Tag: Research

DFW Office Sublease Space is Near a 5-Year Supply

By Younger Partners Research Director Steve Triolet

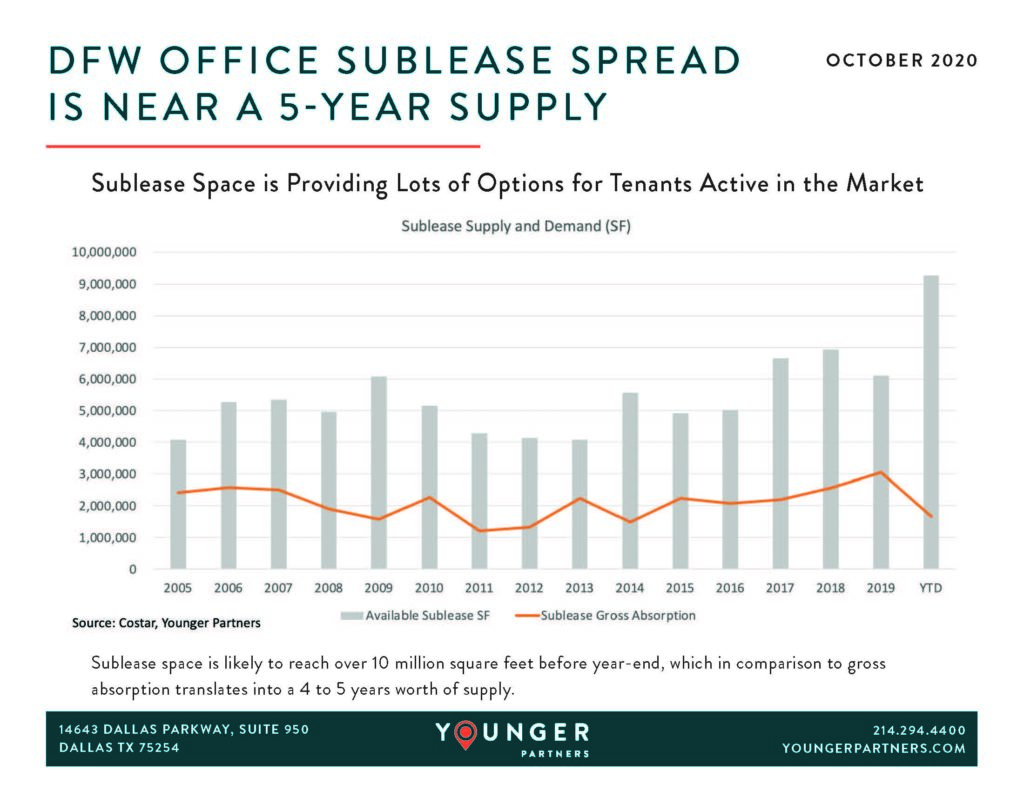

It’s not really new that office sublease space across the US has been rising rapidly over the past 6 months. Dallas, like many markets, are seeing all-time highs. Currently, DFW has just under 9.3 million square feet available with some larger blocks likely to hit the market before year-end (Pioneer Natural Resources, for example, will place 400 to 600K of its headquarters’ space on the market soon). Current estimates point to sublease space surpassing 10 million square feet before the end of the year. That’s a big number, but what does that translate to? I took a historic look at how much sublease space was absorbed on a yearly basis. Typically, there is a little more than 5 million square feet of sublease available and a little more than half of that is absorbed (2.8 million square feet). The other remaining half does not lease and eventually hits the market as direct vacant space (once the master lease gets to a 2-year term or less).

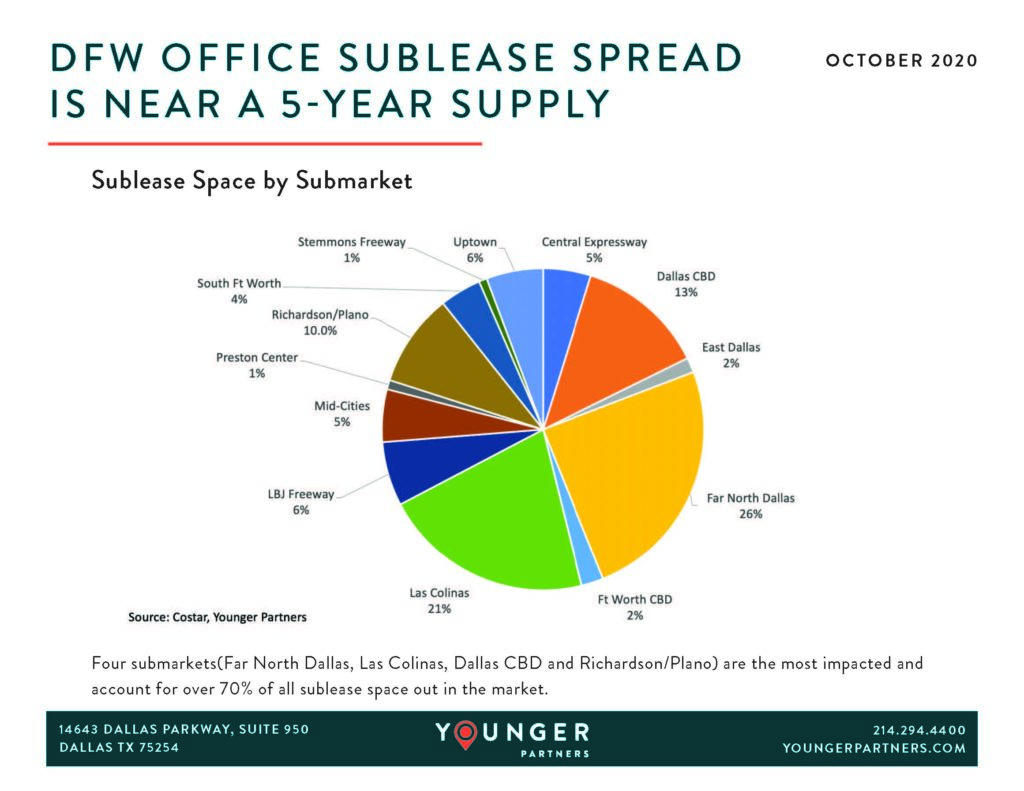

Below you can see these numbers in chart form, along with a pie chart showing the four submarkets that have the highest concentration of sublease space (Far North Dallas, Las Colinas, Dallas CBD and Richardson/Plano).

YP Research: DFW Office Sublease Space Trends Down from All-Time High

By Steve Triolet, YP Research Director

In late 2018, the amount of DFW office sublease space reached an all-time at just under 7 million square feet. In early 2019, however, several large sublease transactions have brought that number down significantly where it currently stands at 5.8 million square feet.

This is a good, healthy sign for the market, especially with over 2.2 million square feet of unaccounted for spec office construction scheduled for delivery over the next year and additional new spec sites announced but not yet started.

DFW Construction Boom: What Does it Mean for Big Blocks of Space?

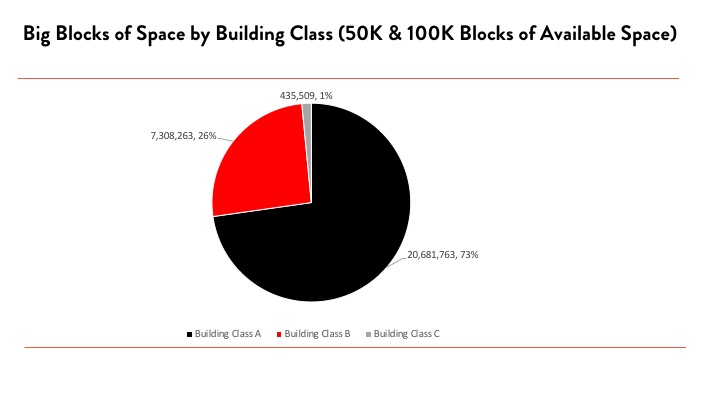

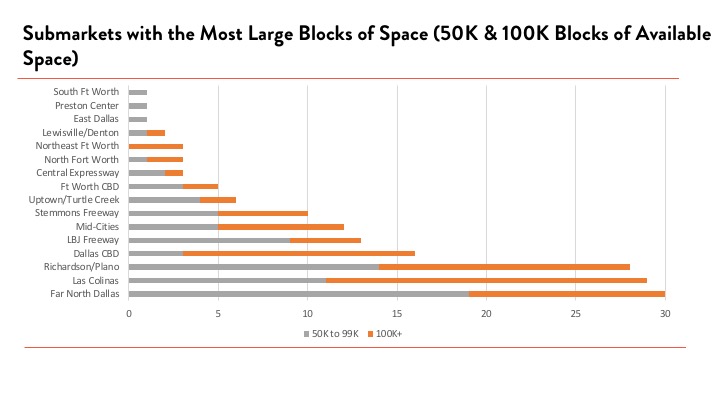

Dallas/Fort Worth is in a construction boom: between 2015 and 2018 almost 23 million square feet of new office inventory was completed with an additional 7.1 million square feet currently underway, says Younger Partners Director of Research Steve Triolet.

All of these numbers are among the highest in the United States for the respective time periods. With a few notable exceptions (Toyota), the vast majority of the tenants taking occupancy of the new space are leaving behind older Class-A space that will need to be backfilled. Class-A space makes up the vast majority of the space available at 20.7 million square feet or 73% of the large blocks of space.

Move Over Co-Working; Financial Industry is the Real Powerhouse

By Steve Triolet, Younger Partners Research Director

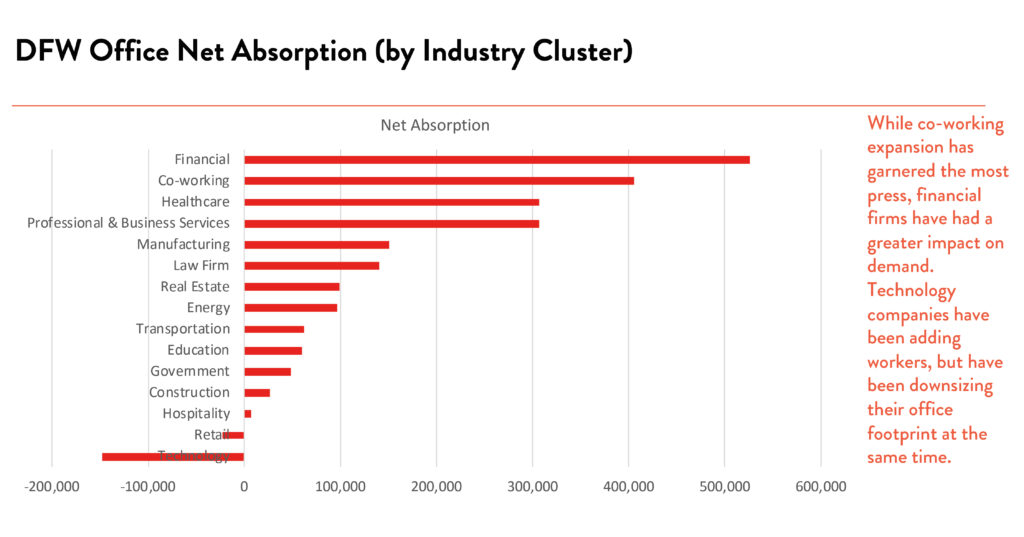

While co-working companies have dominated much of the headlines as far expansion in DFW, the financial industry (which includes insurance companies) have been taking down more office space in 2018. Companies like Allstate Insurance, Mr Cooper (formerly Nationstar Mortgage), New York Life and others have contributed to the majority of positive net absorption over recent quarters. On the opposite end, technology companies been very active as far as leasing activity but have been responsible for overall negative net absorption.

Much like we saw law firms squeezing more attorneys into less space over recent years, a similar trend has been impacting the technology industry, with tech companies downsizing their real estate footprints. NTT Data, Nokia, NetScout and other technology related companies have been moving into newer space and shedding excess square feet in older properties in the process. The attached chart shows the industry clusters and whether in aggregate they have been expanding or contracting in the DFW office market.

Dallas Business Journal – Dallas ranks as fourth-fastest-growing metro area in U.S.

Dallas is the fourth-fastest growing city in the United States, according to Forbes listof America’s 20 Fastest-Growing Cities2014.

That should come as no surprise to those of us who live in the area and see the steady stream of new residents and businesses and growth in many of the long-standing businesses that call DFW home.

Dallas’ 2013 population growth rate was 1.91 percent, Forbes said. The median pay rate in the Dallas-Fort Worth-Arlington MSA was $66,700 and the unemployment rate was 5.83 percent, Forbes said.

Austin led the list with a population growth of 2.5 percent, followed by Raleigh, N.C., and Phoenix, Ariz. Houston ranked No. 10 on the list, with a population growth rate of 1.82 percent and San Antonio fell in at No. 20.