Preparing for the Return of Headquarter Relocations to Texas

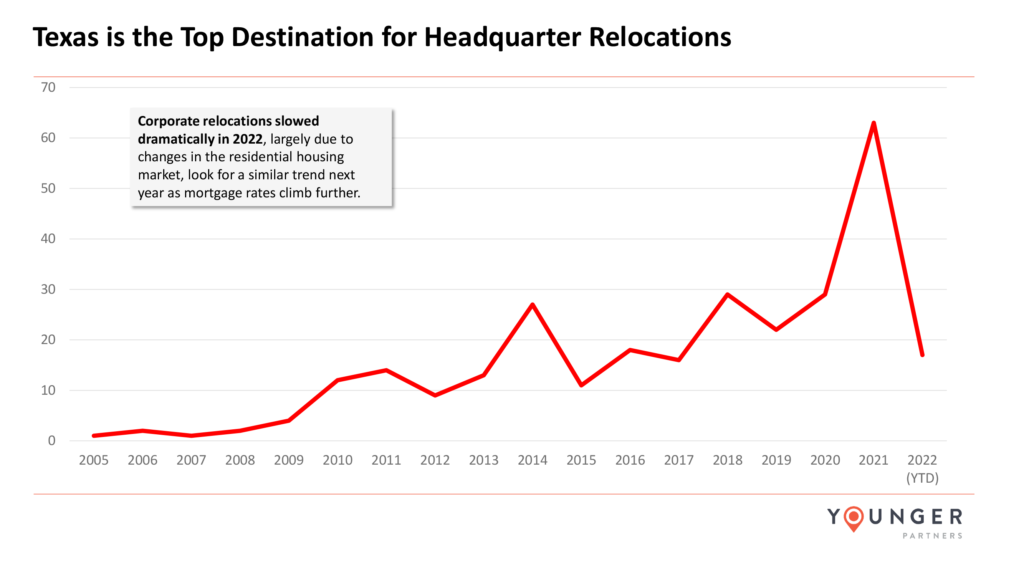

One of the unintended consequences of our sharply rising mortgage rates is the dramatic slowdown in corporate relocations. As the frenzy of commercial real estate activity cools in Texas, savvy business leaders should take this time to reassess their space needs and put thoughtful strategies in place before the market rebounds.

In the near term, C-suite executives understand that most homeowners are extremely hesitant to relocate and purchase a new home because of the higher costs. Over 80 percent of residential mortgages are currently financed at an interest rate less than 3.5 percent, which is well below the 7 percent rate for a 30-year loan today.

Before the recent interest rate hikes, Texas was a hotbed of relocations with 63 companies making a move in 2021. Although this year is not completely over, less than a third of that volume, or 17 companies to be precise, came to the state in 2022.

History proves that the housing market will rise again, just as it did from the recession of 2008 when the recovery was slow and residential markets didn’t stabilize until 2012/2013. Although the future uptick is expected to come quicker than the last cycle, timing is still uncertain.

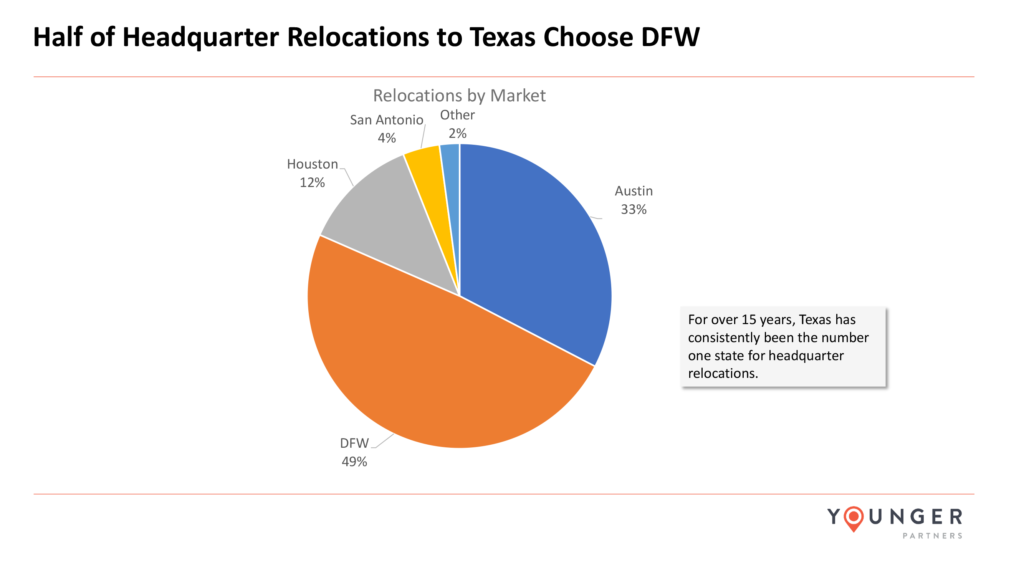

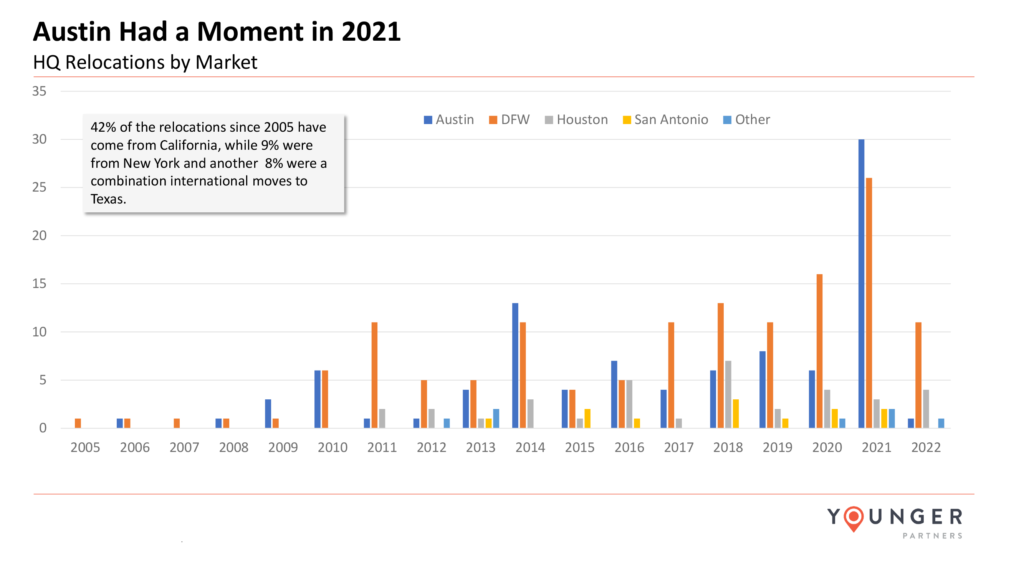

When companies do make the decision to relocate to Texas, almost half will choose Dallas-Fort Worth over the rest of the state. Austin did have a moment in 2021 with a slew of technology relocations, but the historic numbers favor the Dallas-Fort Worth market overall.

With fewer companies touring for potential relocations, office demand is low across Texas. Active large tenants are down roughly 40 percent compared to pre-Covid levels, which is anticipated to last another year or two. Once residential activity adjusts, relocations will be surging into Texas again.

Until that time, corporate leaders should partner with a commercial real estate advisor who can assist with some of the relocation preparations in advance, including:

- Selecting a target submarket that will complement business needs

- Buying land for future development, if needed

- Understanding how major infrastructure developments in the area will affect commutes and labor pools

- Securing economic incentives offered for corporations coming into Texas, or specifically the Dallas-Fort Worth market

- Adjusting the corporate real estate strategy to accommodate hybrid or remote workers

- Creating efficiencies that will reduce relocation costs.