Category: News

The Spread Between the Availability Rate and Vacancy Points

By Steve Triolet, Younger Partners Director of Research

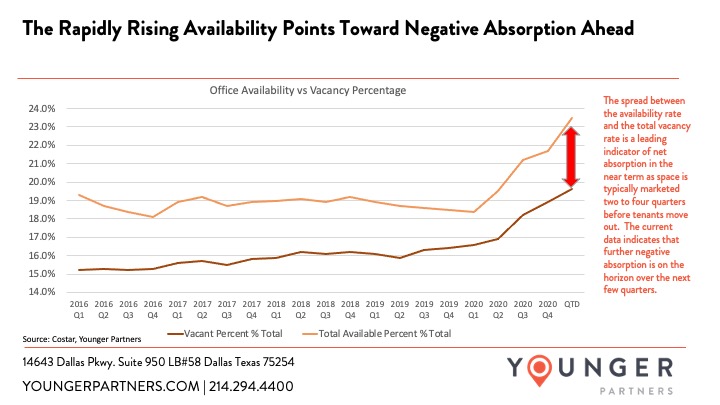

While most numbers like vacancy, net absorption and asking rates that are reported in our quarterly reports give a current pulse on the market fundamentals, there are a few that can be leading indicators of where the market is heading in the quarters ahead. One of those is the availability rate and its relationship with the total vacancy rate. If spread between the availability rate and the vacancy rate is narrowing that means that there is less of pipeline of space coming to the market or as we’ve seen in 2020 and 2021 (to-date) the availability rate for DFW office market has been steadily climbing, outpacing the rising vacancy rate. This indicates negative net absorption ahead, along with softer fundamentals like a higher total vacancy rate.

The rapid rise in the DFW office availability over the past year has been due to a combination of direct and sublease space. While sublease has been gaining more attention in the news, the rise in direct space available (mainly due to new construction) has far outpaced the rise in sublease space. Available sublease space and direct space have increased by roughly 3.5 million and 6 million square feet, respectively over the past year.

YP’s 2020 Top Producers

Congrats to the YP Top Brokers for 2020! Top Producers are Trae Anderson, Sean Dalton, Scot Farber, Jack Gail, Tom Grunnah, David Hinson, Ben McCutchin, John St. Clair and Tom Strohbehn. A new award this year goes to the broker who generated the most revenue by working with other YP brokers. Congrats to Michael Ytem for being our Teammate of the Year. We can’t wait to see what 2021 brings for our great team.

D CEO Selects Nine YP Brokers to 2021 Power Brokers List

Congratulations to the Younger Partners brokers who made D Magazine‘s D CEO 2021 Power Brokers list.

Included in the list for office leasing are Trae Anderson, Kathy Permenter and Sean Dalton. For land and commercial property sales are Scot Farber, Tom Strohbehn, Tom Grunnah, David Hinson, Ben McCutchin and John St. Clair.

See the full list at: https://bit.ly/37PyBKZ

A Look at Office Sublease Terms (How Much Term is Left on the Master Lease)

By Younger Partners Research Director Steve Triolet

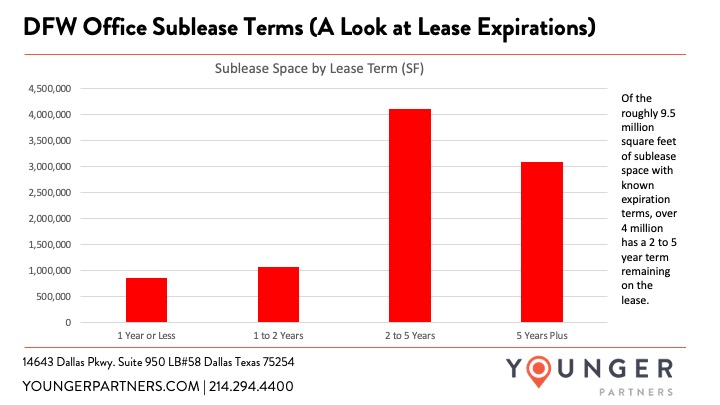

With roughly 9.5 million square feet of office sublease space currently available, it’s important to take a look at how long the lease terms are for the various sublease spaces. Traditionally, subleases with 2 years or less of term left are very difficult to lease unless a direct deal is also worked out (due to the high cost of moving into a new space for a short term lease). As of February 2021, roughly 20% of the current subleases being marketed have lease terms of 2 years or less, making them likely to roll to direct vacant space before a sublessor is found.

Among the leases with longer terms (5 years plus), several of these are concentrated in newly constructed office properties (Uber 115,995 SF, Liberty Mutual 357,500 SF, DXC 100,267 SF and HPE 71,296 SF, among others).

Making Your Own Luck in Commercial Real Estate

Playmakers Talk Show Guest for the February 5th edition of PlayMakers Talk Show: Kathy Permenter, Co-Founding Partner, Younger Partners

Subscribe to the PlayMakers Talk Show Podcast

Kathy Permenter serves as co-managing partner and has a proven track record of creating value for her clients. Kathy is responsible for leasing select assignments and the overall performance of the property leasing team. She attributes her real estate success to her CPA background, years of transaction experience, and a passion to exceed her client’s expectations.

Younger Partners is a full-service boutique commercial real estate firm providing investment, leasing, and management services to investors and tenants in the Dallas/Fort Worth region. Since its founding in April 2012, Younger Partners has grown from its two original partners to over 90 employees responsible for eight million square feet of properties in the Dallas/Fort Worth market.

Kathy has a passion for serving clients. She creates a team atmosphere and has tremendous energy that she brings to everything she does. She’s one of the heavy hitters in DFW Commercial Real Estate and has accomplished that with tenacity and grit.

Younger Partners Investments Acquires Grocery-Anchored Shopping Center

Younger Partners Investments (YPI) completed its first retail acquisition: Heath Town Center, a 77,669-square-foot grocery-anchored retail center at FM 549 and Laurence Drive in Heath. YPI is Younger Partners’ newest platform designed to acquire retail properties. YPI was launched in July 2020 to target retail properties from lifestyle to neighborhood centers throughout the Dallas-Fort Worth area.

The newly built shopping center is anchored by a top-performing Tom Thumb grocery store alongside its 12-pump fuel station and in-store Starbucks. The property’s occupancy is 98 percent with one small vacancy of 1,827 rentable square feet. Younger Partners will handle the property management and leasing of the property.

Younger Partners’ Micah Ashford, Moody Younger and Kathy Permenter represented YPI in the acquisition. JLL’s Adam Howells represented the seller, Malouf Interests, Inc. Financing arranged by Adam Mengacci of Hamilton Realty Finance. Terms of the deal were undisclosed.

“This is a great property to launch our new platform,” says Micah Ashford, who leads YPI’s efforts. “This high-performing Tom Thumb provides consistent traffic patterns to the property and serves as an excellent anchor for the shop tenants, who benefit from maximum exposure. This location is incredible as the City of Heath has seen population growth of 40 percent over the last 10 years.”

Demand has increased at the intersection of FM 549 and Laurence Drive, which was recently expanded. The property is also located immediately adjacent to two heavy daytime traffic generators, Rockwall-Heath High School to the north and Amy Park Elementary School to the south, Ashford adds.

“We feel like retail is one of the most disrupted sectors of commercial real estate,” says Younger Partners Co-Founder and YPI Partner Moody Younger. “While we can relate to the tough times COVID-19 has created, we are confident in the resilience of Texas and we are excited to make this investment in the future of retail and our region. We are actively seeking our next acquisition now.”

Younger Partners Co-Founder and YPI Partner Kathy Permenter says the new division has been part of the partners’ long-term strategy. “With the market going through dramatic changes, this is a good time to do it. I started my career in retail, and it continues to interest me. I look forward to investing in this sector,” she says.

YP Spotlight: Elaine XU

YP’s January Spotlight is broker Elaine Xu, who focuses on land, industrial, office buildings and investment properties. The three-year YP veteran appreciates the teamwork and insightful mentors Younger Partners has to offer. She enjoys that every deal is different with much to learn from each one – from strategic thinking to negotiation tactics.

On weekends, she can be found on the tennis court with friends. Her husband and their two sons, a college freshman and a high school sophomore, love to visit national parks (and have visited more than 20 so far). Thank you, Elaine for being a valued member of the Younger Partners team!

Sharing our Blessings with Toys for Tots

This year, YP collected new toys, bicycles, scooters and helmets for children from infants to teens for Toys for Tots. This organization’s primary goal is to bring the joy of the holiday season and send a message of hope to America’s less fortunate children.

YP Spotlight: Byron McCoy

Our December #YPSpotlight, Byron McCoy, is one of the nine partners at Younger Partners. He joined the company six years ago and focuses on third-party agency leasing and some sales transactions. Byron says what he enjoys most about his role is that every day, every transaction and every client is different. Getting a property to full occupancy is especially satisfying, too. He and his wife of 31 years, Deah, have three grown children – Kent, Caleb and Katherine – and welcomed their first grandchild this year, Brooks Byron.

Salesmanship has been in Byron’s blood since he was a boy: he was a paperboy for the Dallas Times Herald from the third grade until 11th grade. He was enterprising and came up with the idea to include payment envelopes with the newspapers asking for the subscription payments to be mailed in or pinned to the mailbox, The Herald took the idea citywide with the Dallas Morning News following suit. Named Paperboy of the Year twice, Byron did TV commercials for the Herald and used the money to finance his education at Baylor University.

How Can Office Rates Still be Rising?

By Younger Partners Research Director Steve Triolet

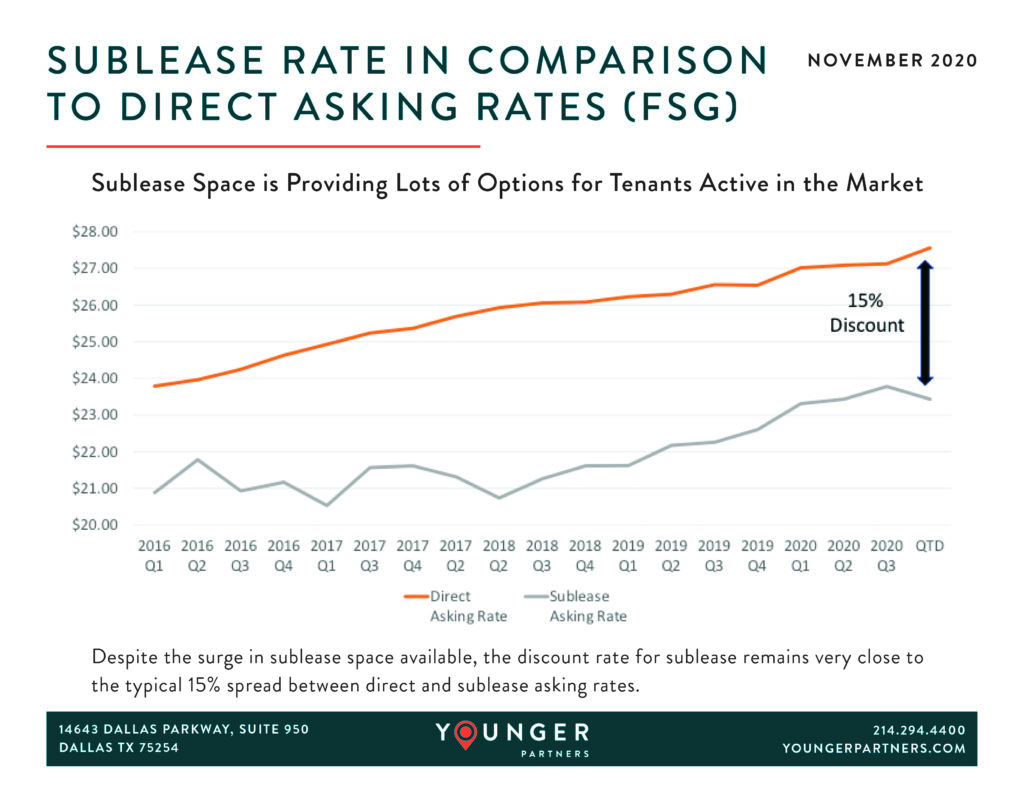

Rates are a lagging indicator, in other words, they often don’t react initially to changing market conditions. Still, over the past few quarters, DFW office asking rates have remained stubbornly high, especially in comparison to other large markets like San Francisco and New York City (which have both seen rates drop about 10% over the past three quarters). The level of distress for owners in those coastal markets is high, so their rates have reacted more quickly.

Diving into the details of what I’m seeing in DFW office rates:

*Lincoln Centre recently raised its asking rate across the business park by $2 to $32 (NNN). The catalyst appears to be the Huitt Zollars lease signing for 32,519 SF at Lincoln Centre III. Lincoln Centre is currently well leased with an occupancy rate near 90%.

On the flipside, some properties in Hall Office Park have seen some rate reductions for direct space. Property G4, for example, at 3011 Internet Blvd recently went from $23 (NNN) to $22 (NNN). The property’s occupancy is low; 82% of the property is available between a combination of direct and sublease space.

Roughly half of the submarkets recently saw a slight decrease in asking rates while the other half had slight increases, making the overall rates relatively flat.

To date, the biggest movement in rates has been for sublease space. While the typical discount between direct and sublease space remains near 15% (which is the historic norm), more than a quarter of all sublease space being marketed does not have a quoted asking rate. Still. among the individual subleases, discounts of around 50% have been quoted. Ashford at Centura Tower I is quoting $15 Plus E, while the direct space at that property was recently quoted at $30 Plus E.

In the most extreme case at Energy Plaza, there is a very large sublease for 570k SF that has over a 60% discount in comparison to direct space ($9.50 full service rate), but that sublease has only a year of term left and has been listed on the market for over three years with no leasing activity to show for it.

Younger Partners Spotlight: Seyoum Amharay

Our November YP Spotlight is Seyoum Amharay. The YP Parking Operations Manager at Republic Center supervises both valet and self-parking activities; he enjoys meeting and engaging with tenants and customers. In his free time, he loves to cook and led the winning team in the YP 2019 Chili Cook Off despite never making chili before.

Each year, he volunteers to cook for the faculty at his daughter’s school. He plans to take his wife, Hirut, and daughter, Elizabeth, to Milan and Rome next year.

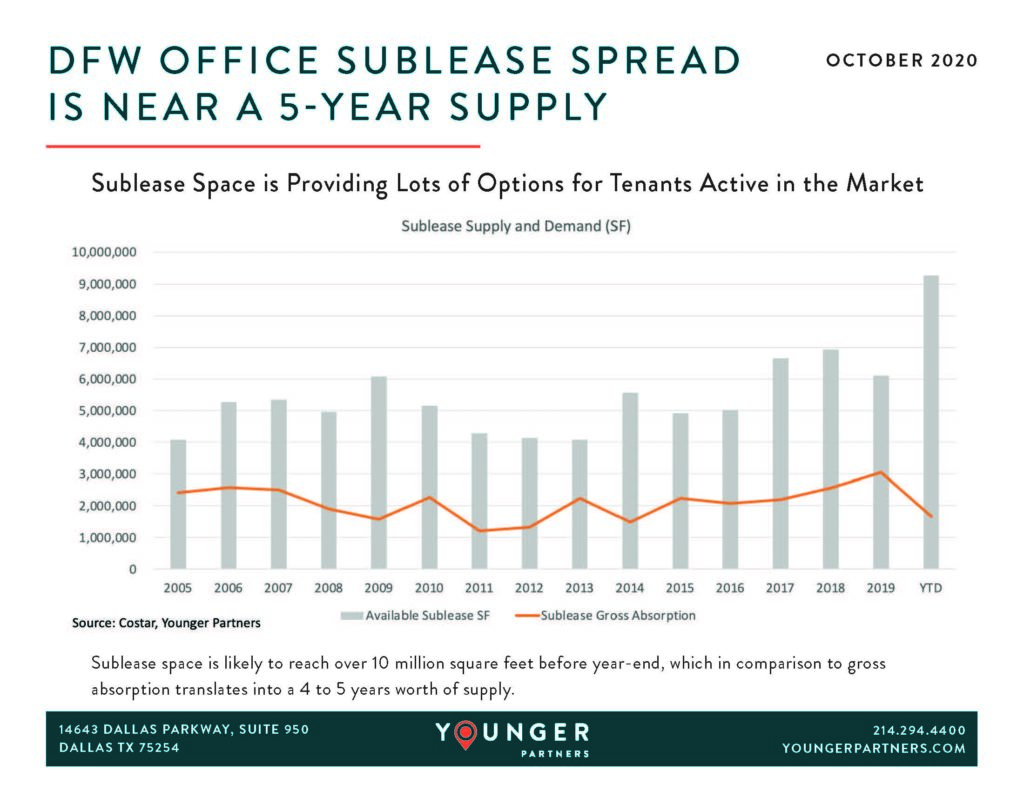

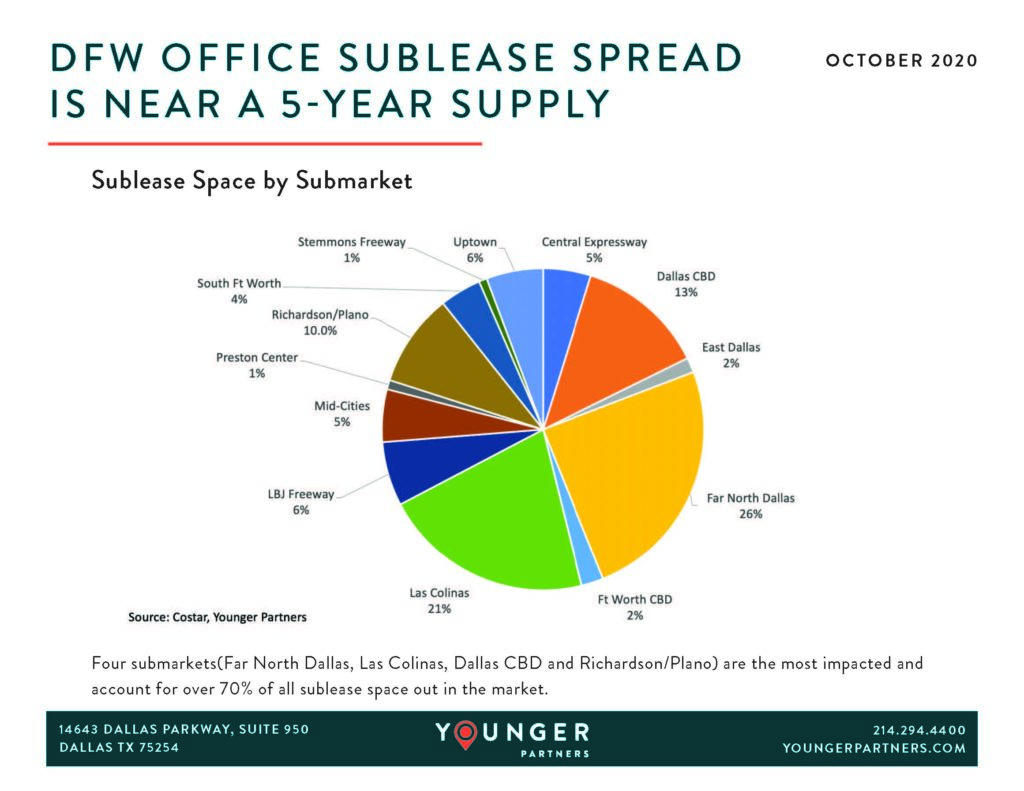

DFW Office Sublease Space is Near a 5-Year Supply

By Younger Partners Research Director Steve Triolet

It’s not really new that office sublease space across the US has been rising rapidly over the past 6 months. Dallas, like many markets, are seeing all-time highs. Currently, DFW has just under 9.3 million square feet available with some larger blocks likely to hit the market before year-end (Pioneer Natural Resources, for example, will place 400 to 600K of its headquarters’ space on the market soon). Current estimates point to sublease space surpassing 10 million square feet before the end of the year. That’s a big number, but what does that translate to? I took a historic look at how much sublease space was absorbed on a yearly basis. Typically, there is a little more than 5 million square feet of sublease available and a little more than half of that is absorbed (2.8 million square feet). The other remaining half does not lease and eventually hits the market as direct vacant space (once the master lease gets to a 2-year term or less).

Below you can see these numbers in chart form, along with a pie chart showing the four submarkets that have the highest concentration of sublease space (Far North Dallas, Las Colinas, Dallas CBD and Richardson/Plano).

YPPS Takes Over Renaissance Tower Property Management

Younger Partners Property Services will take over the property management for the 56-story, 1,738,979-square-foot Renaissance Tower at 1201 Elm St. in Downtown Dallas effective Sept. 1.

The Class A trophy office tower, located in the heart of the Dallas Central Business District, is a Dallas landmark known for its distinctive double “X” lighting and majestic rooftop spires.

“We are continually expanding our relationships with owners,” says Greg Grainger, president of Younger Partners Property Services.

This new assignment brings property managed by YPPS up to more than 5 million square feet of local property managed. YPPS ranked No. 15 on the Dallas Business Journal’s 2019 list of North Texas Commercial Property Managers ranked by total local commercial square feet managed.

The on-site property management team will be led by property management veteran Kay Crawford, who comes to Younger Partners to lead the Renaissance Tower from CBRE.

Completed in 1974, the office tower was substantially renovated between 1986 and 1991. Dallas Area Rapid Transit (DART) light rail runs immediately in front of the building and stops at the Akard Street station, just across Field Street from the property. The property also connects to downtown’s extensive underground walkway system.

The Spread Between the Availability Rate and Vacancy Points to Continued Negative Absorption Over the Next Few Quarters

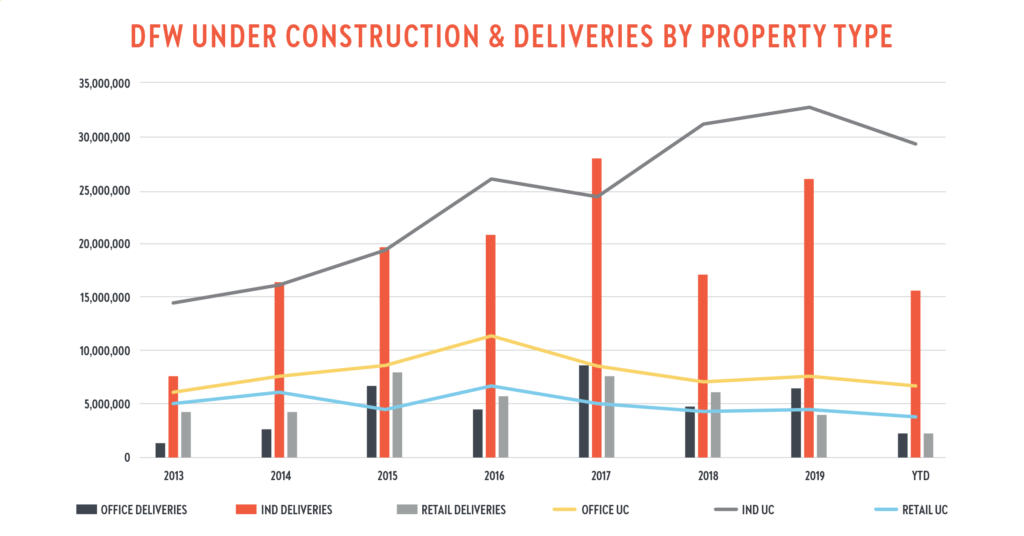

With most properties taking roughly two years between breaking ground and occupancy, the construction pipeline takes time to shift from changing market conditions. Still, I think it is informative to see how the various property types have changed over the past few years, along with some data on the current under construction pipeline.

As you can see in the chart below, the industrial market seems almost unfazed by the current recession, with almost 30 million square feet of space currently under construction (note this does not include flex properties).

Office and retail properties are show parallel trend lines of peaking in 2016 and trending downward since (The current office pipeline is 7.1 million square feet, while the retail pipeline is 3.3 million square feet).

With recent announcements for the office sector though (Cawley is kicking off The Parkwood, a 120,000-square foot office building in Far North Dallas. First United Mortgage Corp. will occupy about half of the property and

Harwood announced Harwood 14 in Uptown. Harwood 14 is a 27 story, 360,000-square foot office project. Haynes and Boone will be the lead tenant and will occupy about 125,000 square feet).

Of the projects currently under way for office and retail, roughly half of the square footage has been pre-leased (54% and 52%, respectively), so the market is scheduled to have over 5 million square foot of new vacant office and retail space delivered over the next two years (3.6 million square feet for office and 1.7 million square feet for retail).

YP Named to DBJ’s 2020 Best Places to Work

We did it! Younger Partners is one of Dallas Business Journal’s 2020 Best Places to Work. The winners were selected from several hundred companies and judged based upon the feedback from employee surveys. Thanks to our team for making this such a great place to work. A service company is only as good as its people and we have the best. #YoungerPartners #OurKindofTeam #DFWworks

August YP Spotlight: Parker Morgan

Our August #YPSpotlight, Parker Morgan, joined Younger Partners as a summer analyst intern from 2015-2017 and became a full-time broker on the office team after graduating from A&M in January 2018.

He enjoys learning more about the industry from the wealth of knowledge possessed by the YP brokerage team. In his downtime, Parker loves to golf and hunt, as well as enjoying Aggie football and the professional Dallas sports teams.

You can often find him spending time with friends and family, including his parents, Randy and Mary and his sisters (twins) Kate and Maggie. #YoungerPartners #MadeforThis #OurKindofPeople

Moody Younger in D CEO: Life Lessons From The Farm

The Younger Partners co-founding partner says his father’s “off your ass and on your feet” advice is resonating more than ever.

BY MOODY YOUNGER PUBLISHED IN COMMERCIAL REAL ESTATE AUGUST 6, 2020

Obviously, it has been a weird year thus far. I don’t think that I am alone in finding it very frustrating. It seems that as we begin to gain momentum, something happens to stop it. Overall, I have been pleased with our company’s performance throughout the uncertainty of the current market conditions. However, I have days when it takes an extra cup of coffee to get me going.

Growing up on a farm in the High Plains of Texas just below the Panhandle, we faced constant uncertainty from the dramatically unpredictable weather, insects, and the inherent randomness of farming. One year we lost a cotton crop due to defective seeds.

I worked on the farm with my dad since I was old enough to remember. There are a couple of things he used to tell my siblings (there are four of us) and me that have resonated with me quite often recently.

The first was, “It’s always something.” He used this phrase anytime any of us complained about unexpected changes or outcomes that we didn’t think were fair. There may be more ‘somethings’ this year, but there is always ‘something’ if you choose to focus on the negative. By saying, “It’s always something,” his message was for us to basically shut up and keep moving forward. Focus on what we could do to improve things and don’t waste time thinking or talking about the ‘something’ that is always there if you choose to make excuses. Excuses were never acceptable to him, and he used all kinds of other witty phrases to establish this position. “It’s always something” was the most passive of the bunch.

The other phrase that has been resonating with me is the one he used in the morning to get us up or if he ever saw us sitting around, not doing anything. It was “Off your ass and on your feet, out of the shade and in the heat!” I am not sure where that phrase originated. My dad’s father was in World War II and grew up during the Great Depression. I expect this was a phrase from that era. For Dad, it didn’t just mean that you were going to work, and it didn’t just mean that you were going to work hard; it meant that you were going to work hard and fast. We didn’t get to walk to get tools or anything on the farm, we ran!

Why are Dad’s phrases resonating so strongly with me now, and how does this relate to the real estate business in Dallas? As real estate brokers, we are salespeople. COVID-19, riots, elections, misrepresentation of facts; “It’s always something.” Staying home, not engaging, lack of in-person connections, missing social interactions that lead to collaboration, that lead to creativity, that lead to deals: “Off your ass, on your feet, out of the shade and in the heat!”

I realize that COVID-19 is very dangerous for people that have significant underlying conditions, and people with those conditions should take all the precautions they deem necessary. However, if you aren’t one of those people, and you plan to be successful in our industry, I strongly recommend that you get “off your ass and on your feet, out of the shade and in the heat!” Because in our industry, “It’s always something.”

As a company, we have had to decide whether to prepare for growth or move home into isolation mode. With the positive influence of our partners and Dad’s phrases bouncing around in our heads, Kathy and I chose growth. We are pursuing new ventures in retail acquisitions and corporate services, expanding our office space by 32 percent, and recruiting new brokers to our platform. Our region of the country is very resilient, and we are incredibly optimistic about its future.

My father passed away in 2002, but if he were here today, I can guarantee that viewing Dallas from the High Plains of Texas, one thing would be apparent to him. The winners next year—when all the pent-up demand emerges for our market—will not be the people hanging out at home complaining about the events of 2020. The winners will be those that are fully engaged in pursuing the tremendous opportunities that will soon emerge for us in North Texas.

Moody Younger is one of the co-founding partners of Younger Partners. To see it in D CEO, click here.

July YP Spotlight: Nancy Vang

Our July #YPSpotlight, Nancy Vang, joined Younger Partners in July 2019 as an accountant for multiple properties.

She says she benefits from a great support system at YP from the office staff to property managers. In her downtime, she enjoys traveling, attending Korean Pop concerts, and playing poker. She is proud of her Hmong heritage; her family was among many immigrants who came to the U.S. from Laos/Thailand after oppression following the Vietnam War. She is grateful for their sacrifices to get her generation to a safer home and provide her with a life that they never had.

She and her husband, Tou Bee, look forward to visiting family, attending postponed concerts, and traveling when it’s safe again. #YoungerPartners #OurKindofPeople #Accounting

Micah Ashford Joins Younger Partners To Lead New Retail Acquisitions Platform

Younger Partners welcomes Micah Ashford to lead a new retail acquisition platform. She is coming off a two-year hiatus from a 20-year career as a partner at Dunhill Partners, a leading commercial real estate firm in the Southwest that focuses on retail shopping centers.

“It is wonderful to join this dynamic organization with such a solid reputation in the commercial real estate industry,” Micah says. “The timing of adding this new investment platform was incredible as I return to the industry. Retail has been cruising along and the impact of the COVID-19 pandemic is unprecedented. I see this as a true opportunity.”

She is thrilled at the prospect of leading the charge in launching this new division and bringing her expertise to an already successful and growing firm.

“We immediately recognized the value that Micah brings us in this new venture,” says Younger Partners Co-Founder Moody Younger. “It was an easy decision for us.” Younger Partners Co-Founder Kathy Permenter added that retail is a specialty niche and having the experience and leadership of Micah makes for a great addition to the team.

Micah’s diversified experience encompasses all facets of commercial real estate including transactional activities, finance and acquisitions. Her role at Younger Partners will include directing acquisitions, financing, and dispositions. She will originate new property opportunities, negotiate partnerships and loan documents, as well as oversee the physical and financial due diligence on those acquisitions.

Micah began her career with Dunhill as an analyst in 1999 and built an impressive roster of key network contacts including highly qualified principals, brokers, lenders, contractors, title associates and legal advisors.

During her career, she has acquired hundreds of centers from the Laguna Design Center in Laugna Niguel, Calif., to the Dallas Design District, and the Nut Tree Legendary Road Stop in Vacaville, Calif. Other projects she’s been affiliated with include the iconic Orinda Theatre Square in Orinda, Calif., and Vintage Park, an Italian shopping promenade in Houston.

Micah can be reached at micah.ashford@youngerpartners.com or by calling 214-238-8016 (office) or 214-215-3871 (mobile).

Younger Partners Adds Retail Investment Division

Younger Partners created a new platform to acquire retail properties: Younger Partners Investments. It will target retail properties from lifestyle to neighborhood centers in the Dallas-Fort Worth Metroplex. Along with this new division comes the hire of Micah Ashford to lead the charge.

“We feel like retail is one of the most disrupted sectors of commercial real estate,” says Younger Partners Co-Founder Moody Younger. “While we can relate to the tough times COVID-19 has created for many, we are confident in the resilience of Texas and we are excited to make this investment in the future of retail and our region. The opportunity to add talent like Micah made the decision to launch this new platform an easy one for us.”

Ashford is coming off a two-year hiatus from a 20-year career as a partner at Dunhill Partners, a leading commercial real estate firm in the Southwest that focuses on retail shopping centers.

Younger Partners Co-Founder Kathy Permenter says the new division has been part of the partners’ long-term strategy. “With the market going through dramatic changes as the result of the COVID-19 pandemic, this is a good time to do it. I started my career in retail, and it continues to interest me. I look forward to investing in this sector,” she says.

Younger says three key factors played a role in why retail was the logical choice for the investment line. First, it doesn’t conflict with Younger Partners’ existing service lines. Additionally, he believes opportunities will emerge in retail and value can be created. Finally, Ashford’s availability to lead the team was the clincher.

You can reach Micah Ashford at micah.ashford@youngerpartners.com or 214-238-8016 (office) and 214-215-3871 (mobile.) For more information on her joining Younger Partners, see her new hire press release here.