Tag: sublease

DFW Office Sublease Space is Near a 5-Year Supply

By Younger Partners Research Director Steve Triolet

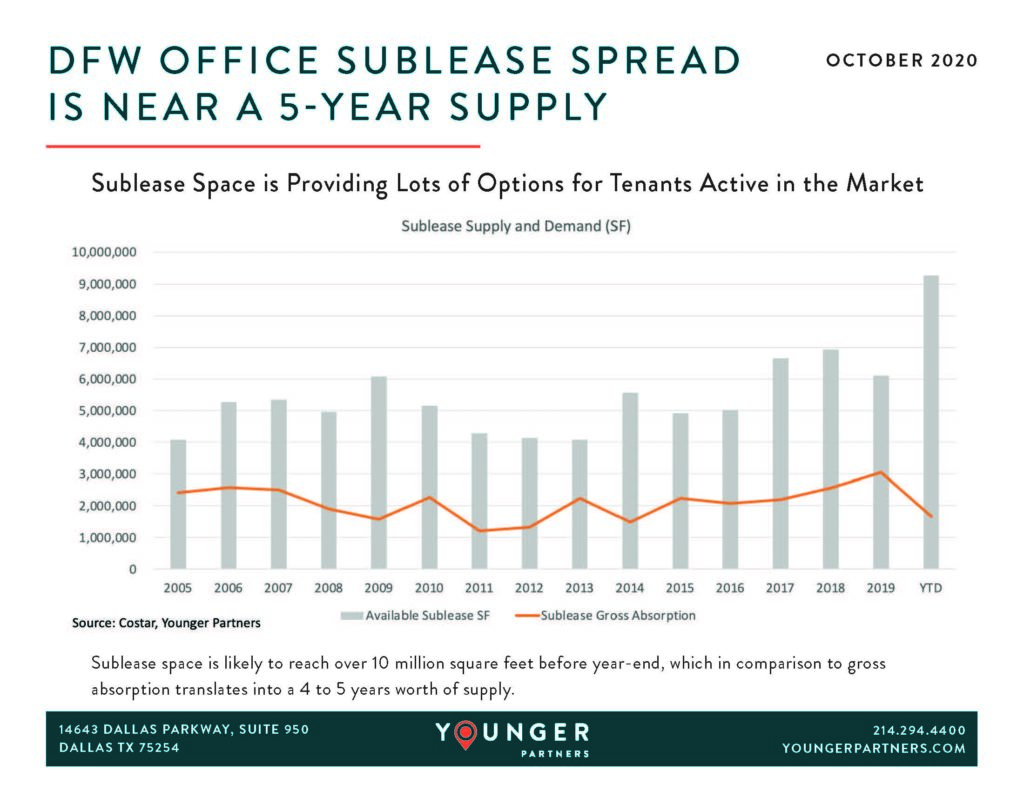

It’s not really new that office sublease space across the US has been rising rapidly over the past 6 months. Dallas, like many markets, are seeing all-time highs. Currently, DFW has just under 9.3 million square feet available with some larger blocks likely to hit the market before year-end (Pioneer Natural Resources, for example, will place 400 to 600K of its headquarters’ space on the market soon). Current estimates point to sublease space surpassing 10 million square feet before the end of the year. That’s a big number, but what does that translate to? I took a historic look at how much sublease space was absorbed on a yearly basis. Typically, there is a little more than 5 million square feet of sublease available and a little more than half of that is absorbed (2.8 million square feet). The other remaining half does not lease and eventually hits the market as direct vacant space (once the master lease gets to a 2-year term or less).

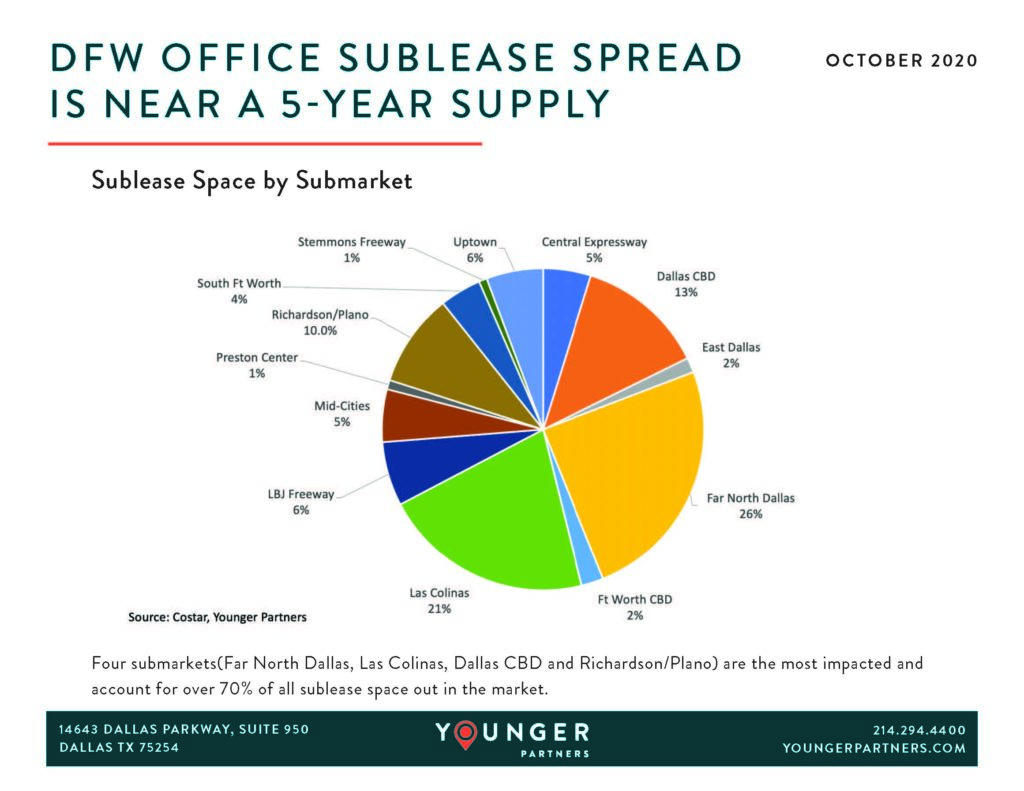

Below you can see these numbers in chart form, along with a pie chart showing the four submarkets that have the highest concentration of sublease space (Far North Dallas, Las Colinas, Dallas CBD and Richardson/Plano).

DFW Office Sublease Space Beginning to Rise Again

By Steve Triolet, Younger Partners Research Director

One indicator of the market’s health is the amount of sublease space available. The DFW office market saw almost 7 million square feet of sublease space in early 2018 (as several tenants opted for new construction). In 2019, sublease declined, but has been on the rise again over the past few quarters as the market has slowed.

Most submarkets have only a little or moderate amount of sublease space. The exceptions being the Dallas CBD, Las Colinas and Richardson/Plano. These three submarkets each have over half a million square feet of sublease space available. For the Dallas CBD, it is over 1 million square feet.

Recent additions to sublease space on the market have mainly been mid-sized to smaller sublease spaces. Some of the larger additions so far this year include, Interstate Hotels, which is trying to sublease 31,596 SF at 125 E John Carpenter, PCI is trying to sublease the top floor (18,371 SF) at 4835 LBJ, and a new 43,162 SF sublease was recently added at Amber Trail Corporate Park.

With the current upheaval in the market, the amount of sublease space is expected to increase over the next few quarters.