Tag: DFWMarket

2022 North Texas Land Absorption Report

As 2022 ended in a rapidly changing market, the year in whole was positive.

By Robert Grunnah and Michael Ytem | March 21, 2023

The North Central Texas land market is still influenced by its prior decade of escalating values, sales and absorption activity. To no surprise, first quarter 2023 land pricing and activity have been primarily affected by rapidly increasing interest rates, the lingering effects of COVID-19, an unstable Global political environment, continued rising inflation, and significant increases in construction costs. A minor disruption in the Oil and Gas market has had a lessening but significant impact on each of the major issues. In reviewing last year’s report, our observations have changed in reaction to the very visible shift in market activity. While listings have slowly increased, prices have seen only a moderate readjustment, sales volume has dramatically declined, and contract defaults (cancellations) are more frequent.

For many years, Younger Partners has produced a report to assist investors in reviewing the viability of acquiring undeveloped land for medium and long-term positive returns. As one of many prognosticators, we utilize our years of brokerage and research experience to add credibility to our observations.

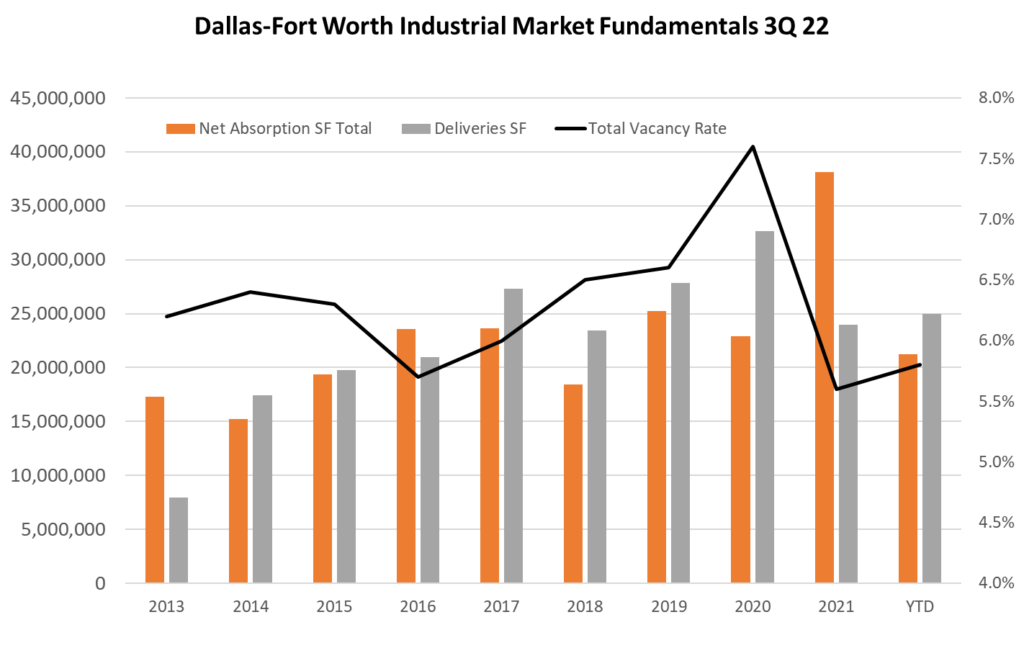

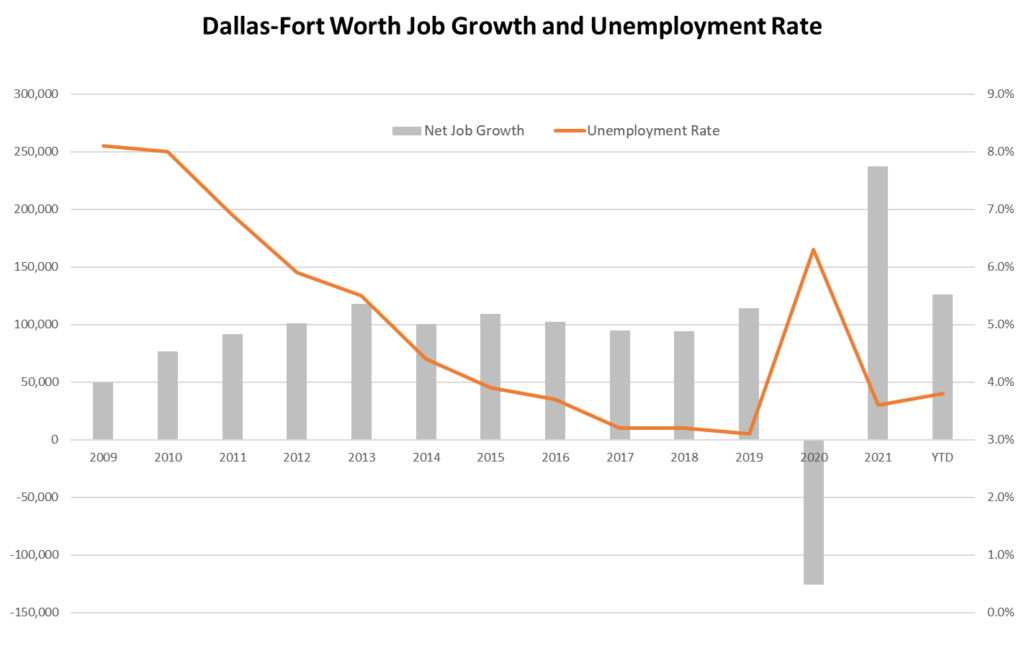

Since our last report in late 2021, DFW has experienced continued growth from the momentum previously gained in most commercial and residential product types, but more recently transitioned to a more limited growth of investment-grade assets. Total transaction volume in the second half of 2022 significantly decreased for both user and investment product for all residential and commercial uses. New absorption of residential land, both developed and undeveloped, and underutilized land, has all but stopped except for well-financed projects currently under construction. One of the few highly respected residential monitoring services recently published a harrowing report for 2023 single-family absorption causing great concern and reactions among major homebuilders. Early 2023, however, has provided an indication that the prior momentum will be moderate and mildly sobering. As sales slow, a pause in planned developments might facilitate the healthy absorption of existing planned products. The single most pressing factor is increasing interest rates, which drives up the cost of construction loans and dramatically reduces the number of qualified home buyers. Year to date, however, while distinctly affected, the result again has been surprisingly moderate. A strong decrease in interest rates would serve pent-up demand in all property types as the single most recovery influence but is not immediately imminent.

Submarkets which were either overlooked or previously bypassed in early 2022 saw significant activity based on proximity and access to core business centers, or much lower land prices. That trend has slowed along with any aggressive, new vertical development projects. The “work from home” popularity has allowed for peripheral residential projects to have more success based on lower land cost and smaller footprints.

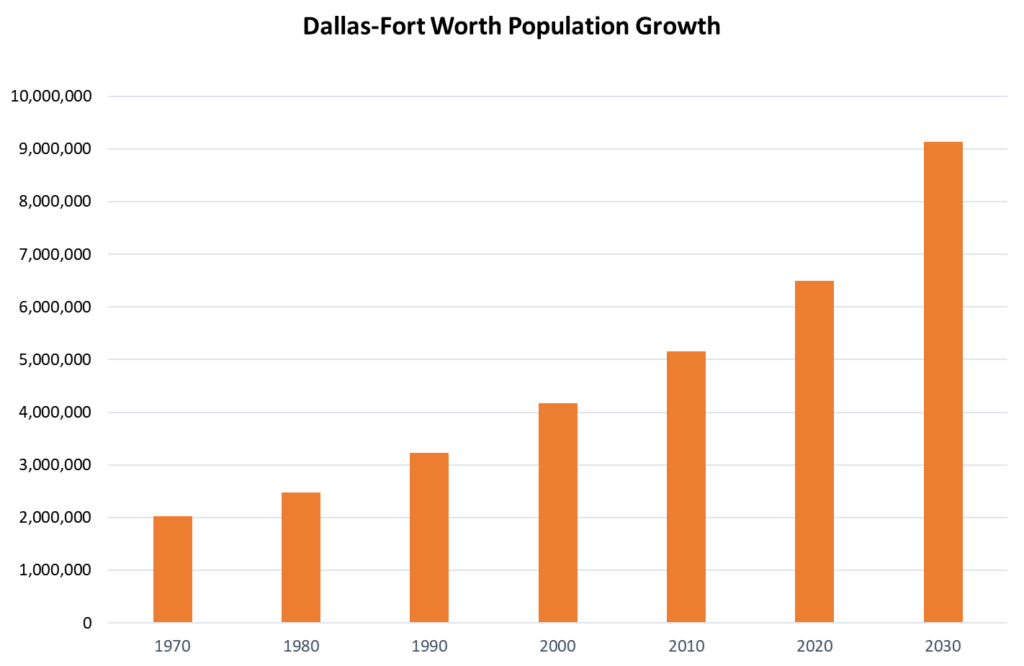

Most peripheral sites are seeing steadily decreasing activity with employers still competing for employees who desire shorter commuting distances despite the COVID-19 flight to home office. “Work from home” continues to gain long-term acceptance by both employees and employers. Older surrounding communities, historically undisturbed by DFW’s growth, have achieved higher than normal growth since 2015. The significant momentum that Texas, and more specifically DFW, gained in company relocations and the commensurate inbound employee increases has moderately decreased, being balanced by the large number of layoffs in tech and finance. While few deny that an extended period of strong economic growth is proving vulnerable, actual project starts and announcements of pending projects still occur, but at a far fewer frequency. Based on the real estate industry’s obvious resistance to all the negative indicators, we have no reason to believe it will be either disastrous or long-term.

Supporting the long-term benefits in land investment, a readjustment should make labor available at a more reasonable cost and at more realistic materials pricing. DFW will remain one of the strongest employment and desired investment markets in the country. Deep cost adjustments, however, are still purely speculative for an undetermined period of time. We do not believe it will sink to levels of the late 1980s, the early 2000s or the 2008 severe down-market recessions. DFW has excellent momentum with a strong defense against a major recession.

Despite sale prices at a multiple of replacement cost and surprisingly moderate positive retail demand, income-producing investments have maintained their active volume due largely to earlier low-interest rates, the need to invest 1031 trade equity and lack of competition by alternative investments. Capitalization rates early in 2022 approached record historical lows. To meet underwriting for either new debt or to remain conforming to existing debt, cap rates must adjust upward signaling initially moderate price reductions if an income property sale is desired. Excessive competition to acquire cash flow assets which remain resistant to the market cap rate adjustment, providing even the thinnest yields, will simply not occur until the financial markets adjust. The cyclical downturn in the national economy and a corresponding drop in physical occupancy will produce a dour impact and threatening or eliminating positive income property cash flows.

Inherently, land investment differs greatly from other types of real estate because of its inability to produce interim cash flow and its vulnerability to cycles. The criteria used to determine potential land opportunities, while becoming more sophisticated over the last two cycles, remains in implementing basic strategies. “Timing” has always determined the net result. We believe that any CRE recession will be short-lived because of the enormous equity investment that has been accumulated a lot of which is awaiting a readjustment and remains undeployed. Because it must produce a return at some point, it will return quickly when opportunity (chaos) is perceived.

Perhaps the most important part of a timing strategy is the ability to project and fund ownership long term. Positive liquidity and the ability to sell for an acceptable profit at the optimum market time can be highly speculative. Leveraging the investment only increases the risk. When an investor is placed in an imposed forced sale position or loses confidence in the future of the investment, returns are jeopardized and most frequently result in a significant loss.

There has yet to be a final cycle, although current sentiment seems to reject that possibility which is an optimistically shallow, inexperienced approach. The financial ability to hold long term investments will affect the yield and does offer a degree of safety. With access to historical data, projecting long-term value, while still speculative, is much more achievable and moderately lessens risk. One observation is watching the pricing of Investment Land migrating from price per acre to price per square foot. This significant change can be attributed more to the inflationary effect of the dollar across the full financial spectrum rather than the intrinsic value of the real estate.

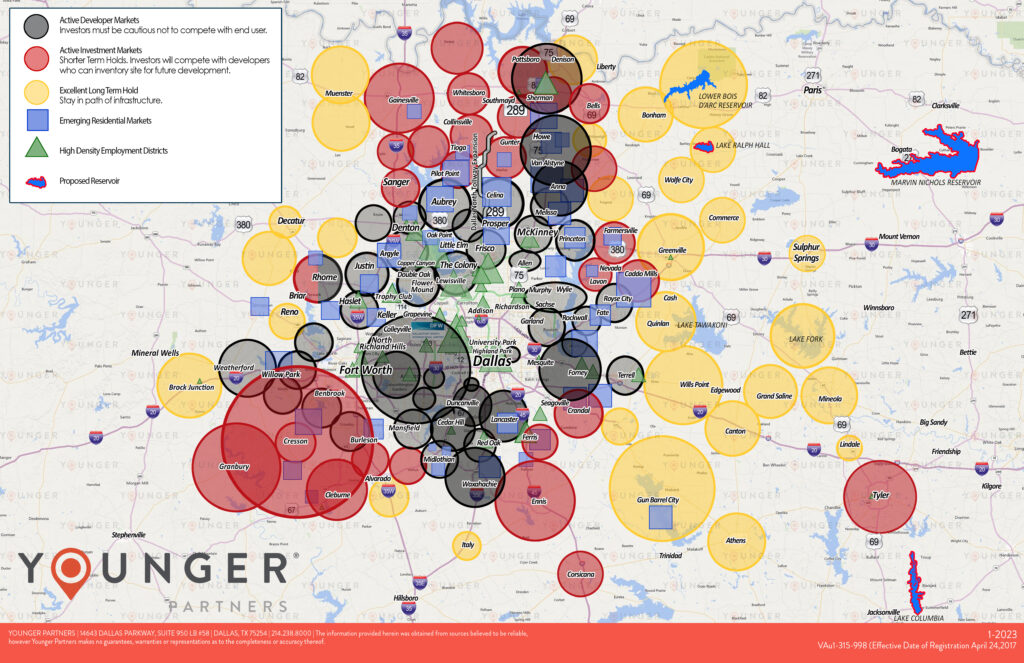

Our Land Absorption Map shows all types of 2022 commercial and residential land activity in specific geographic submarkets. Resources used for the map include actual sales, current listings, and announcements of pending projects. Not difficult to understand, the progression from active to long-term generally follows the availability of infrastructure and newer expanding utility systems, including Municipal Utility Districts. Land currently available for vertical construction will bring significantly higher value over those that must wait for services or possess extraordinarily high-cost offsite access. Over the 20+ years of presenting this map, it is interesting to note that, while the circles have limited movement, the colors change and generally move out from the core in concentric circles. This iteration of the 2022 map displays the first series of circle reductions in 10 years north of DFW and the first set of expansions in south DFW and beyond.

Younger Partners is a founder and member of the highly respected North Texas Land Council (NTLC), a group of 50 active, knowledgeable, and talented land brokers in DFW. Believing that activity generates more activity, the North Texas Land Council, to the advantage of its clients, freely shares information with its competing members and the general market on a level of professionalism unusual within similar organizations. As such, the organization is a benefit to all clients and to those anticipating a land investment. Much of the projected activity displayed on the Younger Land Absorption Map (YLAM) reflects the activities of the NTLC, local and national reporting agencies, and our large group of active company partners.

Because of many increased cost factors, single-family new home prices increased almost 25 percent in a single year making affordability more difficult. Additionally, historically low, long-term interest rates dramatically increased single-family affordability through the first quarter of 2022. Less obvious are the increases in completed per square foot costs in all commercial sectors. The surprisingly continued strong national economy, despite disruptions, as well as strong, continued inbound relocations, have provided record employment and income. Short-term projections are predictable–long-term less so. Perhaps one of the strongest influences softening the impact of a correction is the enormous amount of uncommitted cash held by investors of all classes and liquidity awaiting their perception of pending opportunities. Once an opportunity is perceived, that liquid cash will be quickly redeployed and reinvested, steadying prices in the event of a devaluation caused by any number of external influences. Investors, incorrectly or not, wishing to miss an anticipated opportunity (chaos) will move quickly. An improving stock market and strong oil and gas prices have contributed to lessening the attraction of real estate.

Perhaps the most important part of a timing strategy is the ability to project and fund ownership long term. Positive liquidity and the ability to sell for an acceptable profit at the optimum market time can be highly speculative. Leveraging the investment only increases the risk. When an investor is placed in an imposed forced sale position or loses confidence in the future of the investment, returns are jeopardized and most frequently result in a significant loss.

There has yet to be a final cycle, although current sentiment seems to reject that possibility which is an optimistically shallow, inexperienced approach. The financial ability to hold long term investments will affect the yield and does offer a degree of safety. With access to historical data, projecting long-term value, while still speculative, is much more achievable and moderately lessens risk. One observation is watching the pricing of Investment Land migrating from price per acre to price per square foot. This significant change can be attributed more to the inflationary effect of the dollar across the full financial spectrum rather than the intrinsic value of the real estate.

Our Land Absorption Map shows all types of 2022 commercial and residential land activity in specific geographic submarkets. Resources used for the map include actual sales, current listings, and announcements of pending projects. Not difficult to understand, the progression from active to long-term generally follows the availability of infrastructure and newer expanding utility systems, including Municipal Utility Districts. Land currently available for vertical construction will bring significantly higher value over those that must wait for services or possess extraordinarily high-cost offsite access. Over the 20+ years of presenting this map, it is interesting to note that, while the circles have limited movement, the colors change and generally move out from the core in concentric circles. This iteration of the 2022 map displays the first series of circle reductions in 10 years north of DFW and the first set of expansions in south DFW and beyond.

Younger Partners is a founder and member of the highly respected North Texas Land Council (NTLC), a group of 50 active, knowledgeable, and talented land brokers in DFW. Believing that activity generates more activity, the North Texas Land Council, to the advantage of its clients, freely shares information with its competing members and the general market on a level of professionalism unusual within similar organizations. As such, the organization is a benefit to all clients and to those anticipating a land investment. Much of the projected activity displayed on the Younger Land Absorption Map (YLAM) reflects the activities of the NTLC, local and national reporting agencies, and our large group of active company partners.

Because of many increased cost factors, single-family new home prices increased almost 25 percent in a single year making affordability more difficult. Additionally, historically low, long-term interest rates dramatically increased single-family affordability through the first quarter of 2022. Less obvious are the increases in completed per square foot costs in all commercial sectors. The surprisingly continued strong national economy, despite disruptions, as well as strong, continued inbound relocations, have provided record employment and income. Short-term projections are predictable–long-term less so. Perhaps one of the strongest influences softening the impact of a correction is the enormous amount of uncommitted cash held by investors of all classes and liquidity awaiting their perception of pending opportunities. Once an opportunity is perceived that liquid cash will be quickly redeployed and reinvested, steadying prices in the event of a devaluation caused by any number of external influences. Investors, incorrectly or not, wishing to miss an anticipated opportunity (chaos) will move quickly. An improving stock market and strong oil and gas prices have contributed to lessening the attraction of real estate.

Our continuing extended analysis, as displayed on the “Younger Land Absorption Map” (revised December 2022) is principally based on historical data utilizing over 200 years of market experience held by Younger Partners associates, members of the NTLC, and reliable future projections from sources that have traditionally displayed accurate information. Our market demographic information was provided by Younger Partners’ Steve Triolet, Director of Research, and Michael Ytem, Senior Vice President. As projected earlier, the DFW market still expects to absorb an additional expansion of more than 20,000 acres over the next 15 to 20 years. Recent acquisitions by qualified mixed-use developers, if restarted, threaten to shorten the total absorption time to one-half the projections. We have always had cycles, and this too shall pass.

In conclusion, the principles of sophisticated investing must include and utilize primary criteria. Reviewing the history of our land absorption maps provides distinct, valuable trends in growth well applicable to intelligent investing. Access to infrastructure, the admirably increased effort of developers to utilize available land in our fertile southern corridor, absorption of the remaining few infill sites, high suburban infill land costs, and the migration of employment centers will all play significant roles in prudent land investment decisions. Historically in the investment process, the only remaining elements are sound financial strength and patience.

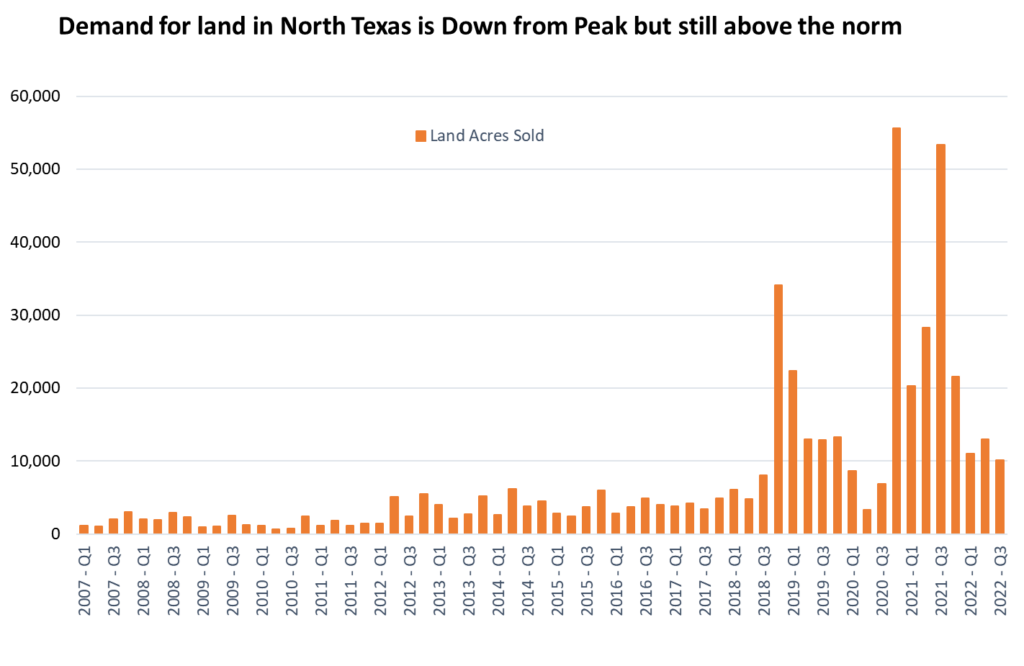

Record Demand for Land in North Texas

The DFW market still expects to absorb an additional expansion of more than 20,000 acres over the next 15 to 20 years, according to Younger Partners’ Robert Grunnah.

By Robert Grunnah | January 27, 2022 | 9:00 am

As 2021 has now come to a very fascinating and positive end, the North Central Texas land market has experienced significant influences modifying its prior accelerating four years of sales and absorption activity. To some surprise, the effects of COVID-19, an unstable political environment, rising inflation in Federal denial, Federal taxes, CRE threats, and significant increases in construction costs have not had a serious impact on land pricing and activity. Additionally, a profound market disruption in retail, entertainment, and hospitality has had an even lesser impact. In reviewing last year’s report, only a few observations have changed to any great degree.