Category: News

ARTISAN CIRCLE ANNOUNCES TWO NEW TENANTS

Younger Partners Sign Leases with Rose Couture Nail Bar and Snap Kitchen.

FORT WORTH, Texas (May 18, 2023) – Younger Partners announced today that the firm has executed leases with Rose Couture Nail Bar and Snap Kitchen.

Rose Couture Nail Bar’s lease includes 3,466 square feet of space at 2809 W. 7th Street. Featuring modern and luxurious amenities, Rose Couture offers premium services which include manicures and pedicures, facial waxing, brow and eyelash tinting, and perming. The salon is designed to provide a unique chic feel, to complement their service offerings. Learn more at www.rcnailbar.com. Rose Couture is expected to open on or before September 1st. The terms of the lease were undisclosed.

Snap Kitchen’s lease includes 1,224 square feet of space at 2941 W. 7th Street. Snap Kitchen offers healthy and delicious ready-to-eat meals, sides, drinks, snacks and more designed to support healthy lifestyles. Snap Kitchen partners with local Texas vendors to ensure it uses sustainably sourced, local ingredients where it can. Learn more at www.snapkitchen.com. The location is scheduled to open this summer. The terms of the lease were undisclosed.

“Snap Kitchen’s Fort Worth customers are some of our most loyal and valued,” said Tony Smith, CEO of Snap Kitchen. “We are excited about this new location at Artisan Circle and the opportunity to serve more nutritious and flavorful dishes to folks in one of Fort Worth’s most bustling, walkable communities.”

“Convenient access to fresh food and beauty treatments are just two examples of what will make Artisan Circle a top-of-mind destination for our multi-generational customers,” said Kathy Permenter, co-managing partner of Younger Partners. “We strive to provide our customers with a diverse selection of high-quality products and services, and these new tenants will help us achieve that goal. We are confident that Rose Couture Nail Salon and Snap Kitchen will be popular additions to Artisan Circle, and we look forward to seeing them thrive.”

Younger Partners Investments purchased Artisan Circle in August of 2022 and has begun revitalizing the development including the completion of new parking technology and is working through their strategic plan to add gathering spaces, improve wayfinding for the 1,500 complimentary parking spaces for Artisan Circle patrons, update signage and add elevators to improve accessibility.

About Artisan Circle

Artisan Circle, a 282,721-square-foot urban village, is a vibrant destination to eat, drink, shop and explore in the heart of the Cultural District in Fort Worth, Texas. Encompassing five walkable blocks, this vibrant streetscape features salons and spas, gourmet and fast-casual restaurants and bars, and a movie theater. Learn more at www.artisancirclefw.com.

About Younger Partners

Dallas-based Younger Partners is a full-service commercial real estate firm providing investment, leasing, and management services to investors and tenants in the Dallas/Fort Worth region. They also specialize in the acquisition and disposition of land, multifamily, office, industrial and retail properties. Younger Partners Investments (YPI) is a Younger Partner’s platform designed to acquire retail properties. Launched in July 2020, YPI targets retail properties from lifestyle to neighborhood centers throughout the DFW area. Younger Partners and YPI are also affiliated with newly formed Apricus Realty Capital. For more information, please visit www.youngerpartners.com.

About Snap Kitchen

Snap Kitchen is an Austin, Texas based omnichannel retailer of healthy and delicious ready-to-eat meals, sides, salads and proteins, plus a growing assortment of drinks, snacks and other convenience grocery items designed to support healthy lifestyles. Snap Kitchen offers its chef-curated menu through retail stores in Austin, Dallas/Ft Worth and Houston, at select Whole Foods, and direct-to-consumer throughout Texas and in many states across the U.S. For more information on Snap Kitchen visit www.snapkitchen.com.

2022 North Texas Land Absorption Report

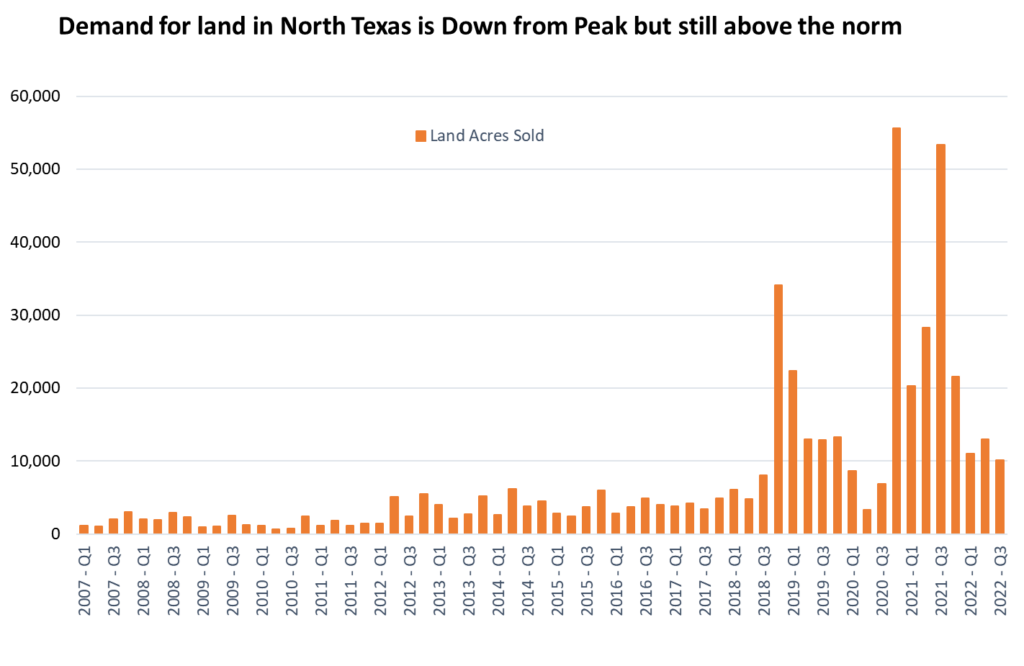

As 2022 ended in a rapidly changing market, the year in whole was positive.

By Robert Grunnah and Michael Ytem | March 21, 2023

The North Central Texas land market is still influenced by its prior decade of escalating values, sales and absorption activity. To no surprise, first quarter 2023 land pricing and activity have been primarily affected by rapidly increasing interest rates, the lingering effects of COVID-19, an unstable Global political environment, continued rising inflation, and significant increases in construction costs. A minor disruption in the Oil and Gas market has had a lessening but significant impact on each of the major issues. In reviewing last year’s report, our observations have changed in reaction to the very visible shift in market activity. While listings have slowly increased, prices have seen only a moderate readjustment, sales volume has dramatically declined, and contract defaults (cancellations) are more frequent.

For many years, Younger Partners has produced a report to assist investors in reviewing the viability of acquiring undeveloped land for medium and long-term positive returns. As one of many prognosticators, we utilize our years of brokerage and research experience to add credibility to our observations.

Since our last report in late 2021, DFW has experienced continued growth from the momentum previously gained in most commercial and residential product types, but more recently transitioned to a more limited growth of investment-grade assets. Total transaction volume in the second half of 2022 significantly decreased for both user and investment product for all residential and commercial uses. New absorption of residential land, both developed and undeveloped, and underutilized land, has all but stopped except for well-financed projects currently under construction. One of the few highly respected residential monitoring services recently published a harrowing report for 2023 single-family absorption causing great concern and reactions among major homebuilders. Early 2023, however, has provided an indication that the prior momentum will be moderate and mildly sobering. As sales slow, a pause in planned developments might facilitate the healthy absorption of existing planned products. The single most pressing factor is increasing interest rates, which drives up the cost of construction loans and dramatically reduces the number of qualified home buyers. Year to date, however, while distinctly affected, the result again has been surprisingly moderate. A strong decrease in interest rates would serve pent-up demand in all property types as the single most recovery influence but is not immediately imminent.

Submarkets which were either overlooked or previously bypassed in early 2022 saw significant activity based on proximity and access to core business centers, or much lower land prices. That trend has slowed along with any aggressive, new vertical development projects. The “work from home” popularity has allowed for peripheral residential projects to have more success based on lower land cost and smaller footprints.

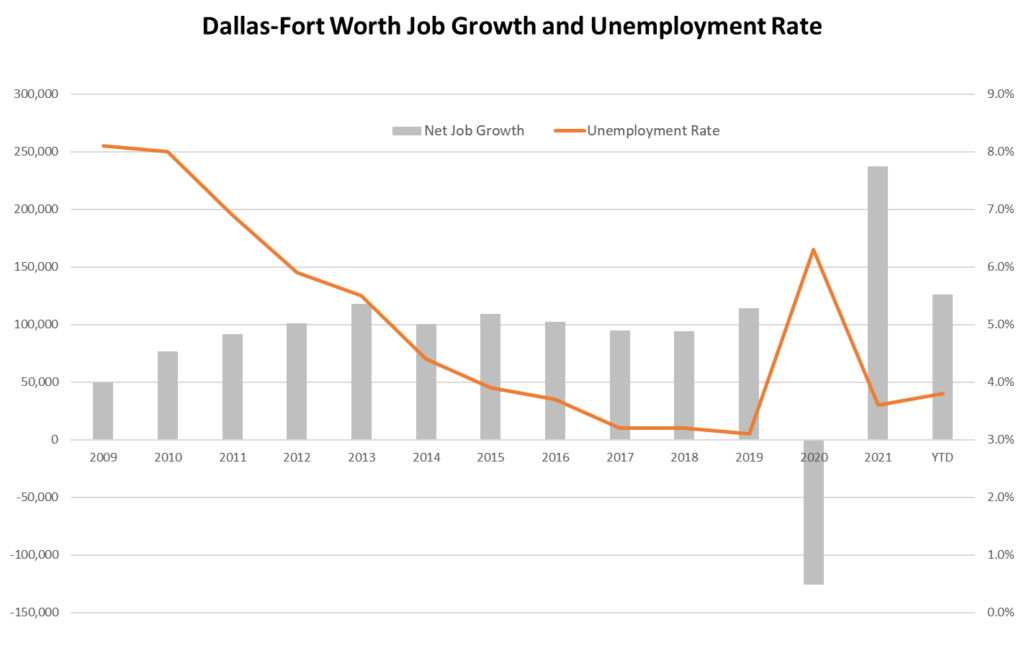

Most peripheral sites are seeing steadily decreasing activity with employers still competing for employees who desire shorter commuting distances despite the COVID-19 flight to home office. “Work from home” continues to gain long-term acceptance by both employees and employers. Older surrounding communities, historically undisturbed by DFW’s growth, have achieved higher than normal growth since 2015. The significant momentum that Texas, and more specifically DFW, gained in company relocations and the commensurate inbound employee increases has moderately decreased, being balanced by the large number of layoffs in tech and finance. While few deny that an extended period of strong economic growth is proving vulnerable, actual project starts and announcements of pending projects still occur, but at a far fewer frequency. Based on the real estate industry’s obvious resistance to all the negative indicators, we have no reason to believe it will be either disastrous or long-term.

Supporting the long-term benefits in land investment, a readjustment should make labor available at a more reasonable cost and at more realistic materials pricing. DFW will remain one of the strongest employment and desired investment markets in the country. Deep cost adjustments, however, are still purely speculative for an undetermined period of time. We do not believe it will sink to levels of the late 1980s, the early 2000s or the 2008 severe down-market recessions. DFW has excellent momentum with a strong defense against a major recession.

Despite sale prices at a multiple of replacement cost and surprisingly moderate positive retail demand, income-producing investments have maintained their active volume due largely to earlier low-interest rates, the need to invest 1031 trade equity and lack of competition by alternative investments. Capitalization rates early in 2022 approached record historical lows. To meet underwriting for either new debt or to remain conforming to existing debt, cap rates must adjust upward signaling initially moderate price reductions if an income property sale is desired. Excessive competition to acquire cash flow assets which remain resistant to the market cap rate adjustment, providing even the thinnest yields, will simply not occur until the financial markets adjust. The cyclical downturn in the national economy and a corresponding drop in physical occupancy will produce a dour impact and threatening or eliminating positive income property cash flows.

Inherently, land investment differs greatly from other types of real estate because of its inability to produce interim cash flow and its vulnerability to cycles. The criteria used to determine potential land opportunities, while becoming more sophisticated over the last two cycles, remains in implementing basic strategies. “Timing” has always determined the net result. We believe that any CRE recession will be short-lived because of the enormous equity investment that has been accumulated a lot of which is awaiting a readjustment and remains undeployed. Because it must produce a return at some point, it will return quickly when opportunity (chaos) is perceived.

Perhaps the most important part of a timing strategy is the ability to project and fund ownership long term. Positive liquidity and the ability to sell for an acceptable profit at the optimum market time can be highly speculative. Leveraging the investment only increases the risk. When an investor is placed in an imposed forced sale position or loses confidence in the future of the investment, returns are jeopardized and most frequently result in a significant loss.

There has yet to be a final cycle, although current sentiment seems to reject that possibility which is an optimistically shallow, inexperienced approach. The financial ability to hold long term investments will affect the yield and does offer a degree of safety. With access to historical data, projecting long-term value, while still speculative, is much more achievable and moderately lessens risk. One observation is watching the pricing of Investment Land migrating from price per acre to price per square foot. This significant change can be attributed more to the inflationary effect of the dollar across the full financial spectrum rather than the intrinsic value of the real estate.

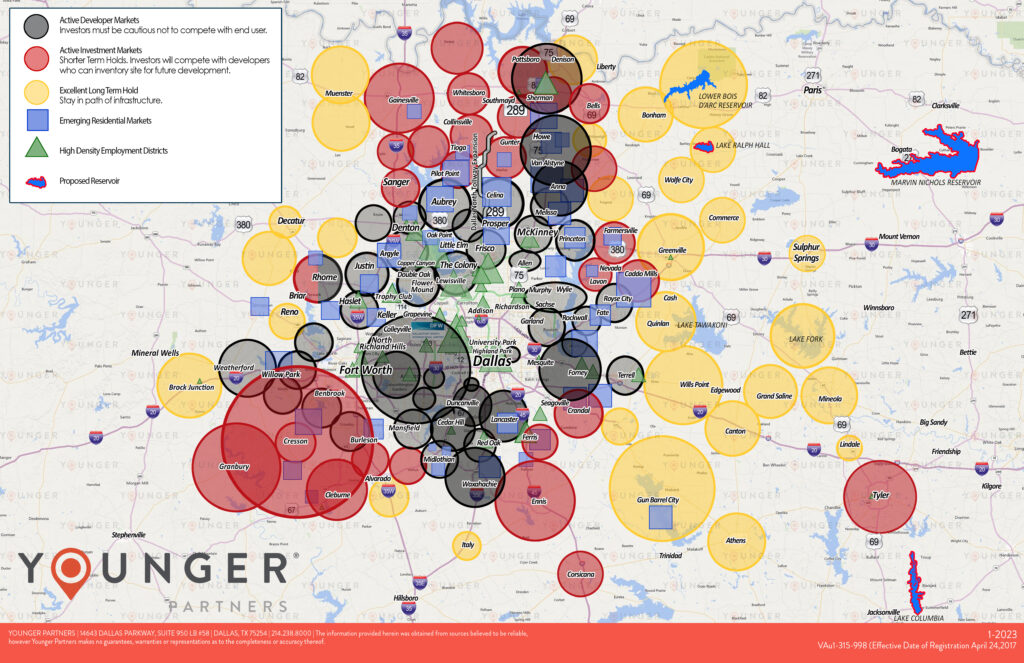

Our Land Absorption Map shows all types of 2022 commercial and residential land activity in specific geographic submarkets. Resources used for the map include actual sales, current listings, and announcements of pending projects. Not difficult to understand, the progression from active to long-term generally follows the availability of infrastructure and newer expanding utility systems, including Municipal Utility Districts. Land currently available for vertical construction will bring significantly higher value over those that must wait for services or possess extraordinarily high-cost offsite access. Over the 20+ years of presenting this map, it is interesting to note that, while the circles have limited movement, the colors change and generally move out from the core in concentric circles. This iteration of the 2022 map displays the first series of circle reductions in 10 years north of DFW and the first set of expansions in south DFW and beyond.

Younger Partners is a founder and member of the highly respected North Texas Land Council (NTLC), a group of 50 active, knowledgeable, and talented land brokers in DFW. Believing that activity generates more activity, the North Texas Land Council, to the advantage of its clients, freely shares information with its competing members and the general market on a level of professionalism unusual within similar organizations. As such, the organization is a benefit to all clients and to those anticipating a land investment. Much of the projected activity displayed on the Younger Land Absorption Map (YLAM) reflects the activities of the NTLC, local and national reporting agencies, and our large group of active company partners.

Because of many increased cost factors, single-family new home prices increased almost 25 percent in a single year making affordability more difficult. Additionally, historically low, long-term interest rates dramatically increased single-family affordability through the first quarter of 2022. Less obvious are the increases in completed per square foot costs in all commercial sectors. The surprisingly continued strong national economy, despite disruptions, as well as strong, continued inbound relocations, have provided record employment and income. Short-term projections are predictable–long-term less so. Perhaps one of the strongest influences softening the impact of a correction is the enormous amount of uncommitted cash held by investors of all classes and liquidity awaiting their perception of pending opportunities. Once an opportunity is perceived, that liquid cash will be quickly redeployed and reinvested, steadying prices in the event of a devaluation caused by any number of external influences. Investors, incorrectly or not, wishing to miss an anticipated opportunity (chaos) will move quickly. An improving stock market and strong oil and gas prices have contributed to lessening the attraction of real estate.

Perhaps the most important part of a timing strategy is the ability to project and fund ownership long term. Positive liquidity and the ability to sell for an acceptable profit at the optimum market time can be highly speculative. Leveraging the investment only increases the risk. When an investor is placed in an imposed forced sale position or loses confidence in the future of the investment, returns are jeopardized and most frequently result in a significant loss.

There has yet to be a final cycle, although current sentiment seems to reject that possibility which is an optimistically shallow, inexperienced approach. The financial ability to hold long term investments will affect the yield and does offer a degree of safety. With access to historical data, projecting long-term value, while still speculative, is much more achievable and moderately lessens risk. One observation is watching the pricing of Investment Land migrating from price per acre to price per square foot. This significant change can be attributed more to the inflationary effect of the dollar across the full financial spectrum rather than the intrinsic value of the real estate.

Our Land Absorption Map shows all types of 2022 commercial and residential land activity in specific geographic submarkets. Resources used for the map include actual sales, current listings, and announcements of pending projects. Not difficult to understand, the progression from active to long-term generally follows the availability of infrastructure and newer expanding utility systems, including Municipal Utility Districts. Land currently available for vertical construction will bring significantly higher value over those that must wait for services or possess extraordinarily high-cost offsite access. Over the 20+ years of presenting this map, it is interesting to note that, while the circles have limited movement, the colors change and generally move out from the core in concentric circles. This iteration of the 2022 map displays the first series of circle reductions in 10 years north of DFW and the first set of expansions in south DFW and beyond.

Younger Partners is a founder and member of the highly respected North Texas Land Council (NTLC), a group of 50 active, knowledgeable, and talented land brokers in DFW. Believing that activity generates more activity, the North Texas Land Council, to the advantage of its clients, freely shares information with its competing members and the general market on a level of professionalism unusual within similar organizations. As such, the organization is a benefit to all clients and to those anticipating a land investment. Much of the projected activity displayed on the Younger Land Absorption Map (YLAM) reflects the activities of the NTLC, local and national reporting agencies, and our large group of active company partners.

Because of many increased cost factors, single-family new home prices increased almost 25 percent in a single year making affordability more difficult. Additionally, historically low, long-term interest rates dramatically increased single-family affordability through the first quarter of 2022. Less obvious are the increases in completed per square foot costs in all commercial sectors. The surprisingly continued strong national economy, despite disruptions, as well as strong, continued inbound relocations, have provided record employment and income. Short-term projections are predictable–long-term less so. Perhaps one of the strongest influences softening the impact of a correction is the enormous amount of uncommitted cash held by investors of all classes and liquidity awaiting their perception of pending opportunities. Once an opportunity is perceived that liquid cash will be quickly redeployed and reinvested, steadying prices in the event of a devaluation caused by any number of external influences. Investors, incorrectly or not, wishing to miss an anticipated opportunity (chaos) will move quickly. An improving stock market and strong oil and gas prices have contributed to lessening the attraction of real estate.

Our continuing extended analysis, as displayed on the “Younger Land Absorption Map” (revised December 2022) is principally based on historical data utilizing over 200 years of market experience held by Younger Partners associates, members of the NTLC, and reliable future projections from sources that have traditionally displayed accurate information. Our market demographic information was provided by Younger Partners’ Steve Triolet, Director of Research, and Michael Ytem, Senior Vice President. As projected earlier, the DFW market still expects to absorb an additional expansion of more than 20,000 acres over the next 15 to 20 years. Recent acquisitions by qualified mixed-use developers, if restarted, threaten to shorten the total absorption time to one-half the projections. We have always had cycles, and this too shall pass.

In conclusion, the principles of sophisticated investing must include and utilize primary criteria. Reviewing the history of our land absorption maps provides distinct, valuable trends in growth well applicable to intelligent investing. Access to infrastructure, the admirably increased effort of developers to utilize available land in our fertile southern corridor, absorption of the remaining few infill sites, high suburban infill land costs, and the migration of employment centers will all play significant roles in prudent land investment decisions. Historically in the investment process, the only remaining elements are sound financial strength and patience.

CoStar News, Financial Firm’s Massive Dallas-Area Layoffs Comes as Sublease Space Reaches New Heights

Genpact’s OpenWealth To Lay Off Nearly 1,000 Employees in Dallas Area

OpenWealth, the financial services subsidiary of Genpact, plans to lay off 964 employees at this office building in Richardson, Texas, effective March 31. (CoStar)

By Candace Carlisle

CoStar News

January 25, 2023 | 6:16 P.M.

Financial advisory and wealth management firm OpenWealth, a subsidiary of New York City-based Genpact, plans to lay off nearly 1,000 employees in the Dallas area by the end of March after one of its clients decided it no longer needs the firm’s services.

The layoffs span a variety of positions at 3300 E. Renner Road in Richardson, Texas, about 20 miles north of downtown Dallas. The layoffs of 964 employees are expected to become effective on March 31, according to a Worker Adjustment and Retraining Notification letter the company sent to the Texas Workforce Commission. Genpact is one of Richardson’s largest employers with 2,500 employees as of 2021.

A Genpact spokeswoman declined to share the details of its “confidential client engagements” but confirmed there was “a business decision by one of our clients that affects the roles of some of our Richardson team.” According to CoStar data, the company has a lease totaling nearly 185,000 square feet of office space at the address.

“Responding to rapidly changing client needs is a standard part of Genpact’s agile operations model,” said Danielle D’Angelo, marketing and communication leader of the Americas for Genpact, in an email to CoStar News. “We’re committed to handling every transition thoughtfully and smoothly and ensuring everyone is treated fairly and respectfully. Richardson remains a strategic market for us, and we have several clients for whom we manage services in this location.”

D’Angelo did not immediately respond to a question by CoStar News asking about the real estate impacts of the layoffs.

Job cuts in the financial services industry have been ongoing with more expected as rising interest rates and difficulty in borrowing debt weigh on the industry. Some of the recent layoffs to hit North Texas are tied to mortgages as rising interest rates impact lending on homes.

There is more than 11 million square feet of sublease space on the Dallas-Fort Worth market, setting a new high watermark for the nation’s fourth-largest metropolitan area, said Andrew Matheny, Transwestern’s research manager in Dallas-Fort Worth.

“The demand for office space will slow down as the business cycle slows down and hiring slows,” Matheny told CoStar News.

Up until this month, Genpact was contributing to that mountain of sublease space with about 86,000 square feet of office space at 3101 E. President George Bush Turnpike on the sublease market. That lease has expired and is now available for tenants to lease directly from the landlord, Matheny said.

Steve Triolet, research manager for Dallas-based Younger Partners, said he expects the amount of subleased office space in Dallas-Fort Worth to meet a new threshold by mid-2023.

“We are on a trajectory to hit 12 million square feet of sublease office space being on the market by mid-2023 based on how much has been added in the last few months,” Triolet told CoStar News. “Some of that space rolls off into direct space — like in Genpact’s case — but more is coming to the market than is being converted to direct vacant space.”

Recent tech industry layoffs add another wrinkle to the office leasing story, Triolet said, with Salesforce yet to add some of its Dallas space to the sublease market like they have in San Francisco. Earlier this month, Salesforce executives told regulators the layoffs would result in a reduction in office space in “certain markets.”

Triolet told CoStar News he’s closely watching to see how those national layoffs trickle into the Dallas-Fort Worth region. If the job market softens, he said, it could once again impact the demand for office space.

“Since there’s been more clarity on hybrid work, it seems the sublease market is increasing,” he said. “There’s sublease space of every shape and size in Uptown, Far North Dallas, Las Colinas-Irving, Richardson and Plano.”

Big Spaces

Some of the office sublease market in Dallas-Fort Worth has begun to get stale, even as it has grown, but new space routinely comes to the market. Ride-hailing company Uber, which listed more than 100,000 square feet of office space on the sublease market in 2020, later scaling down its expansion plans to Dallas and forgoing millions of incentives, has only added to its sublease profile. The available space in the initial phase of The Epic expires this year, rolling for the sublease market, however, Uber has nearly 364,000 square feet of space available for sublease spanning 13 floors of the 23-story office tower, which was completed last year. CBRE is marketing the sublease to would-be tenants on behalf of Uber, according to a marketing brochure.

Reata Pharmaceuticals has been marketing its entire build-to-suit project — a 21-story, 327,000-square-foot office building at 6100 Legacy Drive in Plano — for sublease since last year. CBRE has been marketing the sublease to would-be tenants, which might be a few tenants rather than a single tenant, according to marketing materials. The building, completed in 2021, is still in shell condition.

Meanwhile, another Deep Ellum space is on the sublease market, with fast-growing startup Bestow listing its office space totaling more than 40,000 square feet spanning two floors, fully furnished and designed without the Dallas-based digital life insurance company ever taking occupancy of the space at The Stack Deep Ellum at 2700 Commerce St. in Dallas. Bestow’s office lease — and thus the sublease — runs through the end of January 2034. Dallas-based Altschuler and Co. is marketing the sublease on behalf of Bestow, according to marketing materials.

Triolet said he sees the most traction for subleases being between 3,000 square feet and 10,000 square feet, with office tenants actively taking down subleases in that range on a regular basis. For the bigger spaces, Triolet said it’s likely they will need to chip away at them with smaller deals.

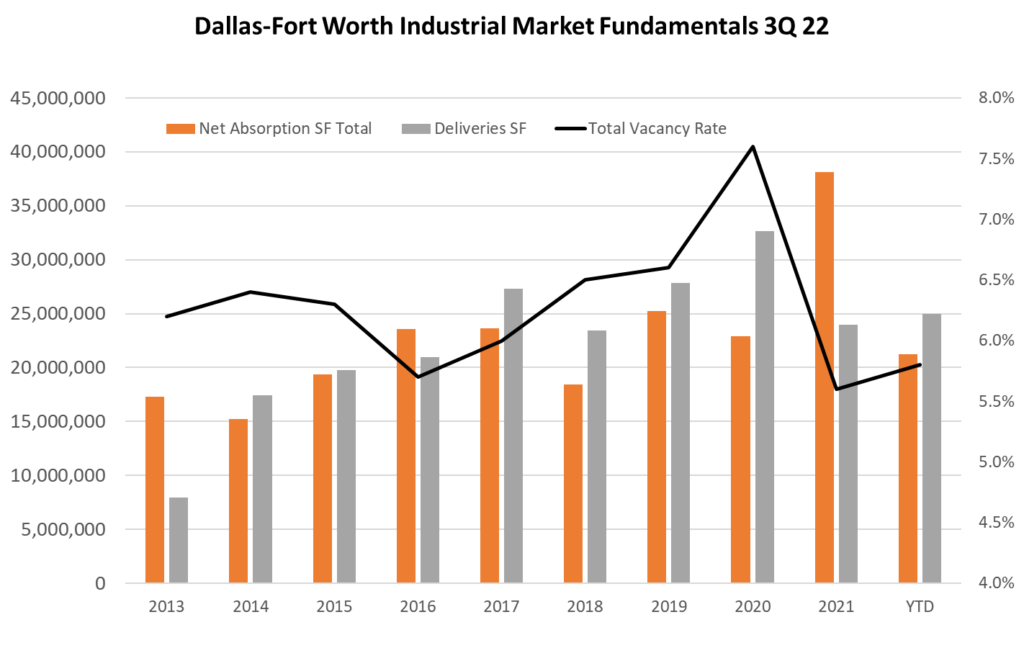

Preparing for the Return of Headquarter Relocations to Texas

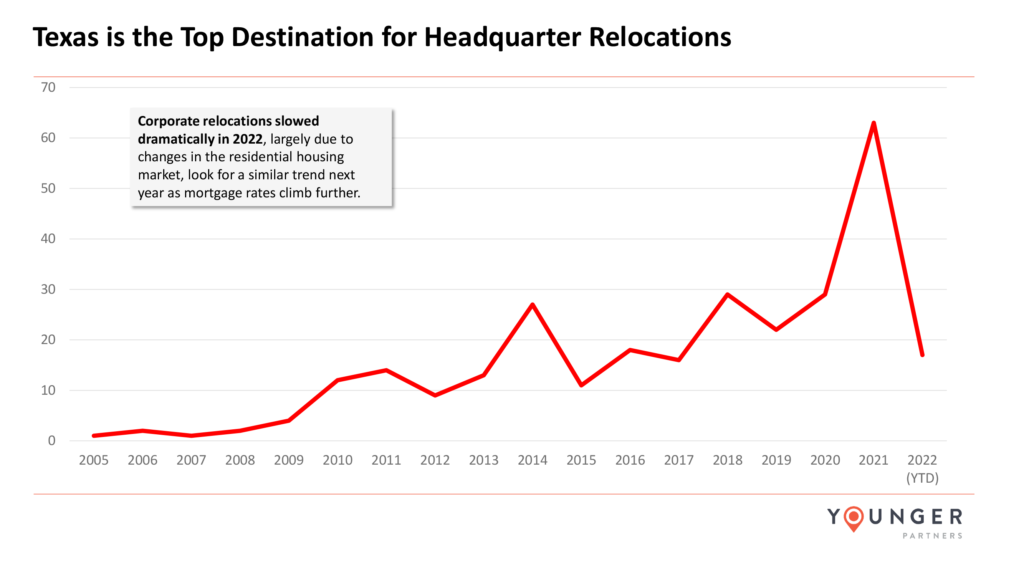

One of the unintended consequences of our sharply rising mortgage rates is the dramatic slowdown in corporate relocations. As the frenzy of commercial real estate activity cools in Texas, savvy business leaders should take this time to reassess their space needs and put thoughtful strategies in place before the market rebounds.

In the near term, C-suite executives understand that most homeowners are extremely hesitant to relocate and purchase a new home because of the higher costs. Over 80 percent of residential mortgages are currently financed at an interest rate less than 3.5 percent, which is well below the 7 percent rate for a 30-year loan today.

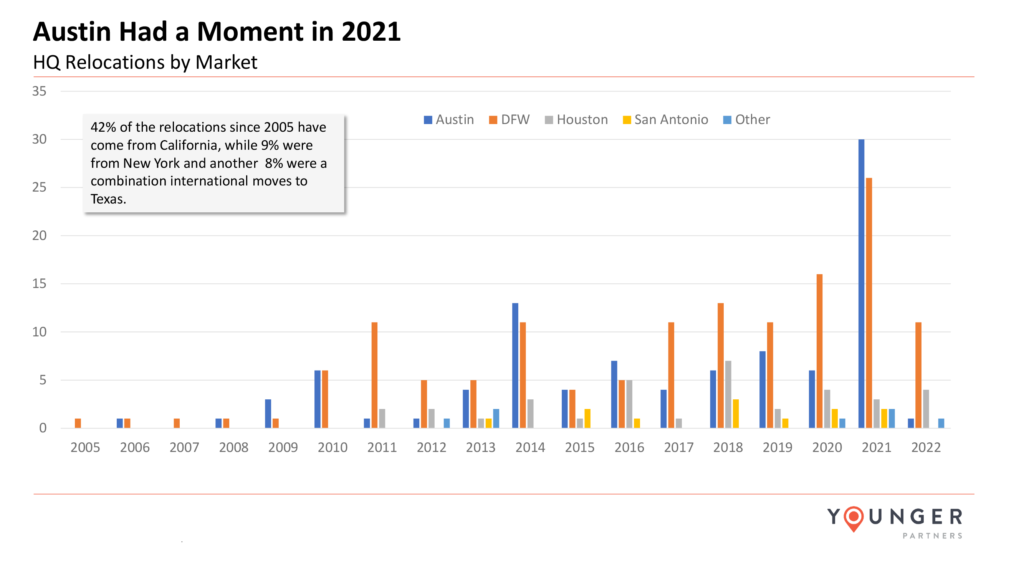

Before the recent interest rate hikes, Texas was a hotbed of relocations with 63 companies making a move in 2021. Although this year is not completely over, less than a third of that volume, or 17 companies to be precise, came to the state in 2022.

History proves that the housing market will rise again, just as it did from the recession of 2008 when the recovery was slow and residential markets didn’t stabilize until 2012/2013. Although the future uptick is expected to come quicker than the last cycle, timing is still uncertain.

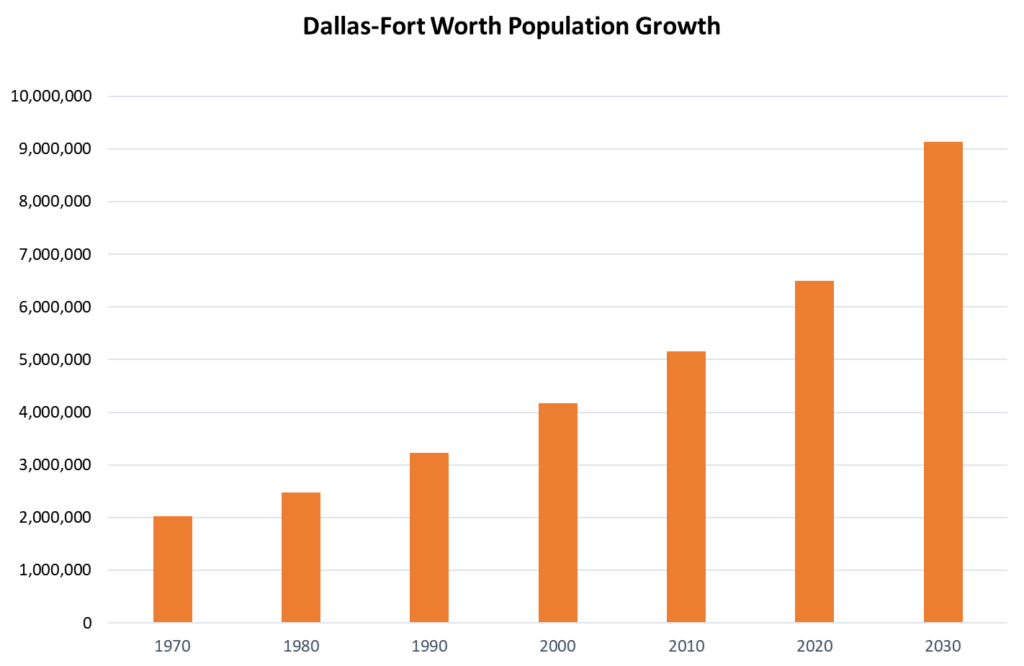

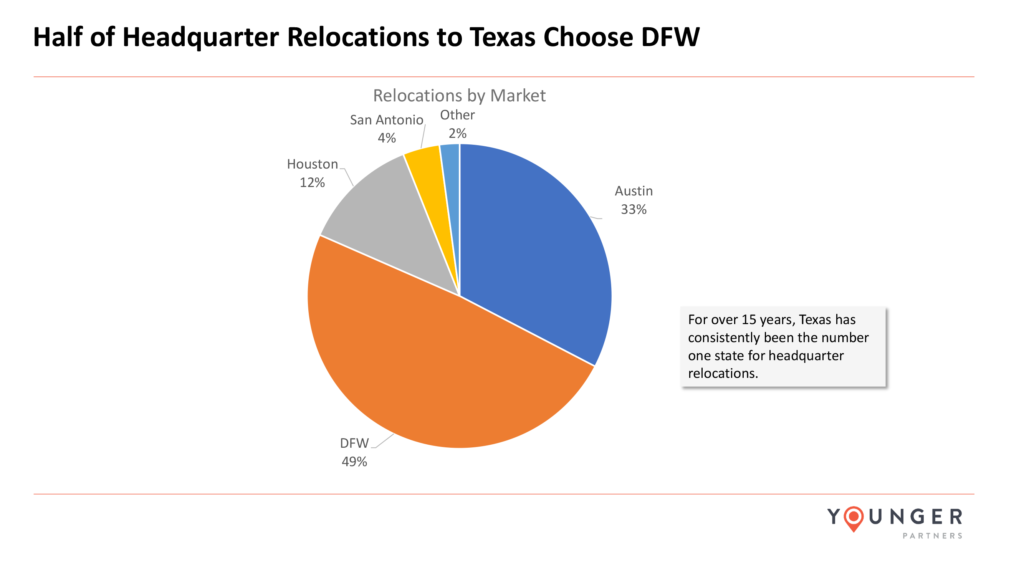

When companies do make the decision to relocate to Texas, almost half will choose Dallas-Fort Worth over the rest of the state. Austin did have a moment in 2021 with a slew of technology relocations, but the historic numbers favor the Dallas-Fort Worth market overall.

With fewer companies touring for potential relocations, office demand is low across Texas. Active large tenants are down roughly 40 percent compared to pre-Covid levels, which is anticipated to last another year or two. Once residential activity adjusts, relocations will be surging into Texas again.

Until that time, corporate leaders should partner with a commercial real estate advisor who can assist with some of the relocation preparations in advance, including:

- Selecting a target submarket that will complement business needs

- Buying land for future development, if needed

- Understanding how major infrastructure developments in the area will affect commutes and labor pools

- Securing economic incentives offered for corporations coming into Texas, or specifically the Dallas-Fort Worth market

- Adjusting the corporate real estate strategy to accommodate hybrid or remote workers

- Creating efficiencies that will reduce relocation costs.

1 Dust Group Takes Space at North Dallas Business Park

1 Dust Group leased 6,686 square feet at North Dallas Business Park, 3109 Garden Brook Dr. in Farmers Branch. Elaine Xu at Younger Partners represented the tenant.

The wholesale electronic products business, which has been providing warehouse and fulfillment services to clients in Asia since 2018, saw an opportunity to expand its existing U.S. business lines with a relocation from Mo. to Texas. North Dallas Business Park’s centralized location will enable 1 Dust Group to provide added storage solutions and quicker fulfillment for customers.

“Dallas-Fort Worth continues to be a magnet for regional, national and even international businesses like 1 Dust Group,” says Xu. “Fulfillment centers such as this benefit from our shipping infrastructure, lower operational costs, favorable tax rates and huge talent pool.”

Front Porch Pantry Delivers Fresh Meals from a 26,000-Square-Foot Food Production Facility

Front Porch Pantry was a relatively unknown contender in the prepared meal delivery business when it launched in 2016 from a small deli kitchen at the back of an Addison liquor store. The Dallas-based company now competes with the likes of Freshly and Factor and ships over 50,000 meals a month across Texas, Oklahoma, Arkansas, and Louisiana.

Founder and Managing Partner Michaelann Dykes claimed her stake in the $10.29 billion global industry with a mission to help busy people eat healthy by delivering tasty home-cooked meals to their doorstep. She began by assembling a cookbook of ‘family favorite’ recipes and started testing her meals.

“The first deli kitchen was fine for making sure my recipes could be precooked from fresh ingredients and reheated without compromise,” says Dykes. Front Porch Pantry initially had two to three customers a week and quickly expanded to a large customer base in the Dallas area. Dykes says the company has an 88% loyalty rate today.

As the menu options for Front Porch Pantry grew, so did the need for more sophisticated real estate. Within the first year, Dykes sought assistance from Tanja McAleavey of Younger Partners who located a commercial gluten-free kitchen with accommodations that were prime for clean cooking. The new facility came with a space expansion option and gave Front Porch Pantry the edge it needed to accelerate in an industry experiencing compound annual growth rate of 13.5%.

In 2019, McAleavey teamed with Jerry Averyt of Younger Partners to find an even larger floor plate that could further scale with company progress. Front Porch Pantry purchased a former office warehouse located at 4600 McEwen Road in Farmers Branch and the pandemic struck during finish-out. Supply chain issues stalled renovations, affecting everything from commercial stoves and plumbing, to build-out on the office and walk-up retail areas. This happened just as Front Porch Pantry’s business, and the prepared meal delivery industry, was skyrocketing.

“No one could have predicted a pandemic that would astronomically affect the industry. Everyone was searching for great meal delivery options, and Front Porch Pantry had them,” says Dykes. “We had difficulty getting many necessary ingredients but with our extensive catalog of recipes, we were able to write and modify recipes according to what was available.”

The doors opened at the new facility in September 2021 and momentum remains strong for Front Porch Pantry. Dykes expects to escalate eight times the current volume as the business takes a national focus.

“Our online ratings speak for themselves. Even customers who love to cook are busy. We give them great taste, great value, and the added convenience of having fully cooked dinners delivered right to the front porch. We deliver in Texas, Oklahoma, Louisiana and Arkansas and look forward to expanding nationwide,” says Dykes.

Front Porch Pantry contact info:

(972) 925-0526

contact@frontporchpantry.com

www.frontporchpantry.com

Kathy Permenter Featured on KRLD CEO Spotlight

Younger Partners Co-Managing Partner Kathy Permenter talks about the company’s recent acquisition of Crockett Row during an interview with David Johnson, host of CEO Spotlight on KRLD 1080-AM.

>>Click here to listen to the August 16, 2022, podcast to learn about upgrades planned for the 282,000-square-foot mixed-use development in Fort Worth’s Cultural District.

Younger Partners Investments Acquires Crockett Row

FORT WORTH, Texas (August 9, 2022) – Younger Partners Investments (YPI) acquired Crockett Row, a 282,334-square-foot urban village with five blocks of pedestrian-friendly Class A retail and office space. Located at the southeast corner of University Drive and West 7th Street, the property sits within the city’s Cultural District just west of downtown Fort Worth.

Younger Partners’ Co-Managing Partners Kathy Permenter and Moody Younger, and YPI Managing Director Micah Ashford, represented YPI in the acquisition. Financing was arranged by Adam Mengacci of Hamilton Realty Finance. Mark Sloan and Jacob Dow at Holland & Knight provided legal representation. Terms of the deal, which was the third acquisition for YPI, were undisclosed.

Embedded within Fort Worth’s larger live-work-play West 7th development, Crockett Row is surrounded by world-class museums, eateries, pubs and entertainment venues, including the new state-of-the-art Dickies Arena. Developed in 2009, Crockett Row’s overall occupancy at the time of closing was 74.6 percent, presenting lucrative opportunities for new tenants to join Movie Tavern, LA Fitness, Fidelity Investments, PMG and Common Desk on the property roster. Younger Partners will handle the property management and leasing of the property.

YPI has plans to freshen the brand and to make improvements to enhance customer experience through the addition of gathering spaces, parking technology to help locate open spaces, improved signage and additional elevators. “We also plan to work with the City to enhance accessibility throughout the property,” said Younger.

“Crockett Row was a target investment for us because of its strong supporting demographic and iconic location in the Cultural District, next to some of Fort Worth’s most affluent neighborhoods,” said Permenter. “The amount of tenant interest in this neighborhood has already far exceeded expectations.”

Crockett Row will benefit from upcoming developments to the area, including Crescent-Fort Worth, bringing 200 luxury hotel rooms, 170,000 square feet of office, and 17 multifamily units within a block from the property in mid-2023. Directly across the street from Crockett Row, the Van Zandt will deliver 147 multifamily units, 100,000 square feet of office and 11,000 square feet of retail, along with upcoming additions Triune Centre, Burnett Lofts and Encore Panther Island.

About Younger Partners

Dallas-based Younger Partners is a full-service boutique commercial real estate firm providing investment, leasing, and management services to investors and tenants in the Dallas/Fort Worth region. They specialize in the acquisition and disposition of land, multifamily, office, industrial and retail properties. Younger Partners Investments (YPI) is a Younger Partner platform designed to acquire retail properties. Launched in July 2020, YPI targets retail properties from lifestyle to neighborhood centers throughout the DFW area. Younger Partners and YPI are also affiliated with newly formed Apricus Realty Capital.

Record Demand for Land in North Texas

The DFW market still expects to absorb an additional expansion of more than 20,000 acres over the next 15 to 20 years, according to Younger Partners’ Robert Grunnah.

By Robert Grunnah | January 27, 2022 | 9:00 am

As 2021 has now come to a very fascinating and positive end, the North Central Texas land market has experienced significant influences modifying its prior accelerating four years of sales and absorption activity. To some surprise, the effects of COVID-19, an unstable political environment, rising inflation in Federal denial, Federal taxes, CRE threats, and significant increases in construction costs have not had a serious impact on land pricing and activity. Additionally, a profound market disruption in retail, entertainment, and hospitality has had an even lesser impact. In reviewing last year’s report, only a few observations have changed to any great degree.

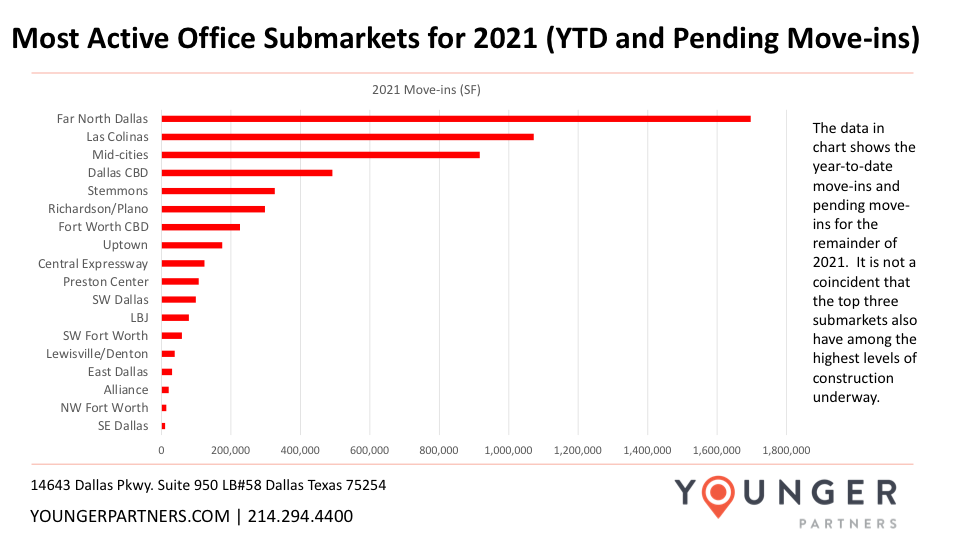

Most Active Office Submarkets for 2021 (YTD and Pending Move-ins)

Far North Dallas and Las Colinas are the two most active submarkets. They both have high levels of construction (both recently completed and projects currently underway). For Far North Dallas, JPMorgan Chase has a phase 2 built-to-suit and along with other construction projects in the Legacy area (Keurig Dr Pepper, Reata Pharmaceuticals) and various spec projects. Las Colinas has Cypress Waters, which continues to deliver multiple properties per year. Mid-Cities has emerged over the past couple of years as a very active submarket due almost exclusively to large built-to-suits like the American Airlines Headquarters that was completed in late 2019 or the multiple phases of Charles Schwab built-to-suits.

Submarket outliers to watch in the future include Uptown and Preston Center (with 1 million and 700K SF, currently underway, respectively). These two smaller, more expensive submarkets have high levels of construction underway, but leasing activity and pending move-ins has not been keeping pace.

Why so many corporate relocations are coming to North Texas

By CeCe Grosz, Marketing Intern

It’s no secret that the Dallas/Fort Worth metroplex boasts a business-friendly tax climate, talented workforce, and profitable market for many industries. But why exactly are we seeing so many businesses relocate to North Texas recently?

Adriana Cruz, executive director of Economic Development and Tourism for the Governor’s office, was recently quoted as saying that Texas has seen “a tremendous increase in the number of prospects and projects we have in very diverse industries” since the pandemic started.

Cruz credited the increased relocations to Texas to a “timely shutdown of the state economy when the pandemic struck and to a careful and methodical, data- and doctor-driven reopening of businesses” (Biz Journals).

Many of the relocations are coming from one place in particular: California. From the beginning of January 2021 to the end of June 2021, the state of California lost 53 headquarters to other locations across the country. Almost half (23) of those relocations moved to the Lone Star State. Since 2018, 107 California headquarters have moved to Texas, five times more than the closest competitor – Tennessee drew 22 CA relocations.

The last five Fortune 500 companies to relocate their headquarters to DFW have all come from California within the last six years. These include CBRE Group, engineering firm Jacobs, health care company McKesson Corp., convenience store supplier Core-Mark International, and financial services company Charles Schwab.

A notable recent relocation is First Foundation, a California financial services company which is now headquartered in the Crescent (Uptown Dallas). The company’s CEO, Scott Kavanaugh, says that “a lot of the move had to do with politically some of the things that are affecting many companies in California… It led to us thinking about where would we geographically want to be, and when you look at the landscape, in my mind, the clear winners are Florida and Texas.”

As of July 2021, the Dallas Regional Chamber is tracking 109 new projects in the city, including corporate office relocations as well as headquarters relocations.

A huge factor in relocations to DFW and Texas as a whole is the affordable cost of housing. The median cost of a house in Texas is only $195k, which is $36k cheaper than the national average. An explanation for all of the California companies relocating here is that the median cost of a California house is $552,800, a huge deviation from the national average. Corporate employees will have a much less burdensome cost of housing if they move to Texas.

The additional reasoning for all of these relocations generally remains consistent across many industries: the pro-business climate and lack of corporate or personal income tax, the central location, the proximity of DFW International Airport, the state’s large talent pool and the quality of life that Texas offers.

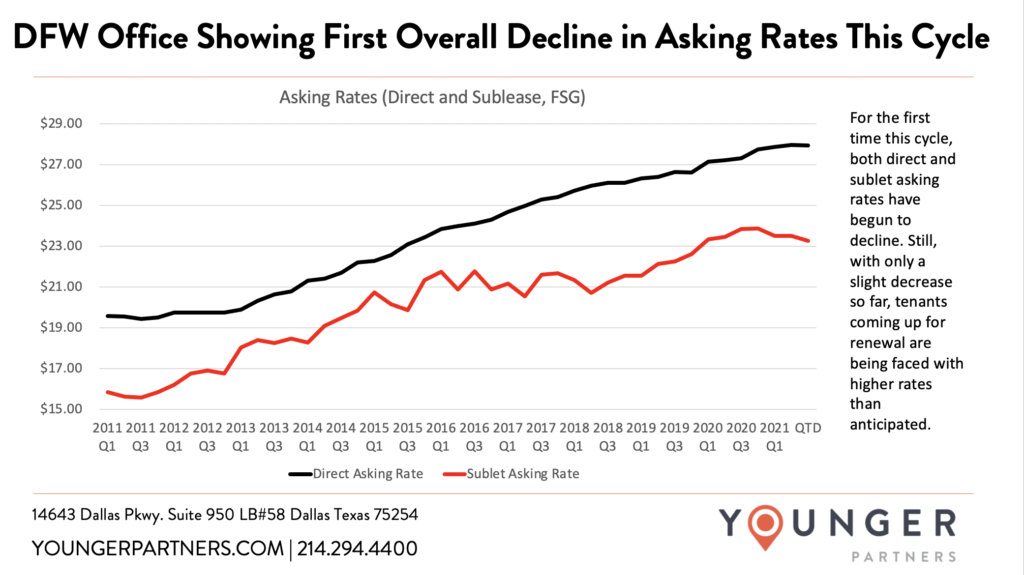

DFW Office Rates Showing First Overall Decline in Asking Rates This Cycle

Asking rates are a lagging indicator to the market fundamentals. After a market downturn, asking rates are not typically significantly impacted until 4 to 6 quarters after the market has shifted. The decline in both direct and sublet asking rates since the end of the second quarter of 2021 should not be surprising as it falls into the typical time range. This decrease in rates, however, has only been slight to date, with overall averages still up on a year-over-year basis.

Specific properties that have reduced their rates since the end of the second quarter include International Plaza II, The Palace Office Center, Westpark Plaza and the Lakes at Bent Tree.

Top Office Design Trends for 2021

By CeCe Grosz, Marketing Intern

Many companies in the Dallas-Fort Worth Metroplex are enjoying the normalcy of returning to the office, with employees once again able to chat by the coffee machine or mingle in the break room. However, some aspects of office design will continue to adapt to the post-pandemic state of the world, and likely won’t return to how they were before. These new office design trends will incorporate new technology and practices into the work environment to improve employee wellness boost employee morale, promote collaboration and corporate culture. Here are the top office design trends we are noticing for 2021:

Hybrid Office

COVID-19 prompted most companies to have their employees work fully from home for several weeks or months. This rapid change in the work environment resulted in employees realizing that they could be productive outside of the office, while being in closer proximity to family and the comfort of their homes. While most employees have already returned to the office, many expect to maintain some remote work, even for one or two days a week: according to Fortune, 63% of high-growth companies are embracing a hybrid work model. Companies can adjust to that by requiring less office space and having employees come into the office in shifts.

Employers are adjusting their office design to feel more “homey” and reduce the stark contrast between working at home versus the office. This includes natural lighting, relaxing spaces around the office for rest or social interaction, as well as incorporating more artwork into the environment.

Increased Sanitization Practices

A trend that has manifested itself throughout the past year is the importance of employees feeling safe when coming to work. Office spaces now feature hand sanitizing stations, increased cleaning of surfaces and touchpoints such as elevator buttons, and the addition of handwashing sinks in kitchen/break room areas.

Kitchen area at Republic Center.

Hot Desks

A new phenomenon for most offices is unassigned seating for employees, also known as “hot desks.” While previously thought that Coronavirus particles were transmitted heavily through shared surfaces, now that we know transmission mainly happens through the air which means unassigned seating could have many benefits for your office.

Research from the University of Arizona found the average office desk to be covered in 400 times the number of bacteria that a toilet seat has. This unsettling finding is the result of office cleaning crews being told not to touch employees’ desks and personal areas. If offices forgo assigning desks and have employees reserve their space before work, the desks can be sanitized after hours to promote a much cleaner workspace.

Biophilic Design

This concept, which aims to incorporate living plants into the corporate office, is taking off in 2021. Biophilic design is inspired by the visual connection between humans and nature. Bringing the outdoors inside boosts the overall quality of life for employees, as well as improving air quality of the office. Companies should consider investing in a “living wall” or adding more plants around the office to improve the health and happiness of their employees. Offices that incorporate plants see increased productivity, improved oxygen flow, and reduced toxins in the air.

Air Quality

In addition to biophilic design, companies have many options to choose from to promote improved air quality around the office. Since COVID-19 began, many offices are updating HVAC systems to enhance the circulation and filtration of air throughout the space.

According to Younger Partners’ Roy Smith, we should be on the lookout for updating HVAC systems to a rating of MERV13. The MERV rating scale stands for Minimum Efficiency Reporting Value and measures the efficiency of the air filter based on what particles it can filter out. “The higher the number, the higher the efficiency of filtration,” says Smith.

While the highest ratings of 16-20 are used mostly in hospitals or nuclear power plants, many offices are upgrading their filtration systems to MERV 13. This rating means that pollen, dust, dust mites, mold, bacteria, pet dander, cooking oil smoke, smoke, smog, AND virus carriers are all filtered out of the air. This would be an excellent investment for the health and safety of your workplace.

When new office spaces are built, companies should seek smart materials that resist mold and have antimicrobial properties, such as copper. The use of these materials will promote better air quality for employees.

Play Ball! Younger Partners Family Day with the Texas Rangers

After skipping a year, the Younger Partners annual Family Day event returned even bigger than before with four homeruns, more $1 hot dogs than we can count, a Rangers win and lots of camaraderie.

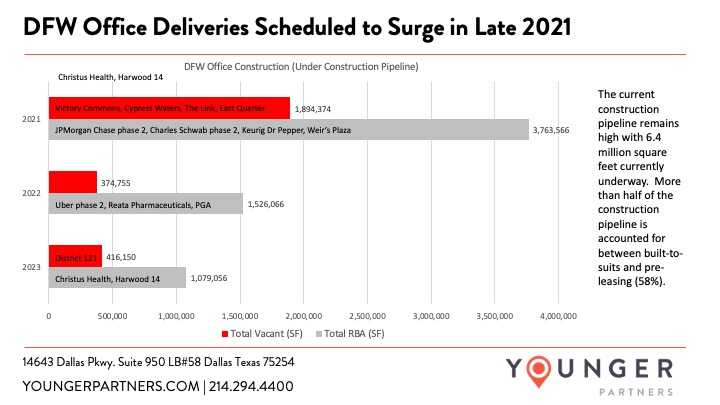

DFW Office Deliveries may be high in late 2021, but taper notably in 2022-23

By Steve Triolet, Younger Partners Research Director

Recently, we looked at current leasing volume trends in comparison to the historic norm. I thought it might be helpful to take a look at the construction delivery pipeline and what it likely indicates for the future market fundamentals for the DFW office market. The construction pipeline remains elevated at 6.4 million square feet. The majority of this construction was started in 2019 and is scheduled for delivery in the second half of 2021. While more than half of the construction pipeline is accounted for between pre-leasing and built-to-suits (58%), there is still almost 2 million square feet of vacant space scheduled for completion before the end of this year. This surge of new vacant construction in 2021 has the potential to move the total vacancy rate up roughly 40 basis points (preliminary numbers show the second quarter total vacancy rate will be 20%).

For 2022, the amount of new vacant space is less than 400,000 square feet, but it is worth noting that the dynamics of Uber at the Epic. The Epic Phase 1 was built in 2019, but most of the project is currently largely available for sublease (115,995 square feet of Uber space), direct space (68,785 square feet) or via co-working space (42,862 square feet). The Epic Phase 2 is 469,000 square feet and scheduled for delivery in mid-2022. The Uber Air division was supposed to be based in Phase 2 and be the primary pilot program for the company. In December 2020, Uber Air was officially discontinued and the app technology behind the division was sold to Joby Aviation. Given the current uncertainty of Uber and its near term growth, there is a high probability that all or a large portion of phase 2 will be placed on the sublease market (similar to what we have seen with Liberty Mutual). Still, even if the Uber space is placed on the market the amount of new unaccounted for space should be about 800,000 square feet or less.

The tapering of construction is expected to accelerate in 2023, with the majority of the pipeline accounted for by Christus Health (456,000 square feet) and Haynes and Boone (125,789 square feet at Harwood 14).

Note: Data is all currently under construction office properties over 15,000 (excluding medical). The larger projects are listed by name within the chart, with largely vacant projects in the red and the larger built-to-suits and spec projects with significant pre-leasing in the gray columns.

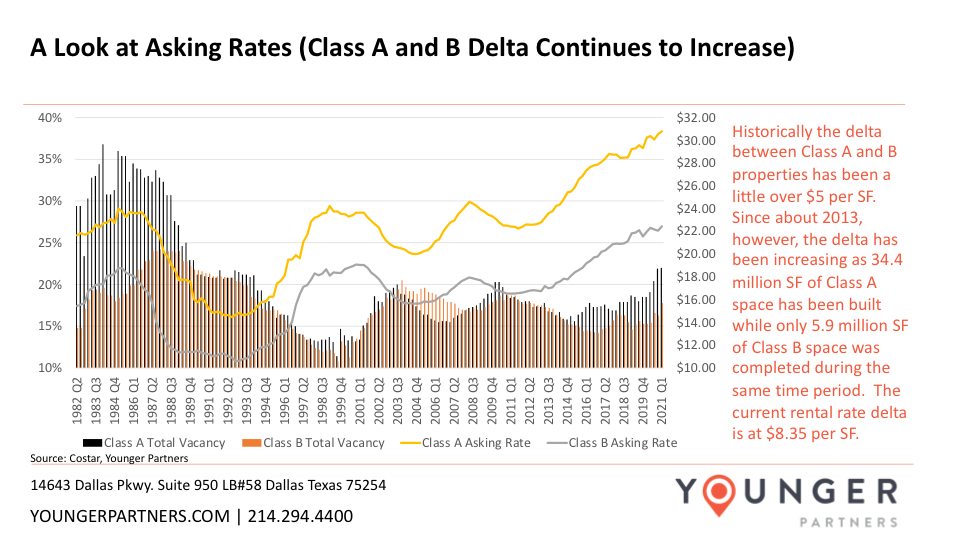

A Look at Office Asking Rates: Class A & B

By Steve Triolet, Younger Partners Research Director

DFW office asking rates, overall, continue to look largely unchanged from one year ago. This is especially true in some of the top office markets like New York City and San Francisco, which have seen double-digit rate declines. Rates are a lagging indicator and previous cycles show that most of the downward movement in rates don’t typically impact the overall average until 12 to 18 months after the economy goes into a recession. So far, effective rates have decreased, mostly in the form of free rent.

One major trend that has taken place over the past year is moderate rate increases for Class-A properties. This is slightly misleading as most of the increases have been driven mainly by the newest construction been delivered to the market. Existing stock, especially in older properties are seeing pressure on rates. Class-B rates have remained flat from an asking rate perspective. With 6.3 million square feet currently underway (95% of which is classified as Class A and quoting an average a $41.95 FSG per sf asking rate), this trend is expected to continue while the construction pipeline remains elevated through 2022.

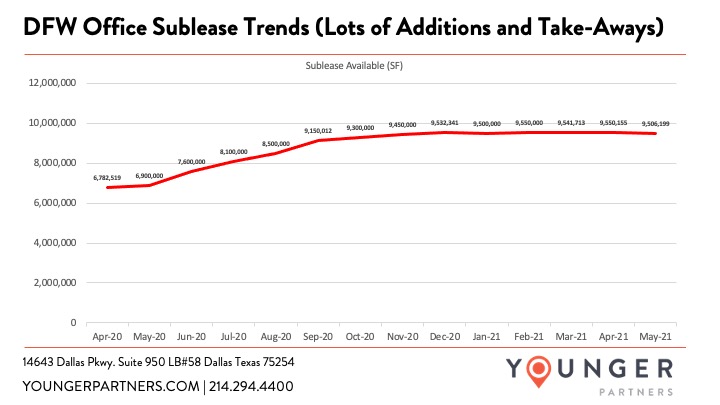

DFW Office Sublease Trends & Takeaways

Over the past seven months, the 9.5 million square feet of sublease office space available across DFW has been largely stagnant. However, there has been an increasing amount of movement over the past two months. We’ve discovered a few primary trends that have been keeping the total flat.

First, there have been short-term subleases with expiring leases rolling over to direct vacant space. Second, some tenants have decided that they want to re-occupy their own space like NTT Data at One Legacy West and PLH Group at Canal Centre. Meanwhile, other tenants continue to put additional sublease space on the market such as Securus Technologies, RealPage, Mitel, PwC and Lockheed Martin.

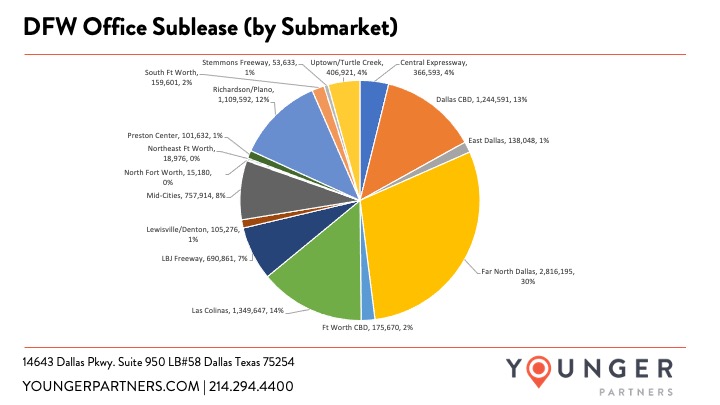

Four submarket account for the vast majority of sublease space available (Far North Dallas, Las Colinas, the Dallas CBD and Richardson/Plano). These four submarkets account for 69% of all sublease space currently available.

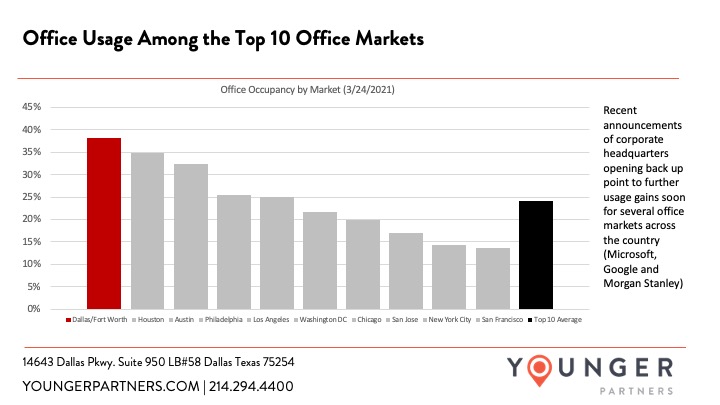

DFW Office Usage Update

By Steve Triolet, Younger Partners Research Director

Near the beginning of the year, I shared some info from Kastle Systems on office usage for the top 10 office markets across the country. Back then and now, DFW remains the top market for office usage (office workers being physically back in the office on at least a hybrid model).

To date, the usage numbers have not moved much this year, but several recent announcements (Microsoft, Google, Morgan Stanley, PwC, Fannie Mae, FDIC) all point toward improvement over the next few months, with post-Labor Day being the most common soft return date for several large corporations. This date seems to be the consistence because of the start of a new school year and the end of summer.

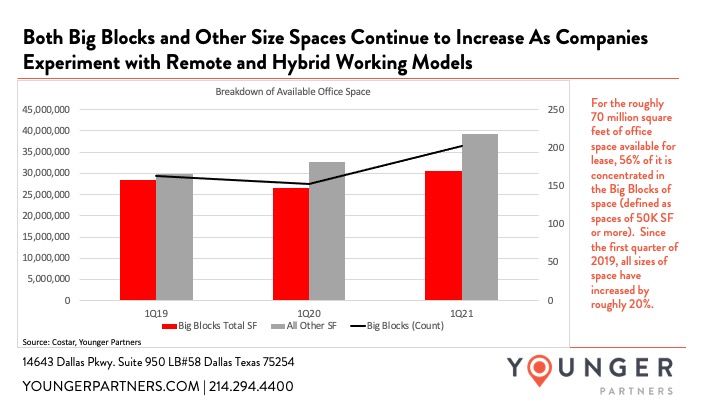

A Breakdown of Available Office Space in DFW

By Steve Triolet, Younger Partners Director of Research

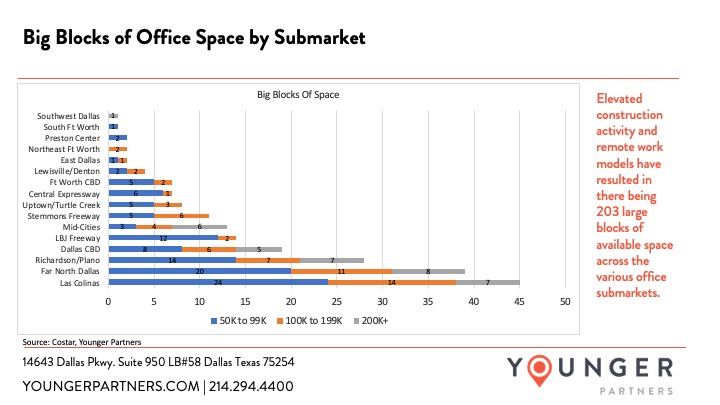

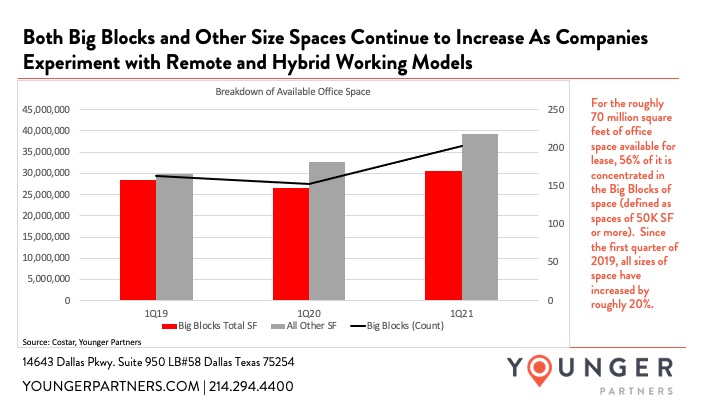

A few times a year I show where the highest concentrations of large blocks of space are. In the second chart below, there is an updated breakdown of the 203 Big Blocks of space currently available by size category and submarket. Outside of that update, I wanted to take a look at the increase in all sizes of space (not just the big blocks of space).

What surprised me most when I analyzed the data is the increase in space was not just in the big blocks of space, but also all size categories. Since the first quarter of 2019, the amount of space being marketed is up 20%. While sublease is a large component of this increase over the past year, sublease space only accounts for roughly 14% of all the available amount of space out in the market.

Younger Partners Spotlight: Trae Anderson

February’s Younger Partners spotlight is our 2020 Top Producer, Trae Anderson. Trae has been with Younger Partners since its inception almost nine years ago and is a Principal with the company. Trae is an avid golfer, history buff, crossword puzzle lover, and a trivia aficionado.

He and his wife of eight years, Rachel, have an almost 2-year-old son, Thomas, and a 10-year-old lab, Finley. The OU alum (and superfan) was also a 2013 recipient of the University of Oklahoma Regents’ Alumni Awards for service to the university. Little known Trae fact: he won the 1989 National Limbo Championship in Chicago. Thank you for all of your contributions to the team!