The fund’s objective is to build workforce housing/apartments in opportunity zone locations in Texas.

Apartment Demand

It is choosing locations that project both job and population growth, and where a need exists for affordable, energy-efficient apartments.

“The reality is that while many taxpayers have heard about opportunity zones and opportunity funds, the majority do not yet know enough to take action,” Walker said. “So while there are many quality investors and private equity firms entering the fund arena every week, I believe this helps to bring legitimacy to socially responsible investing in distressed communities.”

Fund partner Beene added, that “the opportunity zone fundraising will niche down the investor profile and emancipate capital for new investment. We see the primary opportunity zone investor as a more seasoned investor with established funds interested in capital preservation.”

With more seasoned investors coming into the space, comes more competition for deals.

“One additional impact of opportunity zones is increased competition for sites with strong investment fundamentals,” Beene added. “Many opportunity zone locations are difficult investment scenarios with poor financial appeal and decades of negative momentum. The few opportunity zone sites with stronger investment fundamentals will be pursued in high demand. I anticipate a price premium for opportunity zone locations in attractive areas as more investors learn about the advantages.”

For Roland Pott, broker of record for New Jersey at Slatehouse Group Property Management, that means increased uncertainty for what happens in markets in which he works.

“I do a lot of work in Trenton, New Jersey, and we have a concentration of opportunity zones. Because it is not a major market city, I think that our zones here will be slower to receive the influx of capital, whereas opportunity zone neighborhoods in larger cities will be more primed to receive capital more quickly.”

Still the coming wave of big institutional money into opportunity zones could mean an extension of the already long-running recovery, according to Matthew Honnold, an economic analyst with Wells Fargo Securities.

The new opportunity zone initiative comes at a time when overall property prices have begun to ease, especially in major gateway markets. Outside of Puerto Rico, the markets with the most opportunity zones are located within New York, Los Angeles, Chicago and Houston, areas that will likely be on the receiving end of a substantial amount of new investment, Honnold’s group reported.

“The net effect of these provisions will likely be to draw significantly more capital into the industry in 2019, which will further support property valuations and restrain cap rates, even as interest rates increase,” the company reported.

An Evening of Winners: NTCAR 2018 Stemmons Service Award Event

Congrats to Younger Partners Co-Founder Kathy Permenter on her NTCAR Stemmons Service Award nomination. We are so incredibly proud of her achievements both professionally and within the community she serves. She was nominated along with Venture’s Mike Geisler, Fischer & Co’s Sharon Friedberg & Citadel Partners’ Scott Morse. Congratulations to the 2018 winner, Scott Morse. Here’s a wrap up of the Younger Partners team at the event at the Dallas Country Club.