Category: News

YP Annual Family Fun Day at Six Flags

Younger Partners’ Republic Center Lease Wins 2017 DBJ Best Real Estate Deal of the Year for Neighborhood Impact

Younger Partners was awarded the Dallas Business Journal Best Real Estate Deal of 2017 for Neighborhood Impact for the AIA Dallas & Dallas Center for Architecture lease at Republic Center. YP’s Kathy Permenter, Trae Anderson and Sarah Savage represented Republic Tower. Solender/Hall’s Eliza Solender represented AIA. #DallasBRED?

For the full list of DBJ winners, click here.

For the full list of DBJ winners, click here.

Q&A with YP’s New Research Director Steve Triolet

Commercial real estate research veteran Steve Triolet joined the Younger Partners team recently as director of research. We sat down with him to learn more about how he developed his knack for sniffing out CRE trends in DFW.

YP: How did you land in commercial real estate research?

Steve: My first job out of college was for a small research company (Parks Associates) that tracks home automation, advanced security systems and home network technologies. Early adopters of these emerging technologies were typically high-end homes and some commercial properties. That’s where I first started learning about research as a professional, which later led to commercial real estate research. I cut my teeth at Costar as a commercial research analyst right after the dotcom bust in 2000.

YP: How did you wind up at Younger Partners?

Steve: Outside of following Greg Grainger wherever he goes (I worked with him at CBRE and JLL), my career has mainly been about elevating brokerage research operations. When I started at CBRE in the early 2000s, most researchers were junior brokers in training. They’d learn the market and business by working in research for about two years then move on. This model works well from a brokerage perspective but is less than ideal from a research perspective (as soon you reach a certain level of expertise, you change roles and a new, typically green person replaces you). At CBRE, I helped create a more sophisticated research department, where research professionals could be the backbone of the department (there were still interns and junior brokers in training, but also career research professionals). I was at CBRE for about 6.5 years and then JLL recruited me away to head up their local research department. I was at JLL for 7.5 years, when Xceligent made me an offer I couldn’t refuse. Unfortunately, they went out of business less than a year after I came on board, but that opened the door for my opportunity here at Younger Partners.

YP: What is your role here?

Steve: I try to supplement and support all the lines of business with market knowledge and thought pieces on the state of the market. Every one of us here is in the information business, just from a multitude of different facets (land, office, industrial, etc.). Our clients hire us primarily for our expertise in commercial real estate and our knowledge of the market (and stats to back that up) is a foundation for that.

YP: What do you like most about crunching numbers and doing research?

Steve: I’ve been tracking and reporting on commercial real estate for over 18 years now, so I feel like I know the office and industrial market just about as well as anyone, but I still learn new things on a consistent basis. New technologies and trends come along, that you have to keep on top of (coworking is a current example).

YP: Do you have any hobbies outside of work?

Steve: I do a fair amount of hiking when the weather allows. I’m also an animal lover; my kids have a little menagerie of lizards, turtles and toads that we caught over the past few years from our “nature walks.” I try to check out all of the various nature preserves around the Metroplex, the City of Richardson is currently expanding the Galatyn Nature Preserve which is within walking distance from home.

YP: What’s going to be the trend/story of 2018 commercial real estate in DFW? Why is that the story?

Steve: Several things point to the local market entering a transitional period. Over the past five years, things have been incredibly great, but there are a few things that point to a transition to good, but not great over the next year or so (the construction pipeline, rental rates and sale prices). Longer term, a downward shift is needed if we want Dallas to remain a lower cost destination for companies looking to relocate and/or expand here (rates for office and industrial properties, for example, at are all time high and far beyond previous cycle peaks).

YP: If you had to bet on a CRE industry sector to outperform the others, which one would you pick? Why?

Steve: Industrial is the canary in the coal mine. Let me explain. Industrial is the market to watch the most, it has slightly less risk than office, retail or multifamily because the construction time for industrial properties is less than for the other property types. A very large industrial building can be built in 9 to 12 months, while a typical office building takes about 2 years. Because of this shorter construction time, the industrial market can more quickly adapt to a pickup or slowdown in demand. Locally, bulk industrial properties have been the darling of investors because of our central location gives DFW a logistical advantage to serve as a south central regional hub for the middle of the United States. Also, the tremendous growth we’ve seen from the e-commerce sector has made DFW consistently one of the five best industrial markets in the country. This is not just about Amazon, which has been growing by about 2 million per year but also by some much more niche online retailers like Chewy.com (now a part of PetSmart), Wayfair, etc.

YP’s Steve Triolet in D CEO: DFW Office Construction in Comparison to the Past

When you look at the DFW office market and what we’ve built—so far—this cycle, how does it compares to previous cycles? And what does it all mean for market fundamentals like vacancy and rental rates? That’s what YP’s Steve Triolet answers in his D CEO column.

Check out his insights here.

D CEO Names YP to the Biggest CRE Brokerage Firms in DFW 2018

Younger Partners may be a boutique commercial real estate firm, but we can still shake things up. YP made D CEO’s list of Biggest Commercial Real Estate Brokerage Firms in Dallas-Fort Worth 2018.  Let us show you how we flex our muscles by providing investment, leasing, and management services to investors and tenants in the Dallas/Fort Worth region. Whether it be land, office, industrial, retail, or multifamily, we have market specialists focused on each type of commercial property. See the full list here.

Let us show you how we flex our muscles by providing investment, leasing, and management services to investors and tenants in the Dallas/Fort Worth region. Whether it be land, office, industrial, retail, or multifamily, we have market specialists focused on each type of commercial property. See the full list here.

DBJ Selects YP’s Republic Center Lease to AIA & DCFA as a Finalist for Best Real Estate Deal of 2017

YP is honored to be among the DBJ Best Real Estate Deals of 2017 finalists in the neighborhood impact category for the American Institute of Architects Dallas Chapter and Dallas Center for Architecture lease at Republic Center.

YP’s Kathy Permenter, Trae Anderson and Sarah Savage represented Republic Center. Solender/Hall’s Eliza Solender represented AIA. The long-term lease is for 13,708 square feet of office, exhibition and meeting space on the building’s first two floors, connected by an interior staircase. Located in the heart of the city center near public transportation, the space in Republic Center has high street-front visibility and pedestrian traffic, and is directly across from what will be a special new outdoor space, Pacific Plaza. #DallasBRED

Link to the announcement here.

Byron McCoy Talks Office Market

YP’s own Byron McCoy (second from right) served on the “Too Much, Too Little, or Too Late” real estate panel at the 9th Annual North Texas Realty Symposium on Friday. The event was organized by the Appraisal Institute, North Texas Chapter. Byron says the office market has seen seven consecutive years of rental rate increases in the Dallas area while vacancy hovers around 15%. The key to the hot office market: JOBS. Byron says the DFW market is adding about 90,000 jobs annually and he doesn’t see that decreasing any time soon. The office market is doing a great job of absorbing space, but there is some work to be done in backfilling space left vacant by companies moving into bigger, newer corporate campuses.

YP’s Tom Grunnah Leads Site Selection Efforts for NexMetro Communities

Shared from the Dallas Business Journal:

Phoenix-based NexMetro Communities plans to invest upwards of a half-billion dollars in the next few years on new luxury leased communities in Dallas-Fort Worth. The investment plan comes after the company closed a deal in excess of $100 million with Trez Capital, one of the largest private non-bank lenders in North America.

Trez Capital, which has an office in Dallas, will initially help back five of NexMetro’s Avilla Homes communities this year in Phoenix, Dallas and Denver. The lending relationship will be managed from the Canadian-based firm’s Dallas office.

Recently, the Trez Capital team toured the Avilla Homes neighborhoods and quickly understood the value of these apartment homes for consumers and investors, said Jason Stowe, a vice president in Trez Capital’s office along Keller Springs Road.

“We believe the concept will continue to escalate in demand and popularity,” Stowe said in a prepared statement.

In all, NexMetro Communities Chief Operating Officer Josh Hartmann expects to develop up to $1 billion in communities in North Texas, with an estimated $150 million to $200 million in annual investment in the next few years. The new relationship with Trez Capital will help fund the developer’s expansion plans.

“We are going to continue to do as many projects as we can over the next few years,” Hartmann told the Dallas Business Journal. “Beginning in 2013, we have increased our deliveries of homes 50 to 100 percent year-over-year, and next year we want to build 1,200 to 1,500 homes, with nearly half of those homes in the Dallas.”

“This financing allows us to focus on our core business, which is project execution,” he added.

NexMetro has already closed on two of its initial five projects with Trez Capital, including a land deal in Grand Prairie for a 13-acre tract. Tom Grunnah of Dallas-based Younger Partners is representing NexMetro in its expansion plans in North Texas. (Younger Partners’ Michael Ytem, Kevin Harrell and Jeremy Lillard assisted Grunnah in the Grand Prairie deal.)

Hartmann said North Texas’ constraint on new homes in the pipeline and rising rents for apartment communities has brought a rising interest in the hybrid model — a luxury community of for-rent single-family homes — that NexMetro specializes in putting together.

The firm’s east Plano community has gained traction with homebodies wanting a front porch without the long-term commitment of a mortgage, Hartmann said.

And NexMetro’s soon-to-open community in McKinney already has a long list of more than 250 would-be residents hoping to get into the for-lease community. The community is slated to open in early March.

We chatted with Hartmann about the company’s growth its plans in Dallas-Fort Worth.

Why have you chosen to expand so rapidly in North Texas?

We like North Texas. We like the home values, which have increased almost 11 percent. That’s a pretty good sign that residents may be interested in some alternative in the Dallas market and we can achieve absorption. There hasn’t been much multifamily development outside the urban neighborhoods, and we believe we are in the right place to be able to grow. We like the idea of everything in Dallas.

What does your typical resident want in a community?

The North Texas resident likes to consume a lot. They want a lifestyle where they can eat out and have easy access to entertainment. They want a somewhat suburban feel without paying the rent in a downtown community. We see them wanting to be in more upscale suburban markets in a community with its amenities on steroids (and) with access to a yard. In Plano, we built beautiful front porches and the residents like the idea of having their own private space.

Have you tried to incorporate your product in a master-planned community yet?

We have had some discussions with some master-planned developers, but we haven’t done any deals yet. They are open to the option. We have done that in Phoenix and are looking at other markets, but the product has to fit in a mature master-planned community, like Craig Ranch. The early-stage, master-planned communities don’t have the restaurants and other services our consumers want.

What does that do to your cost of land?

We are generally paying more than the single-family builders, but the economics are just different.

Have you experienced any push-back from municipalities on this type of residential development? It seems renting has a negative connotation to it by some city leaders.

It’s all about having the right mix of residential options. It’s about going through the educational process to explain who we are and what we do. Initially, we do see a knee-jerk reaction, but we explain this is a different product with less turnover that is more of a lifestyle decision by our residents. This isn’t a garden-style apartment building, but a transitional product for space where traditional commercial real estate doesn’t work and is friendly to other single-family communities.

What are your typical rents in Dallas-Fort Worth?

We are at about $1.80 per square foot in Plano, which is a premium to the rental rate in Phoenix of $1.45 per square foot. Plano’s rate will be similar to the McKinney community when it opens.

What kind of properties are you looking to buy?

Our biggest challenge in Dallas is that it is such a successful economic market that land sellers are becoming increasingly picky, and it takes time to get the zoning done. We like 10- to 15-acre remnant sites. We have been successful, but we look at a lot of sites.

How much money to you plan to invest in North Texas in the near future?

Our year-over-year annual investment is in the realm of $150 million to $200 million, depending on the size of the projects. We plan on doing this for the next few years with five to six new projects a year.

Younger Partners Reps NexMetro Communities in its 13-Acre Site Acquisition in Grand Prairie

Phoenix-based NexMetro Communities, the pioneer of next-generation, leased-home neighborhoods, has acquired a 13-acre parcel located on the corner of Sara Jane Parkway and Forum Drive in Grand Prairie. The acquisition represents the third Avilla luxury leased home neighborhood in the Dallas area and the 15th neighborhood acquired by the innovative leased homebuilder in the Sunbelt.  “Dallas Metro continues to experience significant growth, and the unique leased home experience Avilla communities offer is an appealing option for many people looking for a great place to live,” said Josh Hartmann, president and COO of Arizona-based NexMetro Communities, which has more than 2,500 homes either completed, under construction or under contract in the Dallas, Phoenix and Denver metros. “Avilla Heritage will offer an outstanding housing option for these lifestyle renters in the heart of a rich live-work-play area in Dallas County.”

“Dallas Metro continues to experience significant growth, and the unique leased home experience Avilla communities offer is an appealing option for many people looking for a great place to live,” said Josh Hartmann, president and COO of Arizona-based NexMetro Communities, which has more than 2,500 homes either completed, under construction or under contract in the Dallas, Phoenix and Denver metros. “Avilla Heritage will offer an outstanding housing option for these lifestyle renters in the heart of a rich live-work-play area in Dallas County.”

Located near State Highway 161 and Interstate 20, Avilla Heritage in Grand Prairie geographically complements NexMetro’s two other communities: Avilla Premier in Plano, which opened in early 2017, and Avilla Northside in McKinney, which is slated to open early this year. Site construction will begin at Avilla Heritage this month, with a community open slated for 2019 on 140 one-, two-, and three-bedroom leased homes. A well-established distribution center, Grand Prairie is a rapidly growing city known for its hometown charm, family-friendly environment and as a smart place to do business. The site is close to the Dallas-Fort Worth International Airport, major freeways, and boasts nearby large employers such as Lockheed Martin, Poly-America and other aircraft and manufacturing companies. Nearby recreational facilities include the 8,500-acre Joe Pool Lake and more than 4,900 acres of parks that are attracting high-end residential and resort development.

“This location is ideal for the next Avilla luxury leased home community in the Dallas metro area,” said Younger Partners broker Tom Grunnah, who represented NexMetro in the land acquisition. “This 13-acre parcel is in a vibrant corridor that has a multitude of new development, including the new Ikea store, as well as ‘The Epic,’ the City’s incredible new recreation center of the future.” Grunnah represented NexMetro along with colleagues Michael Ytem, Jeremy Lillard, and Kevin Harrell in the transaction. Avilla Heritage will deliver smart design, energy efficiency and distinctive architecture as driving forces. With one-, two- and three-bedroom floor plans, the homes are modern and stylish, with open and spacious floor plans, private entrances, front porches and backyards. All of the floor plans boast 10’ ceilings, allowing an abundance of natural light, and feature high-end finishes including granite countertops, stainless steel appliances, full-size washer and dryers and even a charging station for electric vehicles. Additionally, Avilla Homes are pet-friendly and offer reserved covered parking and optional garages, plus the perks of neighborhood living, complete with a resort-style pool and beautifully landscaped recreation areas, all maintained by a professional management company, without mortgage payments or HOA fees. Priced competitively with surrounding Class-A apartments, the rental rates for these luxury leased-homes will be released soon to the public. Floor plans and additional details are available by visiting the Avilla Homes at avillahomes.com

Avilla Heritage will deliver smart design, energy efficiency and distinctive architecture as driving forces. With one-, two- and three-bedroom floor plans, the homes are modern and stylish, with open and spacious floor plans, private entrances, front porches and backyards. All of the floor plans boast 10’ ceilings, allowing an abundance of natural light, and feature high-end finishes including granite countertops, stainless steel appliances, full-size washer and dryers and even a charging station for electric vehicles. Additionally, Avilla Homes are pet-friendly and offer reserved covered parking and optional garages, plus the perks of neighborhood living, complete with a resort-style pool and beautifully landscaped recreation areas, all maintained by a professional management company, without mortgage payments or HOA fees. Priced competitively with surrounding Class-A apartments, the rental rates for these luxury leased-homes will be released soon to the public. Floor plans and additional details are available by visiting the Avilla Homes at avillahomes.com

About Avilla Homes

A truly unique alternative to the typical rental experience, Avilla Homes neighborhoods feature single level, detached homes for lease in a gated enclave. The one, two and three-bedroom floor plans feature private entrances, outdoor patios and backyards, along with high-end finishes such as 10’ ceilings, granite/quartz countertops, stainless steel appliances and more. The pet friendly communities offer the perks of neighborhood living with optional garages, resort-style pool, beautifully landscaped recreation areas, and even an electric car charging station – all maintained by a professional management company, without mortgage payments or HOA fees. To learn more about Avilla Homes visit www.avillahomes.com.

About NexMetro Communities

NexMetro Communities is an innovative development company focused on building luxury leased home neighborhoods that serve lifestyle conscious consumers seeking a new home experience without the burdens of a mortgage. In partnership with its affiliated companies, NexMetro has developed Avilla Homes neighborhoods since 2010 in key Sunbelt locations. Combining elements of residential single-family living with rental terms and management, NexMetro provides a growing market niche of consumers a leased home experience like no other. For more information on NexMetro, visit www.nexmetro.com.

About Younger Partners

Younger Partners is a full-service boutique commercial real estate firm providing investment, leasing, and management services to investors and tenants in the Dallas/Fort Worth region. We also specialize in the acquisition and disposition of land, multifamily, office, industrial, and retail properties.

YP Staffers Run for a Cause in BMW Dallas Marathon

Congrats to YP’s Michael Ytem, Tanja Ivandic and Autumn Stallings for their participation in the BMW Dallas Marathon. Michael ran a relay & is prepping to meet his goal of running a half-marathon. Tanja ran a 3-minute PR for a half-marathon with a 6:24 pace for 13.1 miles for a time of 1:23:44. Autumn ran a 12-minute personal record in the full marathon.

The Dallas Marathon is a nonprofit organization with a focus on promoting health and physical fitness through running events and related activities. Established in 1971, the history of the organization encompasses tremendous growth and produces what has become Dallas’ largest and Texas’ oldest marathon, the BMW Dallas Marathon as well as Half Marathon & SMU Cox School of Business Relay. Since naming a primary beneficiary in 1997, the Dallas Marathon has donated more than $3.9 million to Texas Scottish Rite Hospital for Children.

YP Partners Collects Toys for Community Partners of Dallas

Younger Partners team members collected toys & gifts for Community Partners of Dallas Toy Drive again this year. These items will be used for the children who come into protective care after the deadline to submit wish cards and for any children whose wishes did not get filled to help ensure that no child is forgotten this holiday season.

These items will be used for the children who come into protective care after the deadline to submit wish cards and for any children whose wishes did not get filled to help ensure that no child is forgotten this holiday season. For more information on CPDTX, click here.

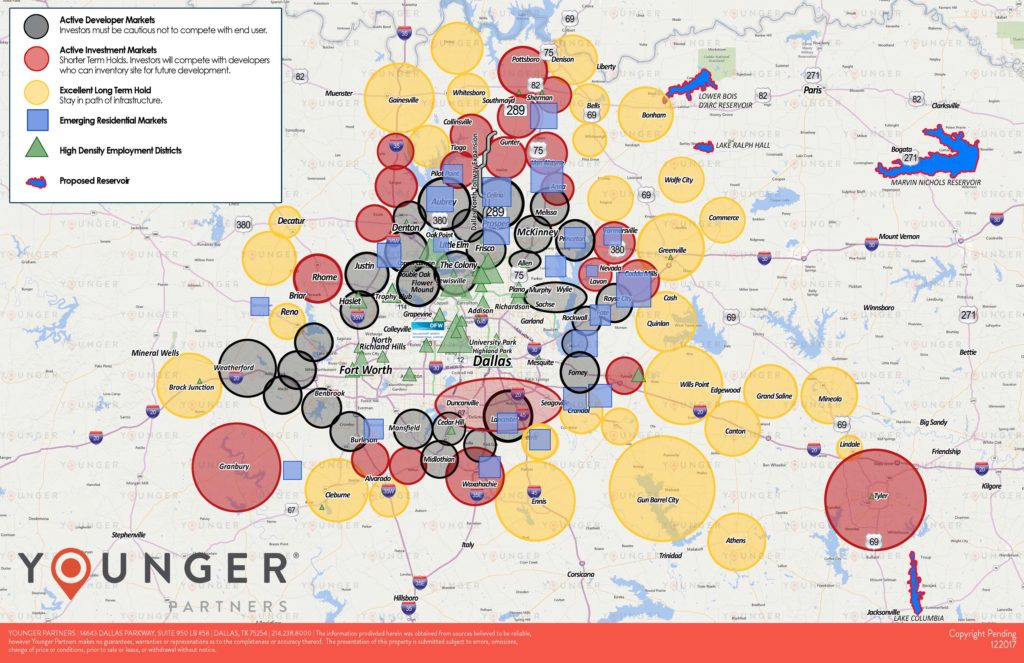

2017 Dallas-Fort Worth Land Absorption Report

By Robert Grunnah

For many years, our Investments/Land Division, now a division of Younger Partners, has produced a report designed to assist investors in deciding the viability of acquiring undeveloped land for medium and long term positive returns. Since our 2016 report was distributed, DFW has experienced continued enormous growth in virtually every commercial and residential product type. Much remains the same in our report this year, except we are seeing legitimate evolving trends that should be considered. Absorption of undeveloped and underutilized land continues at an unprecedented rate. Aggressive, new vertical development has left even fewer desirable infill sites remaining, producing ever increasing activity further out from current job markets and increasing commuter distance demands. However, employers, recognizing that the seriously evident shrinking pool of employee candidates, sensitive to job location, are moving employment centers closer to demand. This competition for employees, inflated raw land cost, a rapidly increasing cost of living, and transportation congestion are all beginning to affect our extended growth cycle. We remain attractive to relocation compared to our competition, however, the gap is decidedly smaller. Our observation is economically based. As long as we have the anticipated continued job growth, inbound population increases, low interest rates, and a sound local economy, there is no reason for an immediate reverse cycle. However, should any one of those standards collapse, the effect will be telling on all. To repeat, there has never been a “last cycle”.

Historically low capitalization rates, purchase prices far in excess of replacement costs, and decreasing retail demand, have made income producing investments extremely vulnerable to negative economic conditions and all but impossible to rationalize purchasing. Excessive competition to acquire cash flow assets producing even the smallest yields is a precursor to failure. A cyclical correction in the national economy would have an exceptional negative impact. Inherently, land investment differs greatly from other types of real estate products generally by its inability to produce interim cash flow and its sensitive vulnerability to recurring cycles. The criteria used to determine potential land opportunities, while becoming considerably more sophisticated over the last two cycles, remains principally in implementing four basic strategies.

Perhaps the most important of these is the ability to project and fund ownership long term. Positive liquidity, the ability to sell for an acceptable profit at the optimum market time, can be highly speculative. When an investor is placed in an imposed forced sale position or loses confidence in the future of the investment, returns are jeopardized and most frequently result in a significant loss.

We have all learned that real estate is “local” in character. No two markets possess the same dynamics. Location will ultimately best determine value. Values of similar properties will vary greatly in specific submarkets and in different geographical locations. Public perception, while an intangible, plays a large role. As an example, southern Dallas County, until recently, has had little attention from investors and developers. Ignored were its extensive existing infrastructure, excellent highway and rail access, attractive land values, and existing employee base. While historically competitive locations north, without similar benefits, trading at prices two and three times higher, the southern sector remained overlooked. Over the last few years, however, both users and developers have rapidly recognized this area as the jewel it is. Millions of square feet of new construction, intermodals, and support commercial have been built and more is planned. Our “slow to lead, quick to follow” mentality has given new life to the “Southern Sector” which promises to have a long term and deserved resurgence.

Anticipated use governed by demand, zoning, proximity to infrastructure, interim use, historical absorption, positively perceived location, and the municipal political climate, are but a few of the investment points to be considered. Current investment and development activity by informed entities and verifiable market comparables are equally important.

To repeat, like most types of investments, real estate is cyclical. Investment success or failure can often solely depend on where the cycle is at the time the purchase is made and the investor’s ability to determine the true state of the cycle. There has yet to be a final cycle, thus, the ability to hold long term may affect the yield but does offer some degree of security. While the ability to use historical data to project long term value as set out above is logical, many down cycles have been created by artificial, non-real estate related influences that were difficult to anticipate. For example, in the late 1980’s, tax law changes and deregulation destroyed the market. In the late 2000’s, the subprime collapse did the same. It is reasonable to assume there will be more fragile “bubbles”.

Younger Partners is a member of the highly respected North Texas Land Council (NTLC), a group comprised of 50 of the most active and talented land brokers in our area. Believing that activity generates more activity, the North Texas Land Council freely shares information with its competing members, and the market in general, on a level of professionalism unusual within similar organizations and, as such, is a benefit to all clients. Much of the projected activity displayed on the Younger Land Absorption Map (YLAM) reflects the activities of the NTLC.

The DFW market today continues to see record prices for infill, readily developable sites possessing available infrastructure, permitted anticipated uses, and demand for product. Developers are now aggressively demolishing fully functional buildings in order to build product more in demand which has historically been a warning to a pending market correction. Fueled by extensive population and employment growth, new construction remains at a record pace which is anticipated to continue at least through 2018, a projection supported by deals currently designed, engineered, and possessing financing commitments. It will be interesting to observe the effect new construction growth achieves as the six major current DFW projects are completed. Of course, the anticipated arrival of HQ2 will extend for years our current positive cycle. Increased land, labor, and materials cost will, however, inevitably have a negative impact. Construction in process and fully financed new projects pending ground breaking, although distinctly slowing, will continue to fuel the real estate market for the short term. That “pipeline” has gotten understandably smaller which presents an interesting speculative projection for 2020 and beyond. Increased activity for pure, longer term investment sites has continued the extension to the outer lying, concentric circle tracts, considered “pure investment tracts”, which until recently remained fairly benign in sales activity and price fluctuation. It appears that such specific investments are becoming more attractive since competing investments such as oil and gas (price fluctuation), a pending bear stock and bond market (the same non-occurring “pending” from last year), and the tech world which offer a less equitable vehicle. Additionally, local investors (the heretofore most active group of land speculators) are seeing increased competition from more patient national and foreign investors. Yet, historically, and perhaps ironically, a large number of the most successful, wealthiest investors have made their patient fortunes in land by simply applying these basic techniques.

Our continuing and extended analysis, as displayed on the “Younger Land Absorption Map” (revised November 2017, available upon request) is principally based on extensive historical data collected utilizing over 100 years of market experience possessed by Younger associates, members of the NTLC, and reliable future projections from sources that have traditionally displayed accurate demographic information. Depending on which source one chooses to use, the DFW market still expects to absorb an additional 1.6 to 2.5 million residents over the next fifteen years. Success in real estate investment will be to determine where that growth will locate. History has taught us that product will be made available and priced based on pure economics. The cost to provide available product to meet demand will depend on the availability of affordable infrastructure (sewer, water, roads, proximity to employment centers, service commercial, schools, political climate, etc.). Land prices will fluctuate according to such availability. Investing in the right product will produce exceptional rewards. Some estimate that it requires approximately 12,000 to 15,000 acres of raw land to accommodate one million people in a reasonably confined, socially acceptable, service provided environment.

We have been fortunate to have had an extended period of prodigious activity which can at least be partially credited to our aggressive polital structure, both local and state, our sophisticated and informed developers and engineers, and our incredibly competent and equally aggressive EDC’s. Of equal depth, however, is the dynamic, well educated, hard working, and professional “under 40” group of brokers, administrators, managers, and general employment base whom have emerged during this cycle. They may well be the first group exiting a positive cycle who have learned and benefited from the experience of their predisessors. They may not need a disaster to stay relevant and solvent.

In conclusion, the principals of sophisticated investment must utilize primary criteria, some of which is outlined above. Access to infrastructure, most importantly water, the admirable, continued effort by our current Dallas Mayor to utilize available land in our southern corridor, absorption of the remaining few infill sites, high suburban infill land costs, and the migration of employment centers will all play significant roles in prudent investment decisions. Utilized in the investment process, the only remaining elements are sound financial strength and patience.

About Younger Partners

Younger Partners is a full service DFW brokerage firm specializing in all areas of commercial real estate sales, leasing, and management including land and income producing investment. Please consider contacting us for any commercial real estate needs. The opinions expressed herein are solely those of Younger’s Investment/Land Division. For questions or comments, please contact us:

Robert Grunnah Robert.Grunnah@youngerpartners.com

Sam Kartalis Sam.Kartalis@youngerpartners.com

Ali Farmehr Ali.Farmehr@youngerpartners.com

Ben McCutchin Ben.McCutchin@youngerpartners.com

Chris Callicutt Chris.Callicutt@youngerpartners.com

Cole Bradford Cole.Bradford@youngerpartners.com

David Hinson David.Hinson@youngerpartners.com

Don Plunk Don.Plunk@youngerpartners.com

Jeremy Lillard Jeremy.Lillard@youngerpartners.com

John St. Clair John.StClair@youngerpartners.com

Kevin Harrell Kevin.Harrell@youngerpatners.com

Lew Wood Lew.Wood@youngerpartners.com

Michael Ytem Michael.Ytem@youngerpartners.com

Nan Li Nan.Li@youngerpartners.com

Renzo Cella Renzo.Cella@youngerpartners.com

Shawn Street Shawn.Street@youngerpartners.com

Tom Grunnah Tom.Grunnah@youngerpartners.com

YP Listing 123-Acre Lake Travis Waterfront Property for Sale

For $6 million, the right buyer can acquire 123 acres, which includes waterfront property on Lake Travis and an 80-slip marina. But, that’s only part of the big picture. What’s at stake is a unique opportunity for an investor to also own and develop four phases of the Waterford at Lake Travis, which includes 49 ready-to-go lots for single-family home development, as well as larger vacant land tracts.

“The location of Waterford at Lake Travis along the north shore in the highly desirable Hill Country, just outside of Austin, is ideal both for retirees and those executives who may work in Austin, but don’t have to make the daily commute,” says Younger Partners broker John St. Clair, who is listing the bank-owned property for sale with colleagues Robert Grunnah and Michael Ytem.

St. Clair says Waterford was extensively planned, engineered, and partially developed, but the timing 10 years ago wasn’t ideal for the project. Since that time, there is now a wealth of amenities, shopping, and restaurants located along the north side of Lake Travis.

This offering includes four phases all within the Lago Vista Extra Territorial Jurisdiction (ETJ). There are 49 developed lake lots with great views as well as acreage to develop more lots. The buyer of Waterford also inherits participation in the Municipal Utility District.

“The developed lots are within an established, partially sold development and are configured to meet the market demand,” St. Clair explains. “The scenic country surrounding the development and lake views from these home sites are impressive as are recreational opportunities surrounding the development including the contiguous marina.”

In addition to the natural beauty of the land is the appeal of the pricing. First United Bank acquired the property through foreclosure and is motivated to sell it at attractive current market levels, St. Clair says.

Lago Vista was incorporated in 1984 as a lakeside resort community with homes, condominiums, golf courses, and the marina. The community encompasses more than 15 miles of Lake Travis shoreline with a population of about 5,000 residents.

“The quality of life in this community is extraordinary whether the homeowners are retirees, looking for a second home, or those benefitting from telecommuting. Working from your gorgeous lake home makes that occasional commute to Austin enjoyable,” St. Clair says.

It is believed that all infrastructure and entitlements are in place to complete the construction of homes on the remaining land and single-family lots. Several homes have been completed and are occupied, St. Clair adds. Because of the bankruptcy and subsequent foreclosure, the property has not been for sale until now. Here is the listing for more details.

#GivingDay

We have a day for giving thanks. We have two for getting deals. Now, we have #GivingTuesday, a global day dedicated to giving back. On the Tuesday after Thanksgiving charities, families, businesses, community centers, and students around the world will come together for one common purpose: to celebrate generosity and to give. Take advantage of all the holiday deals to add to your charitable giving. Combined with your family, friends, local and national organizations and through the power of social media, National Day of Giving can become a tradition worth passing on.

Working at the ICSC Texas Conference & Deal Making

Today is the last day of the ICSC Texas Conference & Deal Making at the Kay Bailey Hutchison Convention Center, 650 S. Griffin St. in Dallas. We will be in Booth 456 with games & prizes! Here’s the fun so far!

The team did a great job setting up the booth and networking.

The prize package Younger Partners offered.

Our great booth and the cornhole competition space.

The fun didn’t end at the end of the work day. Cocktail parties allowed the networking to continue into the evening.

Front Porch Pantry Meal Prep & Delivery Service Inks Lease in Heart of DFW

Busy consumers in the Dallas area who want healthy meal options without the hassles of dining out, fighting crowds, grocery shopping, or spending too much time in the kitchen cooking and cleaning have a new, cost-effective option with the expansion of online gourmet meal preparation and delivery service, Front Porch Pantry.

Launched in March 2016, by founder and managing partner, Michaelann Dykes, Front Porch Pantry is the leading meal delivery service in Texas offering healthy and delicious meals, delivered to your front porch. The unique online gourmet meal prep and delivery service recently signed a new 3,500-square-foot lease at Midway Mills Crossing Shopping Center in Carrollton. The tenant was represented by Tanja Ivandic at Younger Partners. The landlord, Ali Shayan, was represented by Nathan Denton at Lee. “This location is great because the space had previously served as a gluten-free bakery, so the finish-out for a commercial production kitchen was already in place. The location at Midway Road and Trinity Mills Road in Carrollton is central to the entire Metroplex, as well,” Ms. Ivandic says. “We found her a second-generation space in excellent condition to meet the demands of the rapidly growing business. She also has room to expand in this location as her business grows.”

“This location is great because the space had previously served as a gluten-free bakery, so the finish-out for a commercial production kitchen was already in place. The location at Midway Road and Trinity Mills Road in Carrollton is central to the entire Metroplex, as well,” Ms. Ivandic says. “We found her a second-generation space in excellent condition to meet the demands of the rapidly growing business. She also has room to expand in this location as her business grows.” “We looked at many spaces on the market before selecting this particular space. Our needs were for a large production-style commercial kitchen with room for future expansion; this space provides for both,” Ms. Dykes says. “With its central location and easy access to major highways, it is great for our delivery service throughout the DFW area.”

“We looked at many spaces on the market before selecting this particular space. Our needs were for a large production-style commercial kitchen with room for future expansion; this space provides for both,” Ms. Dykes says. “With its central location and easy access to major highways, it is great for our delivery service throughout the DFW area.”

Since its inception, Front Porch Pantry has dramatically grown, Ms. Dykes says. Weekly production has increased from several hundred meals, to thousands. What is most satisfying, she adds, is the fact that the majority of her customers continue to order week after week. “That is a true testament to our quality and taste,” she says. The company is so successful that she’s working on rolling out service across Texas in the near-future with the ultimate goal of creating a national brand with distribution nationwide. Ms. Dyke’s culinary excellence and knowledge of nutritional science, combined with her 20 years of experience in design and manufacturing, provided her with the strong background and experience to launch and grow the firm while answering the age-old question of “what’s for dinner” for her family.

The company is so successful that she’s working on rolling out service across Texas in the near-future with the ultimate goal of creating a national brand with distribution nationwide. Ms. Dyke’s culinary excellence and knowledge of nutritional science, combined with her 20 years of experience in design and manufacturing, provided her with the strong background and experience to launch and grow the firm while answering the age-old question of “what’s for dinner” for her family.

The beauty of the concept is that her customers can enjoy greater diversity eating meals at home, while spending less time and money grocery shopping, less time preparing, and less time eating out. For a service often perceived as a luxury, it is notable that most customers are spending the same or less on their overall food budgets, she says.

One thing customers enjoy the most: no meal prep involved — just heat and eat. Ms. Dykes says her customer-base consists of busy families with limited time, singles that don’t want to go to the trouble of cooking for one, and seniors that need a little extra help navigating the meal process. Ms. Dykes says Front Porch Pantry’s specially trained staff selects the freshest ingredients and takes pride in providing high-quality protein, low-glycemic carbohydrates and heart-healthy menu options. Most ingredients are hormone-free, GMO- and antibiotic-free, 100% organic, gluten-free, dairy-free, and heart healthy options.

Ms. Dykes says Front Porch Pantry’s specially trained staff selects the freshest ingredients and takes pride in providing high-quality protein, low-glycemic carbohydrates and heart-healthy menu options. Most ingredients are hormone-free, GMO- and antibiotic-free, 100% organic, gluten-free, dairy-free, and heart healthy options.

The company’s success in the DFW area has led to the expansion of services throughout Texas with the ultimate goal of creating a national brand with nationwide distribution. And, just in time to relieve the stress of cooking for the holidays, Front Porch Pantry can help with Thanksgiving, too. Make your selections on the website by Nov. 15 for meals to be delivered or picked up on-site on Nov. 20 and 21.

Front Porch Pantry contact info:

Frontporchpantry.com

(972) 925-0526 phone

(469) 229-8876 fax

contact@frontporchpantry.com

Halloween 2017 Starts Today at Younger Partners

Our annual chili cook-off is the start of the Halloween festivities at YP every year. Without sharing the wonderful aromas and chili tastes, here are a few good looks.

Tonie Auer returns to her 80s roots while Claudia McLeod works her witchcraft.

Lew Wood’s team hard at work on their chili.

Lew perfecting his chili.

The gang awaiting the judging.

The judges hard at work in the seclusion of the break room.

The judges hard at work in the seclusion of the break room.

The winning team of Kelly Brannen, Shawn Street, Tonie Auer, Robert Grunnah, and Jeremy Lillard.

Lew was a good loser and didn’t mind showing off his prize: a bottle of Pepto Bismal.

Lew was a good loser and didn’t mind showing off his prize: a bottle of Pepto Bismal.

After six batches of chili to try … we can all use the Pepto Bismal.

ICSC Conference Two Weeks Away: Come See Us There!

Come see us the ICSC Texas Conference & Deal Making at the Kay Bailey Hutchison Convention Center, 650 S. Griffin St, Dallas from Nov. 8 to 10. We will be in Booth 456 with games & prizes!

For more about our retail team, check out our retail services flyer.

Robert Grunnah’s D CEO Column: Musings from the Press Box at the Top of the Ninth

Prattco Selects Byron McCoy & Garrett Marler for Leasing Assignment

Prattco Creekway Industrial bought an 83K SF industrial building in Richardson at 1501 North Plano Road. Younger Partners’ Byron McCoy and Garrett Marler have been selected to lease and market the property.

Read more here.