Author: Younger Partners

Younger Partners Brokers Sale of Arlington Commons

Younger Partners rang in the New Year by brokering the sale of Arlington Commons — Arlington’s first market-rate Class-A multifamily development (outside of student housing) — for an undisclosed price. The public-private partnership has been almost a decade in the making and is already achieving goals set by City of Arlington leadership, neighborhood groups and developer, The Nehemiah Company.

In 2018, Arlington-based The Nehemiah Company completed the 353-unit first phase of Arlington Commons at 425 E. Lamar Blvd. It was sold to New York City-based national real estate investment firm, Praedium Group. Younger Partners’ Bob Helterbran and Lew Wood negotiated the sale.

“The city and community worked for years to encourage a developer to step up in this area with redevelopment. No developer was willing to take the risk. We live here and believed strongly in Arlington and this submarket,” says The Nehemiah Company President and Partner Robert Kembel.

“It is good for Arlington and our company to demonstrate that Class-A housing works so well in Arlington. We are grateful to the City Council and Tarrant County Commissioners for giving us the tools to make this successful for all of the stakeholders in the region.”

Around the mid-2000s, Arlington City Council saw an opportunity to replace three aging apartment complexes on Lamar Boulevard, with high-quality housing and a goal of increasing the city’s property tax base while spurring additional investment. To achieve the goal, city leaders were willing to provide economic development incentives to the developer and allow higher density units to get the most bang for the buck. Unfortunately, there were no developers willing to take the risk, so city leaders approached the Nehemiah Company to find a solution.Arlington Commons

“With our success with the Viridian housing development along some hard-to-develop land in North Arlington, former Mayor Bob Cluck and the council approached us to consider a redevelopment effort within the Lamar/Collins overlay,” Kembel says. “The assessed valuation of the target properties was $10 million before demolition. After the first phase of Arlington Commons, the property is valued at $40 million and by build-out, we anticipate the value to reach $200 million or higher. We are proud that the project has received unanimous support from the Arlington City Council and a ‘thumbs-up’ from neighborhood groups, the school district, and other stakeholders.”

Prior to this redevelopment, property values were declining in the area; now they’re on the rise with the creation of this pedestrian-friendly project, Kembel says. The traffic study supported a more pedestrian friendly street section allowing for a new linear park in the median adjacent to the project. These types of trails and parks are significant quality of life additions expected today by young professionals.

“Without Younger Partners, this project wouldn’t have happened and have the success it has experienced,” Kembel says. “Early on, Younger Partners was working to assemble this land. We were having difficulty locating owners and convincing them to sell to us. Younger Partners stepped in and made it happen.”

Arlington Commons consists of a four-story elevatored building with an attached structured parking garage, 10- to 12-foot ceilings, and views of the adjacent Rolling Hills Country Club golf course, Downtown Fort Worth, and Downtown Dallas. The property’s unit mix consists of one- and two- bedroom homes ranging from 580 to 1,418 square feet. Unit interiors feature granite or quartz countertops, stainless steel appliances, undermount sinks, designer backsplashes, chrome finishes, electronic door entry, vinyl plank wood flooring, custom track lighting, full size washer/dryers, and balconies or patios. Community amenities include a swimming pool, resident lounge and business center within the clubhouse, wellness center with fitness on demand, valet trash, dog park with dog wash station, electronic parcel lockers, and a lounge deck with barbecue grills.

“Arlington has had a dearth of multifamily deliveries. Excluding student housing, only two new market rent projects other than Arlington Commons have been built since 2004 and no new projects are under construction,” says Helterbran, one of the brokers on the deal. “Arlington

Commons continues to outperform the surrounding multifamily market because of its top-of-class location, quality construction and lack of supply for a demographic group that demands excellence. Leasing velocity continues to accelerate without any rental concessions, confirming the depth of this target market.”

The multifamily complex is 85 percent occupied with approximately 65 percent made up of young professionals, he says.

Helterbran says The Nehemiah Company’s multifamily expertise and historical track record with the City of Arlington and Tarrant County, coupled with the city’s commitment to the revitalization of the Lamar/Collins area of North Arlington, led to the private-public partnership for the development of the property and streetscape improvements along East Lamar Boulevard.

Arlington Commons is centrally located within the Dallas-Fort Worth MSA and roughly equidistant from the major employment centers in both downtown Dallas and downtown Fort Worth. The property provides great accessibility and connectivity throughout the Metroplex, as it is proximate to I-30, SH-360, and SH-161, and sits only 12 miles south of the DFW airport.

North Arlington is proximate to both a growing employment base and an expanding entertainment district. The property benefits from close proximity to a diverse employment base such as GM Financial, D.R. Horton, General Motors, the Great Southwest Industrial District, the University of Texas-Arlington, Texas Health Resources, the Centreport Business Park, American Airlines Group, and UPS. In addition, the property is located less than four miles from Arlington’s Entertainment District, which includes AT&T Stadium (home to the Dallas Cowboys), Globe Life Park/Globe Life Field (home to the Texas Rangers), Texas Live!, and Six Flags Over Texas/Hurricane Harbor.

2018 North Texas Land Absorption Report

By Robert Grunnah

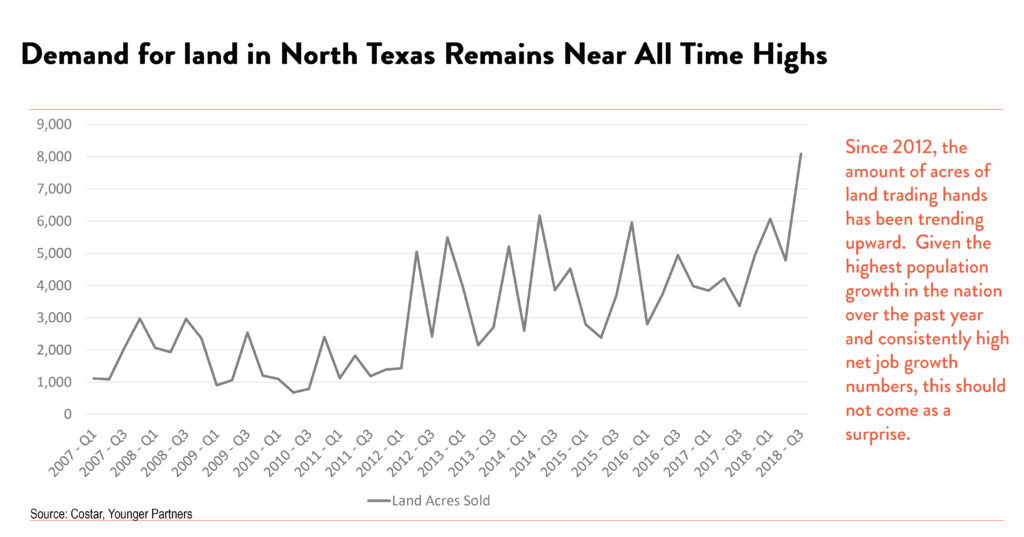

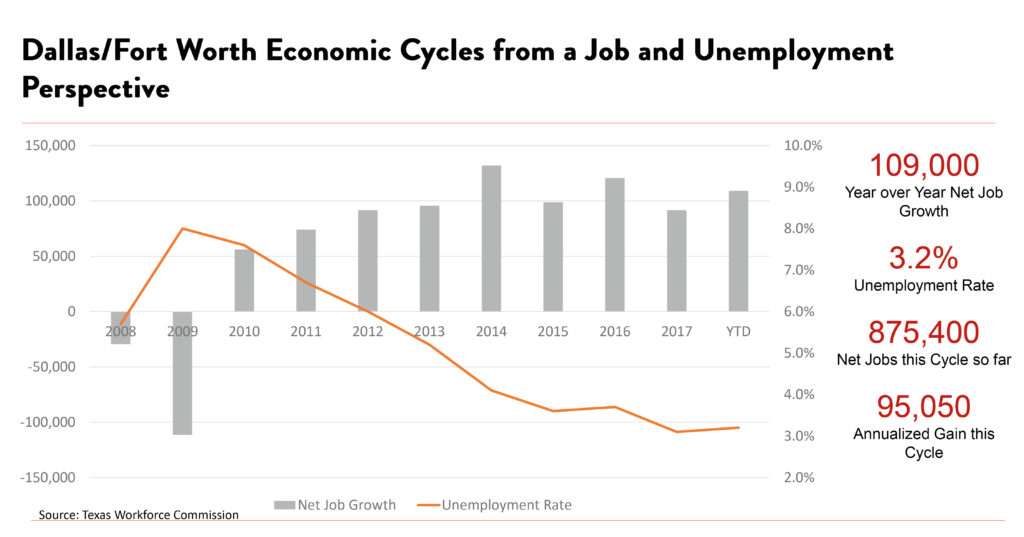

For many years, our Investments/Land Division, formerly Novus Realty Advisors, now a division of Younger Partners, has produced a report designed to assist investors in deciding the viability of acquiring undeveloped land for medium and long-term positive returns. Since our 2017 report was distributed, DFW has experienced continued active growth in virtually every commercial and residential product type. As the accompanying exhibits indicate, transaction volume held steady for both user and investment product. Much remains the same in our report this year, except we are seeing legitimate evolving trends that should be acknowledged. Absorption of developed, undeveloped (land with limited or no access to infrastructure permitting immediate use), and underutilized land activity traded at a comparable rate to 2017. The trend continues as

aggressive, new vertical development has left even fewer desirable infill sites remaining available. More peripheral sites are seeing increasing activity with employers competing for employees desiring a shorter commuting distance. This competition for employees, inflated raw

land and construction costs, a rapidly increasing cost of living, and transportation congestion are all beginning to affect our extended growth cycle. However, we remain attractive to geographical relocations when compared to our competition. With the anticipated continued job growth,

inbound population increases, relatively low interest rates, and a sound local economy, there is no reason for an immediate corrective cycle. Should any one of those benchmarks collapse or even display a solid weakness, a correction is imminent.

While we have retained historically low capitalization rates, despite sale prices at a multiple of replacement cost and static retail demand, income producing investments have maintained their active volume due largely to the need to invest 1031 trade equity and the lack of competition with alternative investments. Excessive competition to acquire cash flow assets providing even the smallest yields produces increased vulnerability to market corrections. A cyclical downturn in the national economy would have a dour negative impact and threaten positive cash flows. Inherently, land investment differs greatly from other types of real estate products generally because of its inability to produce interim cash flow and its considerably more sensitive vulnerability to recurring cycles. The criteria used to determine potential land opportunities, while becoming more sophisticated over the last two cycles, remains principally in implementing basic strategies. Perhaps the most important of these is the ability to project and fund ownership long term. Positive liquidity, the allowed ability to sell for an acceptable profit at the optimum market time, can be highly speculative. When an investor is placed in an imposed forced sale position or loses confidence in the future of the investment, returns are jeopardized and most frequently result in a significant loss.

With expanding IT capabilities and the proliferation of social media vehicles, should an investor wish to search hard enough, she can find support for any speculative investment philosophy, positive or negative, to justify an action. This presentation qualifies as but one of many. However, certain facts remain more pertinent than most as they may apply to investments in unimproved or underutilized land assets in DFW. Again, referring to the accompanying charts, a conservative estimate of pending ten-year population growth for DFW is one million plus new residents. Climate, central location, progressive state and local government, and no personal or corporate income tax would support this projection. Possessing no true natural barriers for continued land absorption, there appears to be no single real estate oriented obstacle to limit this projection. Population growth can be fueled both organically and by external inbound relocations. With trailing twelve-month growth of 120,000 jobs, the majority of the population increase stems from such relocations. It is estimated that only eighty percent of the jobs created by recent moves into DFW have been filled. In the last six years, over thirty-five thousand acres of land have traded with an additional large number not being included when classified as long-term investment land.

Like most types of investments, real estate is cyclical. Investment success or failure can often solely depend on where the cycle is at the time the purchase is made in conjunction with the investor’s ability to determine the true state of the cycle. Buying at various points in a cycle, cost averaging, can provide some security allowing for both buying selling to generate positive results. There has yet to be a final cycle. The ability to hold long term may negatively impact the final yield, but does offer security. While the ability to use historical data to project long term value is logical, many down cycles have been created by artificial, non-real estate related influences that were difficult to anticipate. For example, in the late 1980’s, tax law changes and deregulation destroyed the market. In the late 2000’s, the subprime collapse did the same. It is reasonable to assume there will be more fragile “bubbles”. Included in our report is our Land Absorption Map which sets out various types of 2018 commercial real estate activity in specific geographic areas. Actual sales, current listings and announcements of pending projects are the basic criteria used and have been benchmarked annually to complete the current year’s map. Not difficult to understand, the progression from active to long term generally follows the current availability of infrastructure and newer, expanding city services. Land currently available for vertical construction will bring significantly higher values and greater activity over those that must physically wait for services. Over the twenty plus year’s of presenting the map, it is interesting to note that, while the circles have limited movement, the colors have many changes and generally move out from the core in concentric circles. An ever-increasing burden to investors and developers is the dramatic involvement of politically motivated, impractical restrictions imposed on reasonable growth by many local municipalities. Frequently, viable, beneficial projects are excluded from fruition by flawed, unrelated personal or political interests. Younger Partners is a member of the highly respected North Texas Land Council (NTLC), a group comprised of 50 of the most active and talented land brokers in our area. Believing that activity generates more activity, the North Texas Land Council freely shares information with its competing members, and the market in general, on a level of professionalism unusual within similar organizations and, as such, is a benefit to all clients. Much of the projected activity displayed on the Younger Land Absorption Map (YLAM) reflects the activities of the NTLC.

The market today continues to see record prices for infill, readily developable sites possessing available infrastructure, permitted anticipated uses, and demand for completed product. However, distinct indications of this aggressive approach are beginning to surface perhaps harboring at a minimum at least a cooling off period, or perhaps the “correction” we have anticipated the last few years. As it relates to land, pricing levels may have achieved their pinnacle for this long evolving cycle. For many increased cost factors, single family new home prices have increased fifty percent in five years making affordability more difficult. Less obvious are completed per square foot costs in all commercial sectors. The strong national economy, as well as local, and the continued relocations have provided record employment and income. That momentum will carry through at least the first half of 2019. Past that, projections are difficult. DFW is well positioned to absorb a moderate abated market. Land prices, however, must readjust for the return of an active market.

Again, as last year, the “pipeline” for new projects of all types has gotten understandably smaller which presents an interesting speculative projection for 2020 and beyond. Increased activity for pure, longer term investment sites has continued the extension to the outer lying, concentric circle tracts, considered “pure investment tracts”. Until 2016 such tracts remained fairly benign in sales activity and price fluctuation. These specific investments are becoming more attractive since competing investments such as oil and gas (price fluctuation and over production), a pending bear stock and bond market (the same non-occurring “pending” from last year), and the tech world which offer much higher risk vehicles. Additionally, local investors (the heretofore most active group of land speculators) are seeing increased competition from more patient national and foreign investors. Yet, historically, and perhaps ironically, a large number of the most successful, wealthiest investors have made their patient fortunes in land by simply applying these basic techniques.

Our continuing and extended analysis, as displayed on the “Younger Land Absorption Map” (revised November 2018) is principally based on extensive historical data collected utilizing over 150 years of market experience possessed by Younger associates, members of the NTLC, and reliable future projections from sources that have traditionally displayed accurate demographic information. Our attached graphs were constructed by Steve Triolet, Director of Younger Research. Depending on which source one chooses to use, the DFW market still expects to absorb an additional population expansion of twenty five to thirty percent over the next fifteen years. Success in real estate investment will be to determine where that growth will locate. History has taught us that product will be made available and priced based on pure economics. The cost to provide available product to meet demand will depend on the availability of affordable infrastructure (sewer, water, roads, proximity to employment centers, service commercial, schools, political climate, etc.). Land prices will fluctuate according to such availability, absorption, the national economy, and the popularity of any specific product. Investing in the right opportunities will generate exceptional rewards. Some estimate that it requires approximately 12,000 to 15,000 acres of raw land to accommodate one million people in a reasonably confined, socially acceptable, service provided environment. DFW enjoyed record rainfall in 2018 keeping our resources at sustainable levels. Given the droughts of previous years, with the population growth that has occurred, a dry year will present some worrisome challenges only new sources can cure. A partial answer lies in the creation of two new reservoirs in East Texas, probably ten years from service. Lack of both potable and irrigation water access will be an inevitable liability. We have been fortunate to have had an extended period of prodigious activity which can at least be partially credited to our aggressive political structure, both local and state, our sophisticated and informed developers and engineers, and our incredibly competent and equally aggressive local and regional Economic Development Corporations. Of equal depth, however, is the dynamic, well educated, hard working, and professional “under 40” group of brokers, administrators, managers, and general employment base whom have emerged during this cycle. They may well be the first group exiting a positive cycle who have learned and benefited from the experience of their predecessors. They may not need a disaster to stay relevant and solvent. In conclusion, the principals of successful, sophisticated investment must utilize basic criteria, some of which is outlined above. Access to infrastructure, most importantly water, the admirable, continued effort by our current Dallas Mayor to utilize available land in our southern corridor, absorption of the remaining few infill sites, high suburban infill land costs, and the migration of employment centers will all play significant roles in prudent investment decisions. Utilized in the investment process, the only remaining elements are sound financial strength and patience.

YP Runners Take on BMW Dallas Marathon

Congrats to YP’s Tyler Hemenway, Tanja McAleavey and Autumn Stallings for their participation in the BMW Dallas Marathon. This was Autumn’s sixth year to participate in the BMW Dallas Marathon and her first year to run the Ultra with a time of 7:26:47. Tanja and Tyler both ran in the half-marathon. Tanja finished 20th out of 3,114 women and fifth in her age group. Tyler finished seventh overall with a time of 1:12:14.

The BMW Dallas Marathon Charity Program brings together various local charities in Dallas and national non-profit entities that partner with the BMW Dallas Marathon organization to raise funds in support of various causes. Charity Program partners play a vital role in supporting the success of the BMW Dallas Marathon and related events by providing both runners and volunteers. Among the charities supported are: Muscular Dystrophy Association Team Momentum, Big Brothers Big Sisters, Leukemia & Lymphoma Society Team In Training, Back On My Feet, The Tom Joyner Foundation, and For The Love of the Lake

BMW Dallas Marathon info.

Younger Partners Brings Cheer to Kids in Need

Younger Partners is helping spread some holiday cheer! Team members collected toys, makeup kits and bicycles for Community Partners of Dallas, whose mission is to ensure safety, restore dignity & inspire hope for abused & neglected children served by Dallas County Child Protective Services. We hope these gifts fulfill every child’s holiday wishes. #NoChildForgotten #TogetherWeGive

Here’s the team going to pick up the bikes.

Here’s more info on the toy drive.

Here’s more info on the toy drive.

Younger Partners Property Services Moves Up to No. 16 on DBJ List

Congrats to Younger Partners Property Services for moving up to No. 16 on the @DallasBizNews list of the Top Commercial Property Managers in the Metroplex. #TogetherWeGrow #propertymanagement #YoungerPartners?

Here’s the DBJ full list.

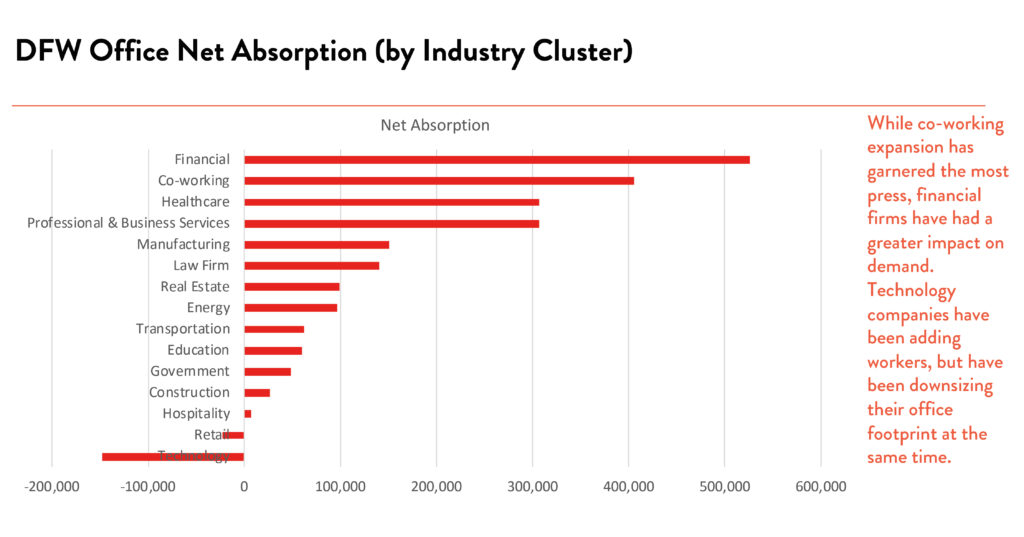

Move Over Co-Working; Financial Industry is the Real Powerhouse

By Steve Triolet, Younger Partners Research Director

While co-working companies have dominated much of the headlines as far expansion in DFW, the financial industry (which includes insurance companies) have been taking down more office space in 2018. Companies like Allstate Insurance, Mr Cooper (formerly Nationstar Mortgage), New York Life and others have contributed to the majority of positive net absorption over recent quarters. On the opposite end, technology companies been very active as far as leasing activity but have been responsible for overall negative net absorption.

Much like we saw law firms squeezing more attorneys into less space over recent years, a similar trend has been impacting the technology industry, with tech companies downsizing their real estate footprints. NTT Data, Nokia, NetScout and other technology related companies have been moving into newer space and shedding excess square feet in older properties in the process. The attached chart shows the industry clusters and whether in aggregate they have been expanding or contracting in the DFW office market.

WFAA Features Park Central 3 & 4 Security Guard

Great example of the quality tenant service at Park Central 3 & 4 as featured on WFAA. They featured one of the great security guards on site who sets out to remember a building of names. See the news clip here. Younger Partners handles the leasing for the property.

Security guard sets out to remember a building of names

If it’s your second day on the job and security is already calling you up by name, you probably made the wrong impression.

But inside one office tower in North Dallas, if the security guard doesn’t know your name, it’s just because he hasn’t met you yet.

“Good morning,” proclaimed Tim Esters, as he welcomed employees by name.

Tim has been guarding the front door in this building for the past three years. No one gets buy without a proper greeting.

“A smile is contagious,” said Tim.

At first, the proper greeting simply missed saying hello. Until, one day, someone responded, ‘Same to you, Tim.’

“If you call me by my name, I’d like to address you by your name,” Tim said.

And so began Tim’s mission to learn and remember as many names in the building as possible. Which, with 21 floors, seemed quite impossible.

“I know a few people from every floor,” he said.

Actually, the total number is much closer to a few thousand.

“I’m being kinda modest I guess,” Tim admitted with a laugh.

Of the nearly 3,000 people who walk through the door Tim knows more than 2,000 of them by name.

Tim says he only needs to hear your name once and he won’t forget it.

He claims there’s no secret to remembering 2,000 names. He’s only exclamation is that he simply loves people.

“Yep. Just like my family,” he said.

It’s obviously a very thoughtful thing to do, but folks hearsay Tim there’s a lot more than just remember their name.

“He makes you feel important,” said one employee.

“He makes you feel known and appreciated,” said another employee.

In America, we dislike each other because of politics or religion. But if Tim Esters shows us anything it’s that we have an ability to love one another even more.

“As a man told me a long time ago, it’s just nice to be nice. That’s just me. It’s just inside of me, to be nice to people.”

Trio of Younger Partners Leaders Featured in DBJ Report on Abundance of Development Sites

North Texas boasts bounty of big corporate campus sites

By Bill Hethcock – Staff Writer, Dallas Business Journal

If nothing else, the push to lure Amazon’s second headquarters shows there’s an abundance of real estate options in North Texas for the world’s biggest companies seeking to relocate or expand.

The Dallas Fort Worth region has capitalized on its low cost to do business, central location within the United States, and relative abundance of skilled workers to bring in corporate relocations on a regular basis — Toyota, FedEx, Liberty Mutual and State Farm to name a few. Texas is a right-to-work state, with no corporate or individual income tax and one of the lowest tax burdens in the country, and North Texas has plenty of potential headquarters and corporate campus sites, making the region one of the top destinations in the world for relocating or expanding companies.

North Texas now is trying to land Amazon’s second headquarters, or HQ2, and the 50,000 jobs expected to come with the $5 billion mega-project. Twenty North American metro areas are competing for the project. The Washington Post reported this morning that the e-commerce giant has held advanced discussions about establishing its second headquarters in Virginia’s Crystal City.

Dallas-Fort Worth officials have pitched more than 30 potential sites capable of accommodating the 8 million square feet of office space Amazon plans to occupy. The e-commerce giant’s campus is expected to span across 100 acres.

In the four primary DFW counties — Dallas, Denton, Collin and Tarrant — there are more than 50 separate sites currently being marketed for large corporate users, said Steve Triolet, research director at Dallas-based commercial real estate firm Younger Partners. Those sites can accommodate a minimum of 250,000 square feet of office space and in many cases, millions of square feet more.

Another analysis compiled by real estate firm JLL showed more than 600 land tracts in DFW that are over 100 acres and are intended for commercial development.

While that list captures a large share of the options, the DFW market is so expansive that it doesn’t catch everything, said Walt Bialas, JLL vice president and director of research in Dallas. For example, it does not include infill tracts such as Dallas Midtown, which is the site of the old Valley View Mall, a 100-plus acre piece of land that is prime for redevelopment, Bialas said.

“Our area has significant tracts scattered everywhere,” Bialas said. “DFW has grown over the decades (by) pushing out its perimeter.”

The abundance of sites across DFW is a plus for companies in search of a new home because it allows them to choose from a variety of quality locations and pick the site that fits their corporate values and needs, said Dan Bowman, executive director and CEO of the Allen Economic Development Corp.

“Corporations win when there are many quality sites to choose from,” Bowman said. “DFW and Collin County not only have many development sites, but they are differentiated and strategically located. These kind of choices create value for relocations.”

In Allen, for example, the focus has been on creating significant green space in developments like Watters Creek, The Strand and Monarch City, Bowman said. Walkability, trails, green space and a quality family environment set Allen apart as a corporate location, he said.

“North Texas has many available shovel-ready sites for corporate relocations, but what makes us unique is the differences among those sites,” Bowman said. “Various Collin County sites offer access to unique labor pools, different transportation corridors, school districts, etc.”

The multitude of cities in the DFW area means the competition is fierce between cities, EDCs, developers and commercial real estate brokers vying for projects. North Texas has 14 cities with a population of over 100,000, and 71 cities with 10,000 people or more.

“I think that having more options is always good when you are a buyer,” said Moody Younger, co-founder of Younger Partners. “The Dallas-Fort Worth Metroplex has more potential sites than most areas because of available land and also because we have many more proven developers than most markets.”

The Dallas Regional Chamber also believes that having plenty of options for companies to consider is one of North Texas’ strengths, said Darren Grubb, a spokesman for the organization.

“Our role at the Dallas Regional Chamber is to help companies, site consultants, brokers or developers navigate our region and understand all aspects of what we offer as a market,” he said. “That optionality of sites, and also our distinct communities, allows us to tailor project responses based on what they are trying to achieve – or present them with a possibility they had not considered.”

The number of potential sites and cities made it challenging for the regional chamber to compile DFW’s bid for Amazon’s second headquarters, said Mike Rosa, senior vice president of Economic Development for the DRC.

“You’re going to submit one bid, as requested by the company, for an area of 7.5 million people and all the powerful communities that we have,” he said. “This is not one large city with a lot of tiny burgs that surround it. We have 14 cities in this region with more than 100,000 people and their own ideas about their destiny and who they are as a city.”

The time and effort that local officials put into the HQ2 bid won’t be wasted if Amazon decides to go elsewhere, Rosa said. Information that North Texas leaders compiled on potential sites, as well as the region’s workforce, education, housing and other considerations, will be useful when luring other large companies, he said. Chasing Amazon has encouraged leaders to cooperate and to think big and boldly about economic development, he added.

Robert Grunnah, a land broker at Younger Partners, said DFW is “legendary” for its ability to attract new business, and availability of quality sites is just one piece of the puzzle.

“The area’s competing communities are responsive and hospitable with a myriad of welcoming political structures,” Grunnah said. ”Having the option of many available sites allows for a more than adequate economic analysis. There are few competing national markets that can offer our diverse business amenities and selection of financially hospitable locations.”

See article here.

Trick or Treat: Younger Partners Style with Chili, Charity & Costumes

Halloween is tomorrow and while some tricks will be had, our team had fun gathering treats for the North Texas Food Bank. Our property management team for DFW Business Center was flying high after being awarded the best Halloween costume, while team captain (and YP co-founder) Moody Younger’s team was awarded the envied title of “BEST CHILI” for our 2018 chili cook off! Congrats to all of our winners! #TrickorTreat #TogetherWeCook #TogetherWeContribute

Younger Partners Finishes Top 10 in DBJ’s 2018 Best Places to Work

The Younger Partners team is humbled to finish in the Top 10 of in the medium category of the Dallas Business Journal’s 2018 Best Places to Work. Thanks to our leadership & the entire team for making this a Best Place to Work. #dfwworks #bptw #teamwork #togetherwewin See the full rankings here.

The BPTW event was deemed “DFW’s biggest company picnic” at the Dr Pepper Ballpark Center in Frisco with colleagues and families invited to join in corn hole, giant Jenga, the hula hoop hustle, among other fun and games.

NTCAR Selects Kathy Permenter as 2018 Stemmons Service Award Finalist

Younger Partners Gives Back; Volunteering at Bonton Farms

Volunteering together is a great teambuilding exercise and allows us to give back to the community simultaneously. The Younger Partners team spent Friday morning on the Bonton Farm harvesting vegetables, chopping & stacking wood, and feeding the goats. #togetherwegiveback #teambuilding

If you’d like to learn more about Bonton Farms, check out their website here.

A hot & sweaty crew after working on the farm.

A hot & sweaty crew after working on the farm.

The earlybirds before the work started.

The Bonton Farms mission statement: An agricultural intervention to restore lives, create jobs and ignite hopein the most forgotten and neglected neighborhoods for the most marginalized and vulnerable people.

Bonton is a South Dallas community where 85% of men have been to prison, poverty is rampant and jobs are scarce. Bonton is also a “Food Desert” where access to healthy foods is non-existent. Bonton Farms is on a mission to change that.

if you’d like to learn more about Bonton Farms, check out their website here.

DFW Business Center: Broker Open House

DFW Business Center hosted a broker open house with great views of the project’s plethora of amenities, from a new fitness center with indoor and outdoor facilities to a tenant lounge and patio dining area, meeting space, a putting green, and more.

For more info: http://www.youngerpartners.com/properties-api/containers/DFW-Business-Center_Disc_Flyer_9.11.18.pdf

For more info: http://www.youngerpartners.com/properties-api/containers/DFW-Business-Center_Disc_Flyer_9.11.18.pdf

Younger Partners & Republic Center Support My Possibilities HIPster Golf Classic

Younger Partners is stoked to sponsor a hole at this year’s My Possibilities HIPster Golf Classic today. My Possibilities is a 501(c)(3) that serves adults with disabilities through a full-day, full-year educational program in Collin County. The event supports the organization & its Hugely Important People (HIPsters). For more information about My Possibilities: https://mypossibilities.org/about/

YP’s Steve Triolet Featured in Dallas Morning News Article on Uptown Dallas Real Estate

Is the office market in Uptown Dallas headed for a glut?

By Steve Brown, Real Estate Editor for the Dallas Morning News

A big new office lease in Dallas’ Uptown is good news for the booming office district just north of downtown.

Data center firm CyrusOne rented 50,000 square feet in the new Harwood No. 10 tower under construction near the entrance to the Dallas North Tollway. The tech company, the first major tenant announced for the 22-story high-rise scheduled to open this winter, is growing its headquarters by about 60 percent in a move from another Uptown building.

The lease may help calm jitters about the amount of new office space on the way for Uptown.

While the central Dallas district doesn’t have the largest share of new office development underway in North Texas, buildings there are the most expensive, with rents topping $50 per square foot.

Most of the office construction these days is in the mid-cities, Las Colinas and the Legacy/Frisco market, but three new office projects going up in Uptown are the most visible and costly. And all of them are speculative, multi-tenant buildings.

Areawide about 75 percent of office projects being built already have tenants lined up — in Uptown, about half of the new space is accounted for.

“Only Uptown is likely to see any significant softening due to new construction in the second half of 2018,” said Younger Partners’ Steve Triolet. “Keep in mind, Uptown is not a large submarket — current total inventory is 13.9 million square feet — but it has 1.2 million square feet scheduled for completion later this year.”

The new office space is coming in Trammell Crow Co.’s Park District project on Pearl Street, in the Union on Cedar Springs Road and the Harwood’s No. 10 tower.

“These three Uptown projects have a combined 654,054 square feet of space that is unaccounted for,” Triolet said.

Of course the developers in Uptown have reason to feel optimistic. Crescent Real Estate hit a home run with its $225 million McKinney & Olive office tower, which opened in 2016 with record rents and almost full occupancy.

And Lincoln Property Co.’s new 1900 Pearl high-rise on the edge of Uptown at Pearl Street and Woodall Rodgers Freeway is almost 90 percent full just months after the opening.

“Most buildings are doing pretty well right now in their leasing velocity,” said JLL’s Greg Biggs. “I don’t think it’s time to worry yet.

“There is still a lot of activity down there — both from within the market and outside the market,” Biggs said. “We get calls from companies wanting to open new offices in Uptown.”

Of course, those same companies are being wooed by downtown Dallas skyscrapers that are getting major remodels to remain competitive. And those downtown buildings are rental rate bargains compared with Uptown’s pricey properties.

“For the value, they are very competitive compared to new construction,” Biggs said. “They are going to be considered 90 percent of the time with the Uptown buildings, especially with the retrofits that the downtown buildings have gone through.”

Uptown law firms Bell Nunnally & Martin and Alston & Bird recently decided to relocate from Uptown to downtown.

“Uptown also recently lost Guidestone, which vacated roughly 200,000 square feet at 2401 Cedar Springs and moved to Pinnacle Tower” in Farmers Branch, Triolet said of the financial firm. “Taking all this into account, watch for increased concessions in Uptown in the near term as the submarket tries to fill these new speculative projects.”

Link to the article here.

What Submarkets Have Changed the Most?

Younger Partners Research Director Steve Triolet took a long look at how much asking rates increased on a submarket level over the past five years (1Q13 vs 1Q18). It probably won’t come as much of surprise that Preston Center and Uptown have seen the biggest increases over that time period, which has in turn pushed rates in Central Expressway (Central often attracts tenants priced out of Uptown and Preston Center), but some of the other submarket trends are a little surprising. LBJ Freeway has seen a good push in rates, but this is partially due to the freeway expansion project wrapping up a couple of years ago.

Meanwhile, the Fort Worth CBD has struggled over the past four years largely due to the energy price collapse that started in mid-2014. While, oil prices have been recovering some in recent months, any rate growth in the Fort Worth CBD in the near term is unlikely as the XTO division of Exxon Mobile is leaving several large blocks of space in Fort Worth this summer and moving 1,200 jobs to Houston.

Meanwhile, the Fort Worth CBD has struggled over the past four years largely due to the energy price collapse that started in mid-2014. While, oil prices have been recovering some in recent months, any rate growth in the Fort Worth CBD in the near term is unlikely as the XTO division of Exxon Mobile is leaving several large blocks of space in Fort Worth this summer and moving 1,200 jobs to Houston.

Robert Grunnah Talks Land Sales, Rising Prices in a Dallas Business Journal Q&A

Land sales, prices soar north of Dallas-Fort Worth as race to Red River hastens

Land sales north of Dallas-Fort Worth are sizzling, with near-term developers and long-term speculators snatching large tracts in the path of projected growth as DFW continues its Manifest Destiny march to the Red River.

Hunt Realty Investments Inc., for example, recently bought a property known as Headquarters Ranch, a more than 2,500-acre site on Frisco’s northern edge and the largest contiguous land assemblage in the city. Hunt Realty will master-develop a massive, mixed-use project alongside the Karahan Cos., led by Fehmi Karahan, who was the driving force behind much of Plano’s Legacy area.

Further north, Younger Partners’ John St. Clair brokered the sale of more than 900 acres to an undisclosed family that has owned land around Texas for generations. The investors bought a 634-acre farm in Howe, about 55 miles north of Dallas, as well as a 371-acre parcel in Sherman, about 65 miles north of Dallas.

The Dallas Business Journal talked with Robert Grunnah, the leader of Dallas-based Younger Partners’ land investments division, to get a sense of who’s selling, who’s buying, for how much, and where. This interview with with Grunnah, who has 40-plus years of experience in the DFW land business, has been edited for brevity and clarity.

What trends are you seeing in terms of land sales to the north? Our long-term history has been to focus on the different cycles that have occurred and the different product types. Land has traditionally been slower (to rebound) in most of the recovery cycles than virtually any other asset. The reason is because it’s not income-producing.

How has this recovery cycle progressed? This has been one of the longest recovery cycles we’ve ever seen. Certainly of the four cycles I’ve experienced, it’s the longest by two or three years. Land has been much slower to recover. We started focusing in the 2009-2011 era on land up north, in the area west of Sherman-Denison and south of Lake Texoma. Land was trading in the $2,000 to $3,000 per acre price range for plain, raw land. It was not very active. There weren’t many trades. Most people were focused on income-producing properties for investment as opposed to land. It stagnated there up until about three or four years ago. But over the last 12 to 18 months, we’ve seen a distinct acceleration of values.

Why? I think it has a lot to do with the current income-producing or vertical asset market. We’re pricing it at two, three or four times replacement cost. Momentum for investment in those types of properties has finally worn thin. The competition for real estate investments in Dallas-Fort Worth has gotten so competitive and pricing has gotten egregiously high for vertical assets. People have decided that if they’ve got to park their money in real estate investment, land is the best opportunity.

So people are turning to raw land? Investment tracts are generally considered to be anything over 100 acres. This is for unimproved investment land that is not tied to any infrastructure nor will it be tied to any infrastructure in the near term. It’s vacant land that is in the path of growth, but is not expected to be absorbed for development anytime in the near term. You take the average 100-acre tract, and you go into the speculative marketplace for land of that nature, and you go north of Celina, you have Gunter, Dorchester, essentially Sherman and Denison. If you come back south again, you come back into Howe, Van Alstyne and Melissa and that area north. That’s really the speculative marketplace.

Why is DFW growing more rapidly northward than other directions? The natural growth pattern for most major cities in the United States is north. For the most part, Dallas-Fort Worth has grown north, and that’s partly because of the availability of sanitary sewer and water. When we first started selling land north of Fort Worth to Mr. Perot in 1985, ’86, ’87, it looked no different than north of Celina looks today. Now, look at what has occurred. That was created first because Mr. Perot had the vision and the resources to create the activity, and secondly because infrastructure was available. The city of Fort Worth jumped out and grabbed that.

What’s in high demand to the north? The demand north of Celina is for larger tracts. If you go into Cooke County, out of Grayson County, you’ve got some beautiful estates — horse farms and such — and those people will utilize it for secondary use, agricultural use, until there is demand pressure.

What trends are you seeing in pricing? There’s no quantitative method to value a piece of raw, speculative land like the 100 acres I’m talking about. What is it worth? Does it have impounded water on it? If yes, that’s more valuable. Does it have trees and creeks on it? If so, that’s more valuable. It’s priced more like a commodity. We’ve seen pure, speculative investment land go from $2,000 to $3,000 per acre five years ago to the $10,000 to $12,000 per acre range today. And there’s nothing that has changed. There’s no development on the property line. There’s not road going through the middle of it. There’s none of that. It’s just commodity-based pricing. It’s what people see as an investment. No one has ever lost money at any price level on buying 100 acres north of Celina, west of U.S. 75 and east of Interstate 35 at any price. All they have to do is be able to carry the land through the cycles, and at some point the cycle will exceed what they paid.

Even if they’re highly leveraged? A lot of people have gone broke up there because they’ve leveraged it and they were forced to pay debt service. One of the greatest advantages of land ownership today is that you have agricultural exemption. You can carry that land for nothing. And if you buy a nice enough piece of land, you can put cows on it, get your ag exemption, and make money. It’s income-producing land — a rare thing.

Can you tell me who made this latest purchase of 1,000 acres in Sherman and Howe? I can’t tell you who it is, but it’s a family that traces their roots in Texas back four or five generations. They have bought land in the path of growth for three or four of those generations. They buy it, they put cows on it, they hold it and wait until the market changes and growth gets to it. Then they sell it for a significantly higher price and go out further and buy more. It’s a classic investment strategy that doesn’t fail. But again, in order to make it profitable, you have to be in a position that you can carry it.You cannot be in a leveraged position or you’ll lose it. That’s what happened to so many people in the late ’80s and the 2008, ’09, 2010 era.

What are your thoughts on Hunt Realty Investments’ purchase of the Headquarters Ranch property in Frisco? It stands out as such a significant acquisition that you really can’t apply the standard investment procedures in that deal. They’re going to need to develop that land in order to make it work. I admire them because they’re going in at the peak of a market. But with the financial resources that the investor pool has, they can wait that out two more cycles, and they’ll have no concerns. They’ll do extremely well because of where it’s located. With the job growth and the job centers that are moving in that direction, it’s an absolute home run. It was a brilliant move.

Where is DFW’s northern frontier? It’s creeping up there. It’s further north than we’ve seen it. We’re north of U.S. 82 now, which is north of Denison-Sherman.

How is the extension of the Dallas North Tollway progressing? Everybody is still speculating on the extension of the toll road, and it’s just creeping along at a snail’s pace. But it will ultimately go all the way up to U.S. 82. In my lifetime, no. In your lifetime, probably not. But when you look at what people are paying for land today — $15 to $20 per square foot at the intersection of the toll road and 380, that’s wealth created by the toll road.

You can see the story on the DBJ website here.

YP’s Steve Triolet Featured in D CEO’s CRE Opinion

CRE Opinion: Extremes of the Investment Spectrum

The number of office properties being marketed for sale in Dallas-Fort Wort is up, especially in types of commercial properties.

In early 2018, Younger Partners noticed a surge in office properties that have been marketed for sale, far above the norm we’ve seen over the past several years. Part of this increase in properties for sale is certainly tied to interest rates and the anticipated movement in cap rates that are expected to follow. In early 2018, there was more than 11 million square feet of office properties being marketed for sale. Since then, the number and square feet of office properties available for sale has steadily increased and now is more than 17 million square feet.

The thing is, the most active parts of the office investment market in DFW seem to be at either end of the risk spectrum, with large built-to-suit investments like State Farm’s Richardson campus that sold in late 2016 as a sale-lease back for $400 per square foot. Institutional investors prefer core, Class A properties and the large built-to-suits are generally very low risk. In fact, most are single tenant assets with 10 to 15-year leases. Some of the current inventory is similar to this, like AT&T’s Whitacre Tower, in the Dallas core, which is currently for sale.

The other end of the spectrum are the high vacancy properties, which are commonly referred to as value-add. These vacated properties (which, in many cases, are the old locations for new built-to-suit projects) can be an attractive investment for investors with a higher appetite for risk.

In late 2017, International Plaza I and II were vacated by JPMorgan Chase and Fannie Mae (both tenants moved into new built-to-suit properties in the Legacy area) and the two properties were then sold in early 2018 for $152 per square foot. These two adjacent properties are currently one of the largest contiguous blocks of Class A space in DFW. Sometimes the vacated properties go through distressed sales, where the banks take back possession or they sale at foreclosure auction. The former Zale Corp. property at 901 Walnut Hill Lane in Irving went through foreclosure in October 2017.

Outside of the extremes, there are more investment grade office options currently available in DFW than we’ve seen in well over a decade. With so much inventory available, sales transaction volume will either be delayed due to lack of buyers, or a record number of office properties will trade hands in 2018. Currently the market is already on pace to surpass 2016, which was the highest year this business cycle.

Steve Triolet is the research director at Younger Partners.

You can see the article here.

Younger Partners in Bisnow: 3 Impacts All This New Office Supply Is Having On Fundamentals

By Catie Dixon, Bisnow

DFW loves new.

Younger Partners Research Director Steve Triolet delved into the impact of Dallas’ huge office pipeline on the market and found that deliveries — 20.1M SF of Class-A and 3.8M SF of Class-B office has come online since 2013 — are shaping the city in a few ways.

1) Rent Explosion

The delta between Class-A and Class-B office rents is widening as new supply sets new bars for pricing. Historically, there was a $4 to $5 gap per square foot between what tenants paid for a top-tier building and a Class-B one, but that has been increasing over the past five years, Triolet said. The delta is now $8/SF.

2) New-Build Is Low-Risk, But Could Hurt Everyone Else

The best performing submarkets are typically the ones with the newest buildings, and those properties are almost guaranteed to do well. “Even in an overbuilding situation, it’s rare for the newest buildings to go into distress,” Triolet said. “The properties that struggle the most at almost any point in the business cycle are the older, outdated properties.” Even with a growing discount on pricing, these properties are more often struggling to attract tenants.

3) Time On Market Is Shrinking, Which Is Unexpected

The overall vacancy rate in DFW office has been rising for three years. Typically, the average time to lease space is directly correlated to vacancy — as competition increases, so does the amount of time it takes to fill a building. Not this time.

The average time on market has been trending downward for the past five years and particularly the last three. Basically, tenants are quickly jumping on new space, and there has been more new space to jump to recently. DFW has been absorbing a strong 5M SF per year for about five years, making it one of the most active leasing markets in the U.S.

No surprise: Time on market is much longer for older properties than new or newly renovated ones.

“The underlining message is old, unimproved space tends to languish on the market, while there continues to be a healthy appetite for higher-quality space, especially new and improved office space,” Triolet said.

CoStar Article Features Younger Partners Research, Leadership

CoStar article by Candace Carlisle

New Office Buildings Delivering Low Vacancy Rates in Dallas-Fort Worth: The Areas With the Lowest Vacancies Also have the Newest Office Options

Developers putting new office buildings on the ground in Dallas-Fort Worth are also helping boost occupancy rates in key neighborhoods as tenants flock to the younger generation properties.

It’s no accident some of North Texas’ submarkets with the lowest vacancy rates, including Far North Dallas, Uptown, Richardson and Las Colinas, have all delivered buildings in this real estate cycle, said Steve Triolet, research director for Dallas-based Younger Partners. “Tenants really prefer new product over old product,” Triolet told Costar News. “If you look at the 1980s vintage of buildings from the heyday of construction in Dallas, most of those skyscrapers are 35 years old and, to stay competitive, they have to renovate.”

Those skyscrapers in downtown Dallas, including Trammell Crow Center, Bank of America Plaza, Fountain Place, Ross Tower and Chase Tower, have all recently undergone or are undergoing massive multimillion-dollar upgrades. The facelifts help those buildings compete with new buildings coming to the market, including PwC Tower and The Union.

That is exactly what happened in the case of downtown law firm Vinson & Elkins, which had originally planned to relocate its Dallas office to The Union. But construction delays led to the law firm staying put at Trammell Crow Center after the downtown skyscraper unveiled a massive renovation and adjacent development to compliment the high-rise office building.

And the suburbs around Dallas are also following suit, with Far North Dallas in Plano’s Legacy Business Park and northward on the Dallas North Tollway to Frisco boasting one of the region’s submarkets with the most construction — and one of the lowest vacancy rates of 15 percent, said Triolet, who has been studying the tenant movement in North Texas for the last decade.

“We are seeing the vacancy rates get chronically larger when it comes to older buildings,” he added.

Older, build-to-suit are often the most difficult to fill, Triolet said, with few companies seeking to lease or buy the aging office stock designed specifically for an early 1980s business.

This is a trend longtime Dallas leader Moody Younger has seen for some time.

“The new office buildings are not for everyone, but Dallas does like bright, shiny new stuff more so than older buildings,” Younger told CoStar News. “In Dallas, we are also still able to provide new buildings at a reasonable cost.”

For tenants seeking new digs, Younger said they want a combination of amenities in a new building coupled with the walkable location coming with new buildings being delivered today in North Texas.

“Well-located properties with amenities are leasing up and I don’t see that trend stopping,” he said. “This is what is hot right now and it’s here to stay for the foreseeable future.”