Tag: Submarket Office Market

A Breakdown of Available Office Space in DFW

By Steve Triolet, Younger Partners Director of Research

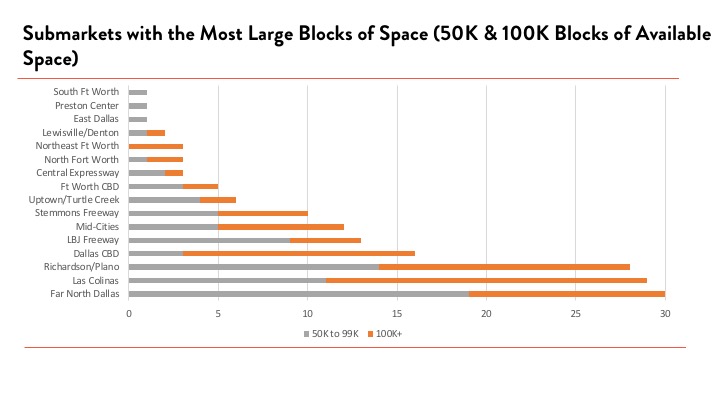

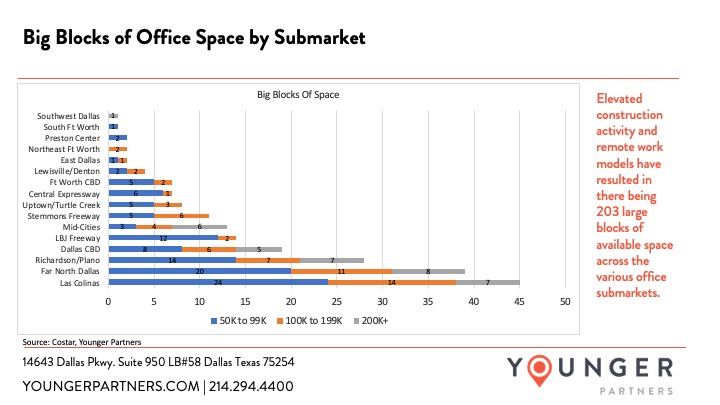

A few times a year I show where the highest concentrations of large blocks of space are. In the second chart below, there is an updated breakdown of the 203 Big Blocks of space currently available by size category and submarket. Outside of that update, I wanted to take a look at the increase in all sizes of space (not just the big blocks of space).

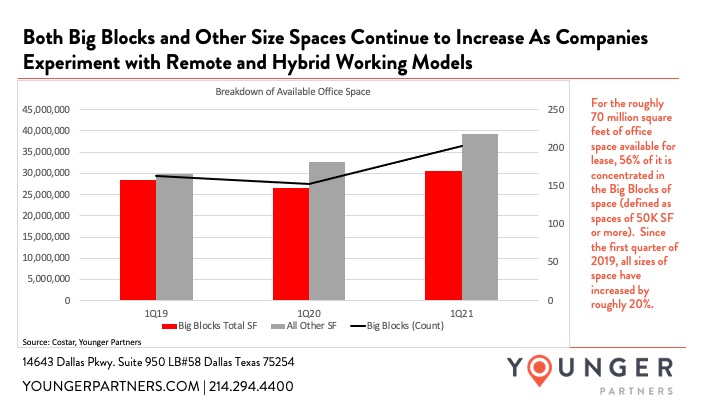

What surprised me most when I analyzed the data is the increase in space was not just in the big blocks of space, but also all size categories. Since the first quarter of 2019, the amount of space being marketed is up 20%. While sublease is a large component of this increase over the past year, sublease space only accounts for roughly 14% of all the available amount of space out in the market.

DFW Construction Boom: What Does it Mean for Big Blocks of Space?

Dallas/Fort Worth is in a construction boom: between 2015 and 2018 almost 23 million square feet of new office inventory was completed with an additional 7.1 million square feet currently underway, says Younger Partners Director of Research Steve Triolet.

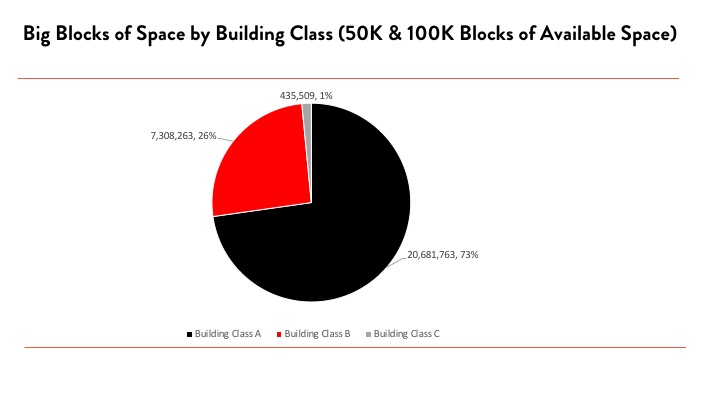

All of these numbers are among the highest in the United States for the respective time periods. With a few notable exceptions (Toyota), the vast majority of the tenants taking occupancy of the new space are leaving behind older Class-A space that will need to be backfilled. Class-A space makes up the vast majority of the space available at 20.7 million square feet or 73% of the large blocks of space.